News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Monero Faces the Most Dangerous Month Ever, Targeting $5 Billion Whale

APT faces downward pressure as 11 million coins are unlocked, with a potential drop to $4.52 if bearish momentum persists.

Share link:In this post: Trump approved a deal letting Nvidia and AMD sell certain AI chips to China if the U.S. gets 15% of the revenue. Lawmakers from both parties warned it could create a “pay-for-play” model for sensitive tech exports. Legal experts questioned whether the payment is effectively an export tax.

Share link:In this post: IBM and Google say they can build a large-scale quantum computer before 2030. Amazon warns it could take 15–30 years to reach a truly useful system. Qubit instability, high costs, and complex error correction remain major hurdles.

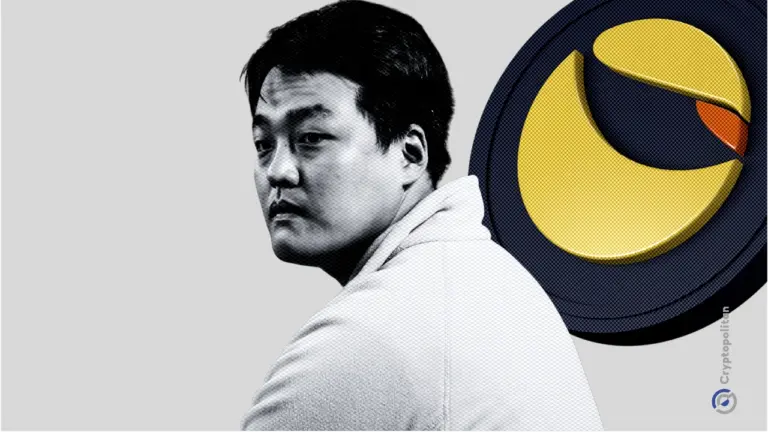

Share link:In this post: Do Kwon is expected to admit guilt in a U.S. court over the $40B TerraUSD collapse. A judge has set a hearing where Kwon must explain how he broke the law. The 2022 crash of TerraUSD caused major losses and led to other crypto failures.

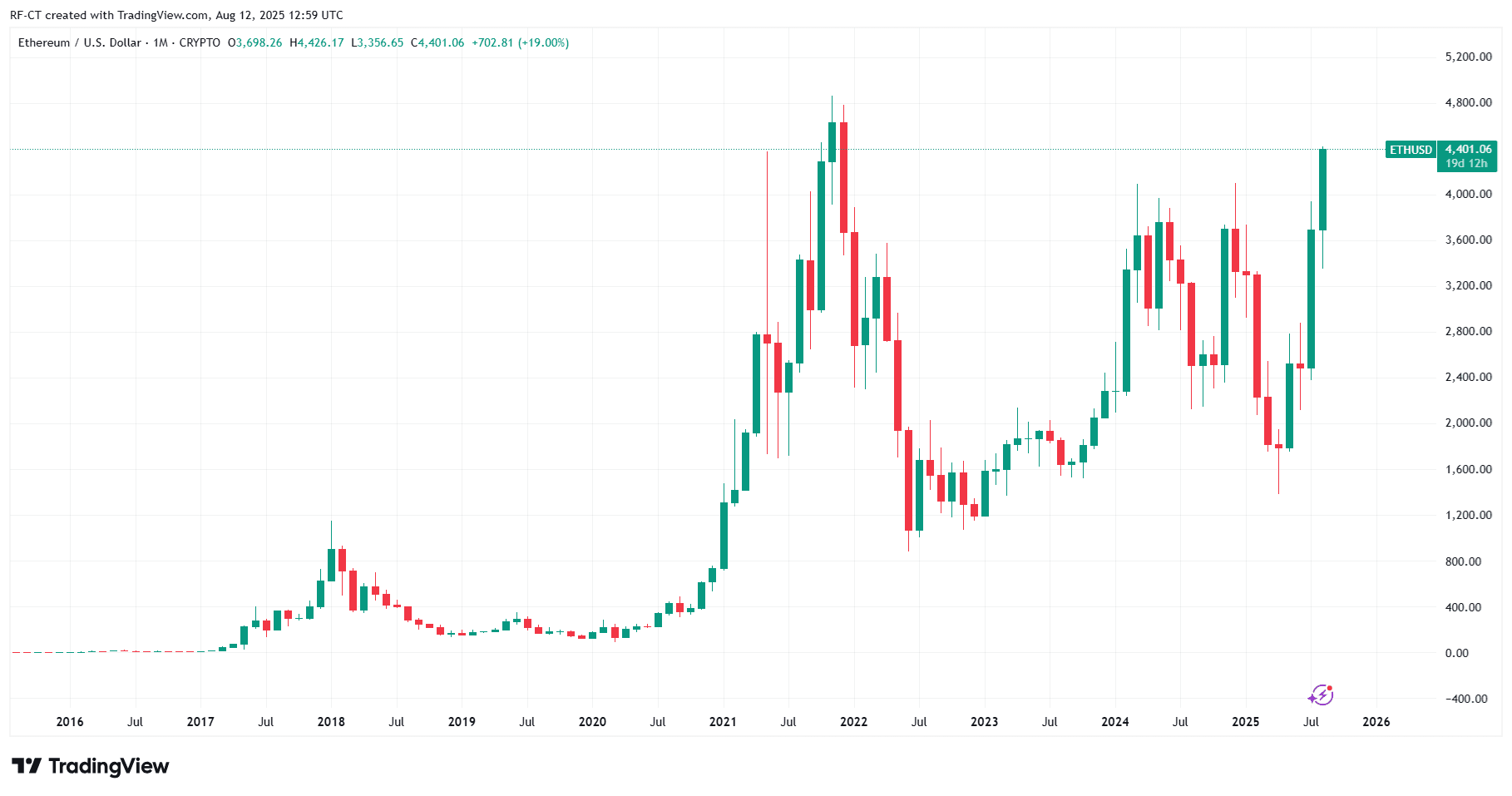

- 18:11Data: If ETH falls below $4,012, the cumulative long liquidation intensity on major CEXs will reach $1.835 billionsAccording to ChainCatcher, citing Coinglass data, if ETH falls below $4,012, the cumulative long liquidation intensity on major CEXs will reach $1.835 billions. Conversely, if ETH breaks above $4,404, the cumulative short liquidation intensity on major CEXs will reach $907 millions.

- 18:11BTC surpasses $115,000Jinse Finance reported that according to market data, BTC has surpassed $115,000 and is now quoted at $115,052.88, with a 24-hour increase of 1.11%. The market is experiencing significant volatility, so please manage your risks accordingly.

- 17:43Garrett Jin: Trading platforms that take the lead in establishing stable funds will attract capital inflows and drive industry developmentBlockBeats News, October 13, the whale Garrett Jin, who previously made headlines by selling over $4.23 billions worth of BTC to switch positions to ETH, posted that "A deeper issue in the crypto industry is that trading platforms offer high leverage on assets lacking intrinsic value to meet user demand and increase profits. Such high leverage previously only existed in the forex market, where underlying assets have value support, lower volatility, and liquidity is provided by banks." If trading platforms continue to offer extremely high leverage, they should at least establish mechanisms similar to stabilization funds, as in the US stock market, to provide liquidity support during crises. Only in this way can trust be rebuilt, capital be attracted to return, and healthy market development be promoted. The crash on October 11 once again proved that under extreme volatility, the market is in urgent need of liquidity support. Trading platforms that take the lead in establishing stabilization funds will not only attract capital inflows but also drive the entire industry forward."