In-depth Analysis of USD.AI: Backed by YZi Labs Investment, Enjoying Both Stable Returns and AI Dividends

USD.AI generates yields through AI hardware collateralization, filling the gap in computing resource financing.

Original Title: "YZi Labs Invests in USD.AI: A Detailed Look at the New Stablecoin Model"

Original Author: San, TechFlow by Deep Tide

On August 26, YZi Labs announced a strategic investment in USD.AI, a stablecoin protocol that provides hardware-collateralized financing for AI infrastructure.

According to Coingecko data, the current global stablecoin market cap has exceeded $285 billions. Giants such as Circle and Kraken are also entering the stablecoin payment chain track.

However, the vast majority of current stablecoin projects still rely on traditional models pegged to the US dollar, US Treasury bonds, etc., with overall innovation appearing somewhat lacking and generally "lacking imagination." Against this backdrop, a distinctive challenger is entering the market with a brand-new approach.

Recently, a unique stablecoin project, USD.AI, which integrates DePIN, RWA, and AI, has sparked heated discussion in the market. It is not simply pegged to the US dollar, but instead generates yield through AI hardware collateral, filling the financing gap for computing resources.

Recently, USD.AI officially launched and opened its deposit channel, quickly gaining traction. This could bring new opportunities for the integration of AI and stablecoins.

Project Background

According to Rootdata, the project was founded in 2024. Among the project team, one of the core founders of USD.AI, David Choi, is the co-founder and CEO of the well-known NFT lending platform MetaStreer and was previously an investment banking analyst at Deutsche Bank.

What truly brought USD.AI into the spotlight is its impressive financing background.

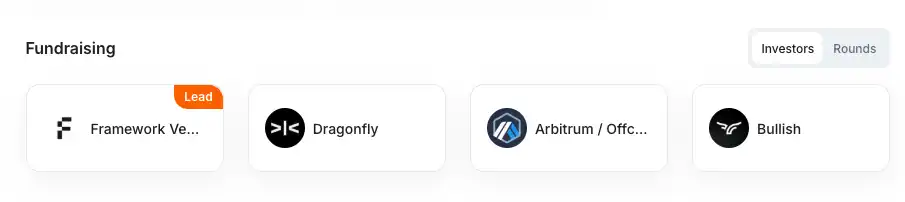

On the 14th of this month, USD.AI announced the completion of a $13.4 millions Series A funding round, led by Framework Ventures.

As an investment institution focused on DeFi and infrastructure, Framework Ventures has previously supported star projects such as Uniswap and ChainLink. Its participation as the lead investor in USD.AI this time also reflects institutional recognition of the project's innovative value. Other investors are equally strong, including well-known crypto VC Dragonfly, Layer2 network giant Arbitrum, and the recently IPO-listed popular exchange Bullish, among others.

This round of luxurious financing not only injected substantial resources into USD.AI, but also validated the appeal of DePIN combined with AI stablecoin projects to top-tier capital, significantly raising market expectations. After the financing announcement, the USD.AI team seized the momentum and officially launched on the 19th, sparking widespread discussion in the market.

Operating Principles and Core Mechanisms

Against the backdrop of growing demand for AI computing power, USD.AI is designed to combine stablecoin protocols with AI infrastructure financing, addressing issues not yet tackled by other projects in the market:

Small and medium-sized AI companies own valuable GPU hardware but find it difficult to obtain operating funds through traditional channels.

The core goal of the project is to use on-chain capital to support AI companies in hardware procurement and operations, filling the financing gap left by traditional finance in the emerging AI economy, while maintaining the low-risk characteristics of stablecoins.

