News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

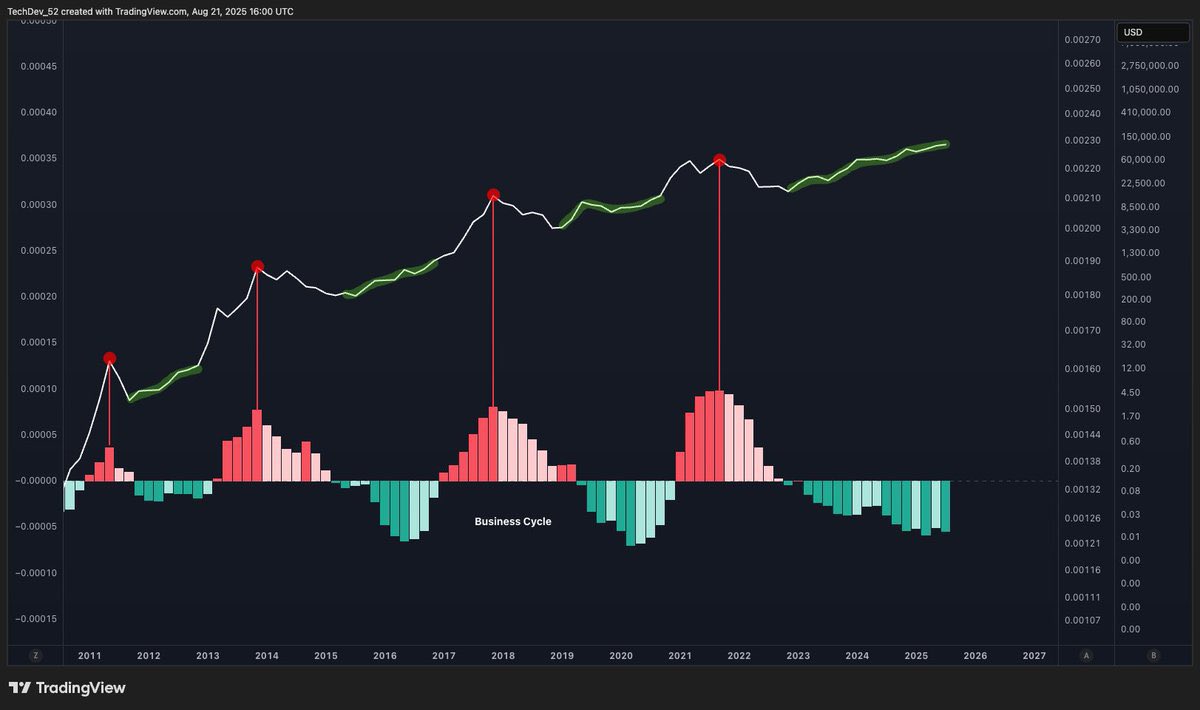

Altcoins show a double bottom with MACD flip, echoing the 2018–2021 supercycle that delivered 15x gains.Altcoins Repeat Familiar Bullish PatternWhy This Setup Looks Stronger NowWill Altcoins Deliver Another 15x?

Chainlink ($LINK) is catching up to Hyperliquid ($HYPE) in market cap. Here's what it means for both tokens.Chainlink Market Cap Nears HyperliquidWhat’s Fueling the Surge?Could Chainlink Take the Lead?

A Satoshi-era Bitcoin whale flips $437M in BTC into ETH, amassing over 641K ETH in a week, signaling a major crypto market move.Massive Shift from BTC to ETH by Satoshi-Era Whale$2.94B in ETH Accumulated in One WeekWhat This Means for the Market

Story (IP) is on fire with a sharp rally, but on-chain data suggests the momentum may lack strong support. A pullback looms unless demand strengthens.

This is more like a consortium blockchain dedicated to stablecoins.

USD.AI generates yields through AI hardware collateralization, filling the gap in computing resource financing.

- 09:29MegaETH token sale oversubscribed by 8.9 times, with subscription amount exceeding $450 millionAccording to ChainCatcher, MegaETH's token sale was oversubscribed by 8.9 times, with subscription amounts exceeding $450 million.

- 09:19The first Solana staking ETF, BSOL, will offer physical subscription and redemption functions.Jinse Finance reported that on October 28, Bitwise will launch the first 100% Solana staking ETF to be listed on the New York Stock Exchange, with the stock code BSOL. Bitwise plans to stake 100% of the SOL holdings of the Bitwise Onchain Solutions Staking BSOL Fund, supported by Solana staking technology provider Helius, with a staking yield of 7.34% and a management fee of 0.20%. For the first three months, the management fee for the first 1 billion USD in assets will be 0%. In addition, the Bitwise Solana Staking ETF will offer physical subscription and redemption functions.

- 09:19Matrixport: Bitcoin is still in a range-bound stateJinse Finance reported that Matrixport stated Bitcoin remains in a range-bound consolidation; in contrast, the US stock market has repeatedly reached new historical highs driven by the AI boom. There are certain similarities to the rhythm seen last year: after a prolonged period of low volatility consolidation, prices experienced a relatively rapid upward movement within about three weeks (historical review, not indicative of the future). The current narrow fluctuations place higher demands on traders' patience. The short-term outlook is mainly wait-and-see, while the mid-term pattern remains unchanged. If the Federal Reserve maintains a dovish stance and continues to cut interest rates, the market will mostly be waiting for clearer external driving signals. Historically, similar rhythms have often been observed: after a long period of consolidation, volatility tends to be released intensively within a short period.