News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

OnRe, the onchain asset manager providing access to reinsurance-backed assets onchain, today announced expanded global access for ONyc through a new independently operated permissionless channel. This new channel gives DeFi users a direct way to access reinsurance-backed assets. In just the first week of its soft launch through OnReʼs Points Program, more than $1M of

HBAR has slipped slightly in the past day but still shows gains over the month. With whales adding millions and a breakout pattern forming, the token could see a 12% bounce if resistance breaks.

Spot Bitcoin ETFs saw a net inflow of over $600M on Thursday, with Ethereum ETFs seeing over $300M. The new capital signals a potential reversal from September's outflows.

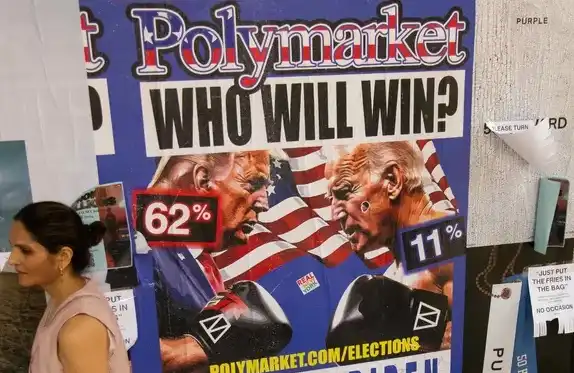

To achieve scalability, the Predictive Market needs high leverage, high-frequency trading, and high market outcomes value.

- 22:04The total holdings of Ethereum treasury companies have surpassed 5.7 million ETH, while the total holdings of Ethereum ETF amount to 6.89 million ETH.According to Jinse Finance, data from strategicethreserve shows that the total holdings of Ethereum treasury strategy companies have reached 5.7 million, accounting for 4.71% of the supply; the total holdings of Ethereum ETFs have reached 6.89 million, accounting for 5.7% of the supply.

- 21:33Two addresses are long on BTC, ETH, and SOL, currently holding long positions worth a total of $33.72 million.BlockBeats News, October 12, according to on-chain analyst Ai Aunt (@ai_9684xtpa), two addresses are long on BTC, ETH, and SOL, currently holding a total of $33.72 million in long positions. · Address 0x728...fAD88: Deposited 3.3 million USDC as margin three hours ago, opened 20x leveraged long positions on ETH and 20x leveraged long positions on SOL, with a total value of $19.66 million. The ETH entry price is $3,829.34, and the SOL entry price is $180.97. · Address 0xe9d...e43a5: Deposited 1 million USDC as margin two hours ago, opened a 25x leveraged long position on BTC, holding 125.73 BTC ($14.06 million), with an entry price of $111,593.4.

- 21:33If Ethereum breaks through $4,000, the total liquidation intensity of short positions on major CEXs will reach 221 million.BlockBeats News, October 12, according to Coinglass data, if Ethereum breaks through $4,000, the cumulative short liquidation intensity on major CEXs will reach 221 millions. Conversely, if Ethereum falls below $3,900, the cumulative long liquidation intensity on major CEXs will reach 185 millions. BlockBeats Note: The liquidation chart does not display the exact number of contracts pending liquidation, nor the precise value of contracts being liquidated. The bars on the liquidation chart actually represent the relative importance, or intensity, of each liquidation cluster compared to adjacent clusters. Therefore, the liquidation chart shows the extent to which the underlying price reaching a certain level will be affected. A higher "liquidation bar" indicates that once the price reaches that level, there will be a stronger reaction due to a wave of liquidity.