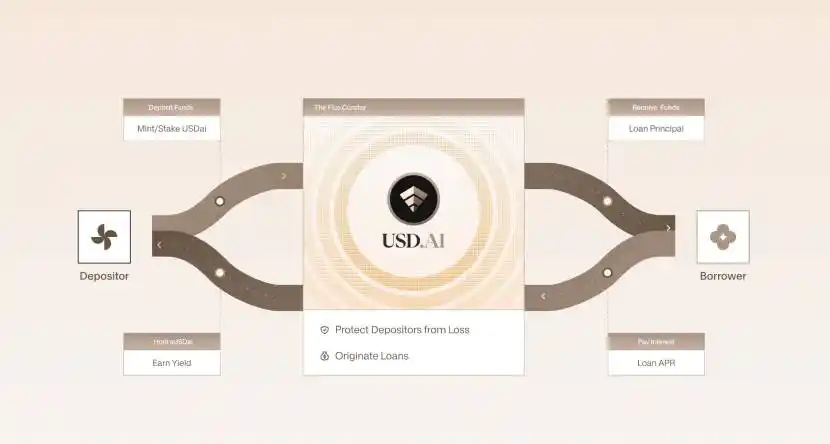

USD.AI revolves around a closed-loop system of "collateral-minting-investment-yield," combining the current hot concepts of RWA and AI, and demonstrates its unique innovative advantages in this round of the stablecoin wave.

The operating principle of USD.AI starts with users using stablecoins such as USDT or USDC as collateral to mint USDai stablecoins at a 1:1 ratio. USDai is backed by US Treasury bonds and mainstream stablecoins to achieve a peg to the US dollar price, with instant redemption capability and certain liquidity, making it suitable for trading or providing liquidity in the DeFi ecosystem. At the same time, users can further choose to stake USDai to obtain sUSDai tokens, and then participate in other DeFi projects to earn additional yields, achieving a "one fish, many meals" effect.

USD.AI uses user deposits for two types of asset investments: first, providing loans to AI companies for purchasing GPUs and other hardware, generating high interest; the current official website shows an annualized yield of 6.96%. Second, if funds are idle, they are invested in US Treasury bonds to provide a stable base yield. sUSDai holders can amplify their returns through DeFi protocols, with the project's official website listing a target annualized yield of 15%-25%, while USDai holders enjoy low-risk stable returns.

The core mechanism of USD.AI includes the following key components to ensure its innovation and stability:

1. Dual-token system: USDai serves as a low-risk stablecoin suitable for users seeking stability; sUSDai targets investors seeking high returns, offering both flexibility and risk exposure. This design meets the needs of users with different risk preferences while maintaining compatibility with the DeFi ecosystem.

2. Asset tokenization and Caliber framework: Through the CALIBER framework, USD.AI tokenizes physical assets such as AI hardware into on-chain assets, combining legal and technical means to ensure asset ownership is transparent and legally binding. On-chain insurance mechanisms further reduce default risk.

3. QEV redemption mechanism: To address the long-term and low-liquidity nature of AI infrastructure assets, USD.AI designed the QEV mechanism, which manages sUSDai redemption requests through a market-driven approach, avoiding the inefficiency of first-come, first-served, while ensuring fairness and protocol stability.

4. FiLo Curator expansion mechanism: This mechanism allows the protocol to introduce new borrowers on a large scale, expanding the AI infrastructure investment portfolio, while maintaining user interests through structural protection and risk alignment mechanisms, ensuring diversity and sustainability of yield sources.

In summary, user funds deposited into USD.AI will be used to lend to AI companies that need GPU and other hardware computing power to earn interest, with the entire process being transparent and traceable. If funds are idle, they will be used to purchase US Treasury bonds for guaranteed returns.

USD.AI's innovative mechanism gives it a unique competitive advantage. Compared to traditional stablecoin projects, USD.AI achieves higher yields through AI infrastructure investment; compared to high-risk DeFi protocols, its risk isolation and insurance mechanisms significantly reduce systemic risk.

USD.AI not only injects new vitality into the stablecoin market, but also provides a scalable solution for the capital needs of the AI economy, and is expected to become a pioneering project in the integration of stablecoins and AI infrastructure.

