News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The player in the trenches understands the direction of liquidity. They grasp a simple truth: the era of a singular memecoin season is no more.

Aster faces heavy selling pressure with RSI and CMF signaling strong outflows. Holding above $1.17 is key to avoiding a deeper fall toward $1.00.

For companies exposed to the dual risks of the crypto market and the stock market, has the worst already passed?

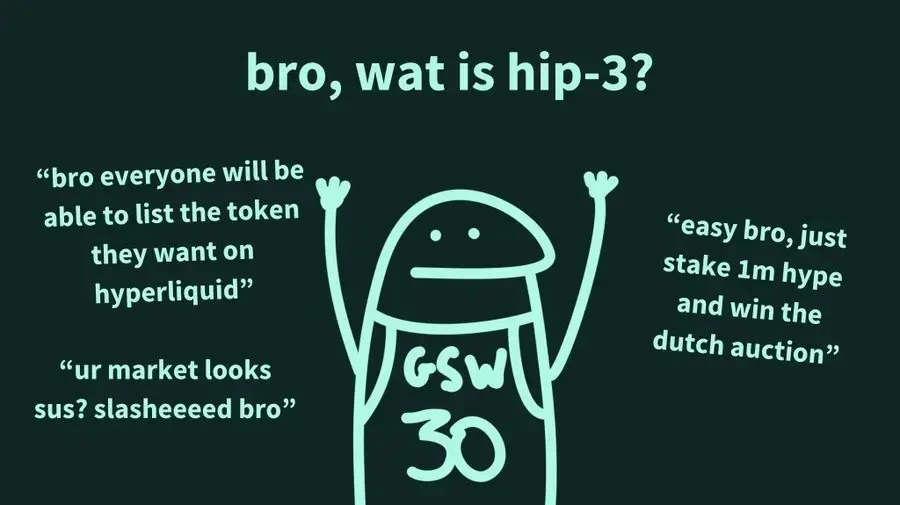

HIP-3 is a major improvement proposal for the Hyperliquid exchange, aimed at decentralizing the launch process of perpetual contract markets by allowing any developer to deploy new contract trading markets on HyperCore.

Bitcoin rebounds as trade tensions ease and Israeli hostages are released, with buyers returning to the market after last week's cryptocurrency crash.

Yieldbasis recently completed a $5 million funding round (accounting for 2.5% of total supply) through Kraken and Legion, with a fully diluted valuation (FDV) of $200 million.