News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 10)|13.8 billion LINEA tokens unlock today; Trump will begin the final round of interviews for the next Federal Reserve Chair this week2Bitcoin’s back above $94K: Is the BTC bull run back on?3BlackRock Enters Ethereum Staking With a First-of-Its-Kind ETF

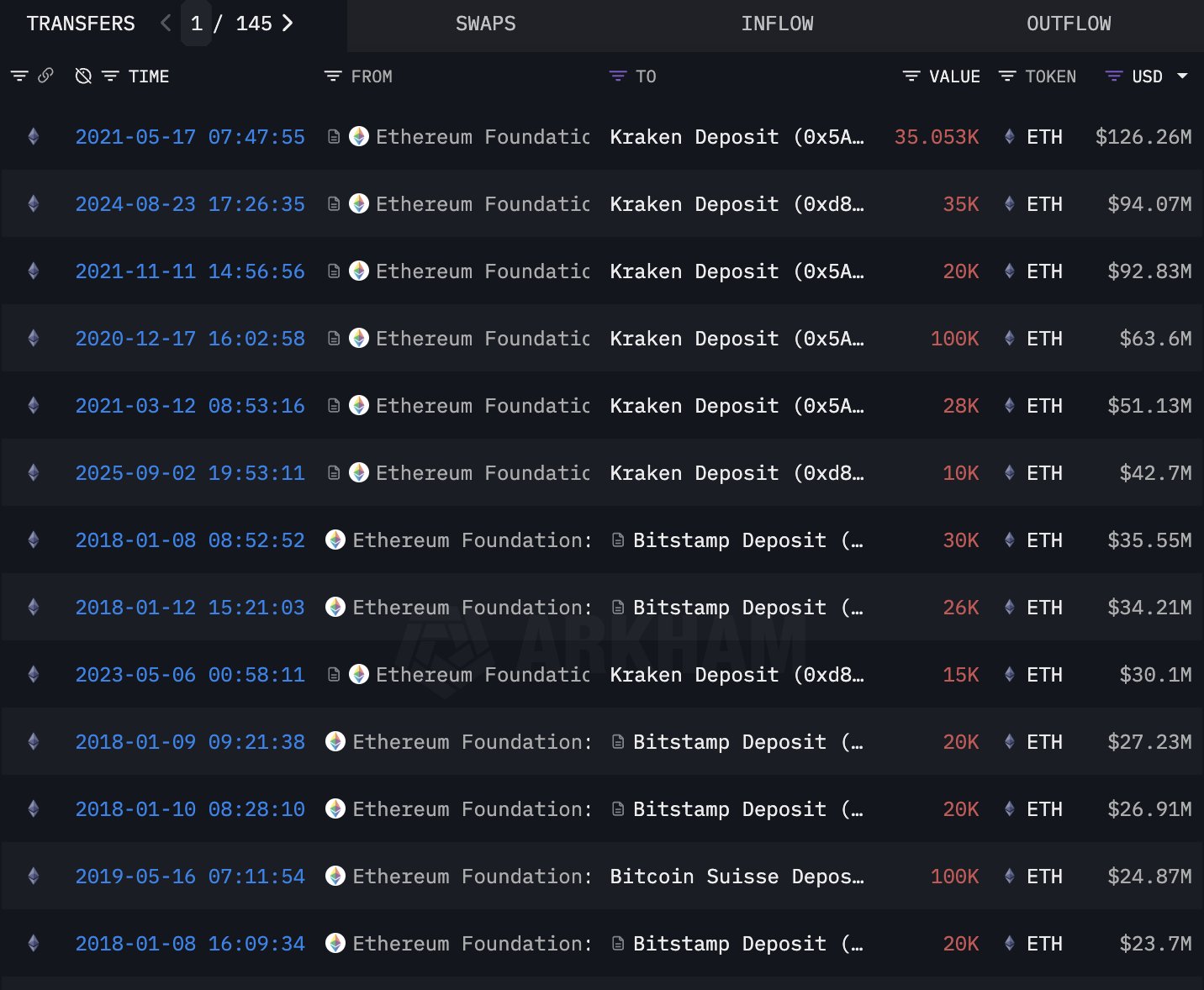

Ethereum Foundation to Sell 10,000 ETH: Can It Sustain?

CryptoNewsNet·2025/09/03 14:55

Lido Launches GG Vault for One-Click Access to DeFi Yields

CryptoNewsNet·2025/09/03 14:55

Can Ethereum Institutional Demand Counteract Bearish Options Traders?

CryptoNewsNet·2025/09/03 14:55

U.S. Bank Resumes Bitcoin Custody Services, Adds Support for ETFs

CryptoNewsNet·2025/09/03 14:55

AlphaTon Capital Shares Surge on TON Treasury Announcement

CryptoNewsNet·2025/09/03 14:55

Hayden Adams: The Story of Uniswap

A cryptocurrency visionary who is changing the way digital assets are traded worldwide.

Block unicorn·2025/09/03 14:52

Dogecoin price stalls as $175M treasury launch fails to spark momentum

Coinjournal·2025/09/03 14:50

XLM eyes $0.40 ahead of Stellar’s Protocol 23 upgrade

Coinjournal·2025/09/03 14:50

Ray Dalio Warns Dollar’s Weakness Could Bolster Crypto and Gold

DeFi Planet·2025/09/03 14:45

Reflect Money Launches USDC+ on Solana, Raises $3.75 Million

DeFi Planet·2025/09/03 14:45

Flash

- 20:10Charles Schwab: Fed Decision May Benefit Risk Assets in the Short Term, But Volatility Expected to Remain HighJinse Finance reported that Charles Schwab analyst Richard Flynn stated that by taking preemptive action, the Federal Reserve is sending a cautious signal in the face of rising downside risks, especially as global growth remains sluggish and policy uncertainty persists. For investors, this is a measured adjustment rather than a dramatic shift. Although this rate cut may provide short-term support for risk assets and could potentially trigger a seasonal 'Santa Claus rally,' volatility may remain elevated as the market needs to assess its impact on future policy and the broader economic outlook.

- 20:10Powell: There is no zero-risk path for policyJinse Finance reported that Federal Reserve Chairman Powell stated that there is no zero-risk path for policy, and in recent months, the balance of risks has changed.

- 20:10Goldman Sachs: Fed Hawks Reassured, Future Easing Depends on Labor MarketJinse Finance reported that Goldman Sachs analyst Kay Haigh stated that the Federal Reserve has reached the end of its "preemptive rate cuts." She believes: "The next responsibility lies with labor market data, which must weaken further to justify additional near-term easing policies. The 'hard dissent' from voting members and the 'soft dissent' reflected in the 'dot plot' highlight the hawkish camp within the Federal Reserve, while the reintroduction of language regarding the 'extent and timing' of future policy decisions in the statement is likely intended to appease them. Although this leaves the possibility for future rate cuts, the weakness in the labor market must reach a higher threshold."

News