How to Participate

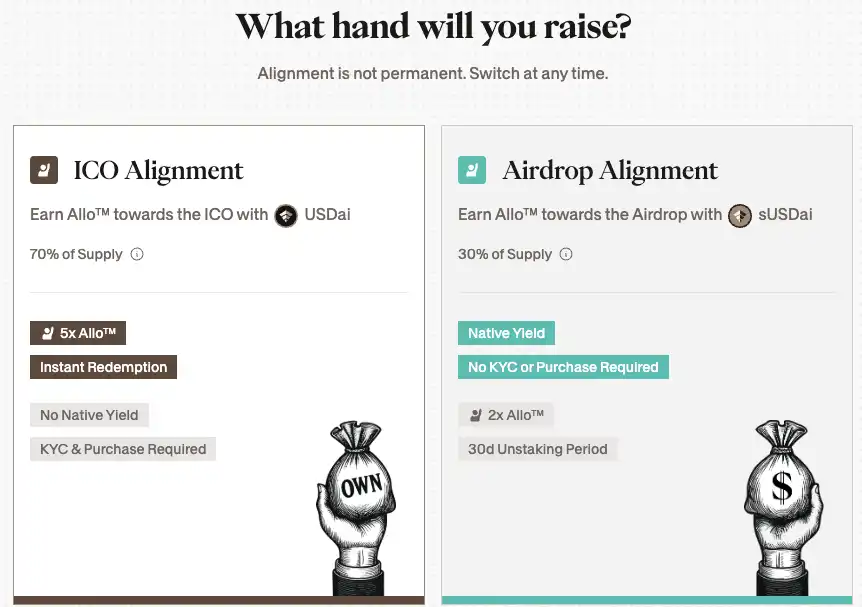

Currently, the USD.AI project has opened user deposits and invites other users to earn USD.AI reward system Allo points.

Currently, purchasing USDai or sUSDai will grant qUSDai, which serves as a deposit queue proof and will automatically convert to the corresponding token within 24 hours.

USD.AI currently has a total deposit cap of $100 millions. Since all purchased funds are currently in qUSDai status, the current TVL only shows the $52 millions deposited during the internal testing period.

Market Discussion

The current market view on the USD.AI project is polarized.

Supporters generally believe that USD.AI is a uniquely innovative stablecoin project that combines the current hot AI concept, allowing users to enjoy AI dividends while ensuring stable returns. Multiple participation strategies are provided so that different types of users can find suitable solutions, combining the "stability" characteristic of stablecoins with high-risk, high-return options.

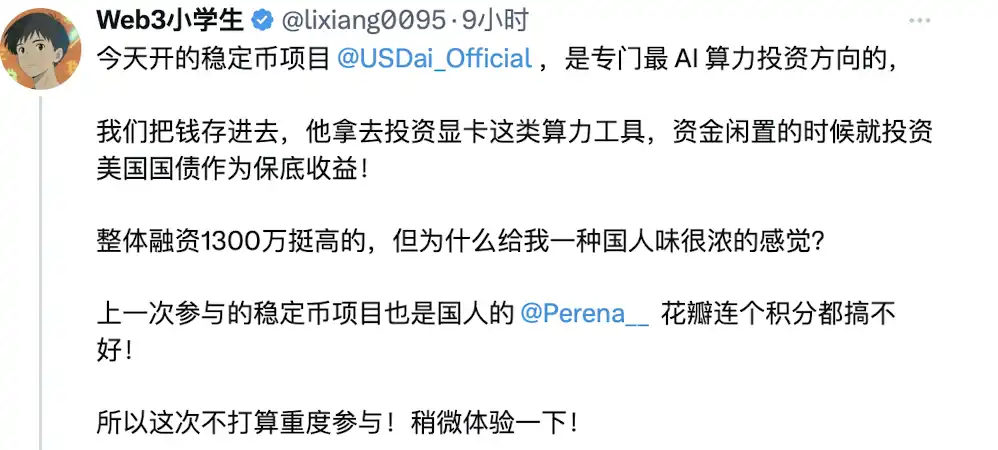

On the other hand, opponents believe that the information disclosed by USD.AI shows that the team may be predominantly Chinese, and that the project is simply piecing together popular concepts without substantive innovation.

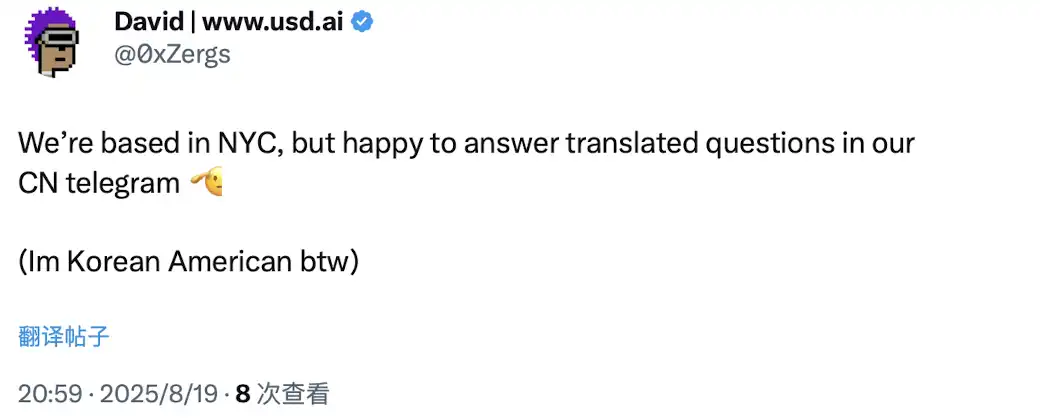

Interestingly, USD.AI core founder David just replied under this FUD tweet, stating that he is Korean-American and that the project headquarters is located in New York, but he is very happy to answer questions from Chinese users.

In the author's view, USD.AI does provide a different answer to the hot stablecoin track, but whether it can win market favor and recognition still depends on whether everyone is willing to "vote with their feet" and quickly fill the $100 millions TVL cap.

Its success or failure will also serve as a touchstone for the market's acceptance of the emerging narrative of "AI infrastructure + stablecoin."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is XRP Poised to Break Above $2.64 and Challenge a New All-Time High?

- XRP faces critical technical support at $2.64, where Fibonacci levels, moving averages, and liquidity accumulation converge, signaling potential for a breakout toward $3.30. - Institutional demand surges with $9.02B in derivatives volume and 1,100% higher open interest, driven by XRP's utility in cross-border payments and Ripple's ODL expansion. - SEC's 2025 commodity classification removes regulatory hurdles, accelerating ETF approvals that could inject $5–$8B in capital, mirroring Bitcoin's ETF-driven

Mastering Emotional Discipline in Crypto: A Strategic Edge for 2025 and Beyond

- Crypto investors face severe emotional biases (FOMO, panic selling) causing 37% average losses during market corrections, per 2025 studies. - 2025 investors combat these traps using automated stop-loss orders, pre-defined trading plans, and dollar-cost averaging frameworks. - Behavioral nudges like sentiment analysis and portfolio diversification help identify irrational market patterns and enforce discipline. - Structured approaches reduce emotional decision-making, with 60% higher strategy adherence du

Eclipse Labs' Strategic Pivotal Shift to User-Facing Applications: Assessing the Long-Term Value and Operational Efficiency of Blockchain Infrastruct

- Eclipse Labs pivoted to user-facing apps after a 65% token value drop, securing $50M funding to build a "breakout application" leveraging its Solana-on-Ethereum rollup. - The shift includes 65% workforce cuts, leadership changes, and a flywheel strategy where user growth drives infrastructure demand, mirroring Ethereum and Solana's consumer-centric transitions. - Risks include market saturation, technical execution challenges, and SEC scrutiny, contrasting with peers like Polygon and Avalanche who balanc

SPX6900's Bearish Downturn and Whale Activity: Is the Meme Coin Set for a Critical Breakdown?

- SPX6900 (SPX) has dropped 22% to $1.97 as whale selling, weak technicals, and bearish derivatives signal a critical breakdown. - Whale activity shows profit-taking via large sales, with 134 whale transactions on June 9 and a $4.46M dump on July 20 triggering price declines. - Technical indicators (EMA, RSI, MACD) and derivatives data (12% open interest surge) confirm deteriorating momentum and short-position dominance. - Meme coin's volatility and lack of fundamentals amplify risks; investors advised to