News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

Remitly Appoints Sebastian J. Gunningham as Chief Executive Officer

Finviz·2026/02/18 21:09

CEA Industries Board Advances Plan to Revise Asset Management Deal

Finviz·2026/02/18 21:09

Carvana shares plunge after key profit measure falls short, future guidance remains unclear

101 finance·2026/02/18 21:09

Carlsmed Announces first corra personalized Cervical Plating Procedure

Finviz·2026/02/18 21:09

RF Acquisition Corp III Announces Closing of $100 Million Initial Public Offering

Finviz·2026/02/18 21:09

Eupraxia Pharmaceuticals Announces Proposed Public Offering

Finviz·2026/02/18 21:06

US judge blocks ex-Palantir staffers from poaching workers for new AI firm

101 finance·2026/02/18 21:03

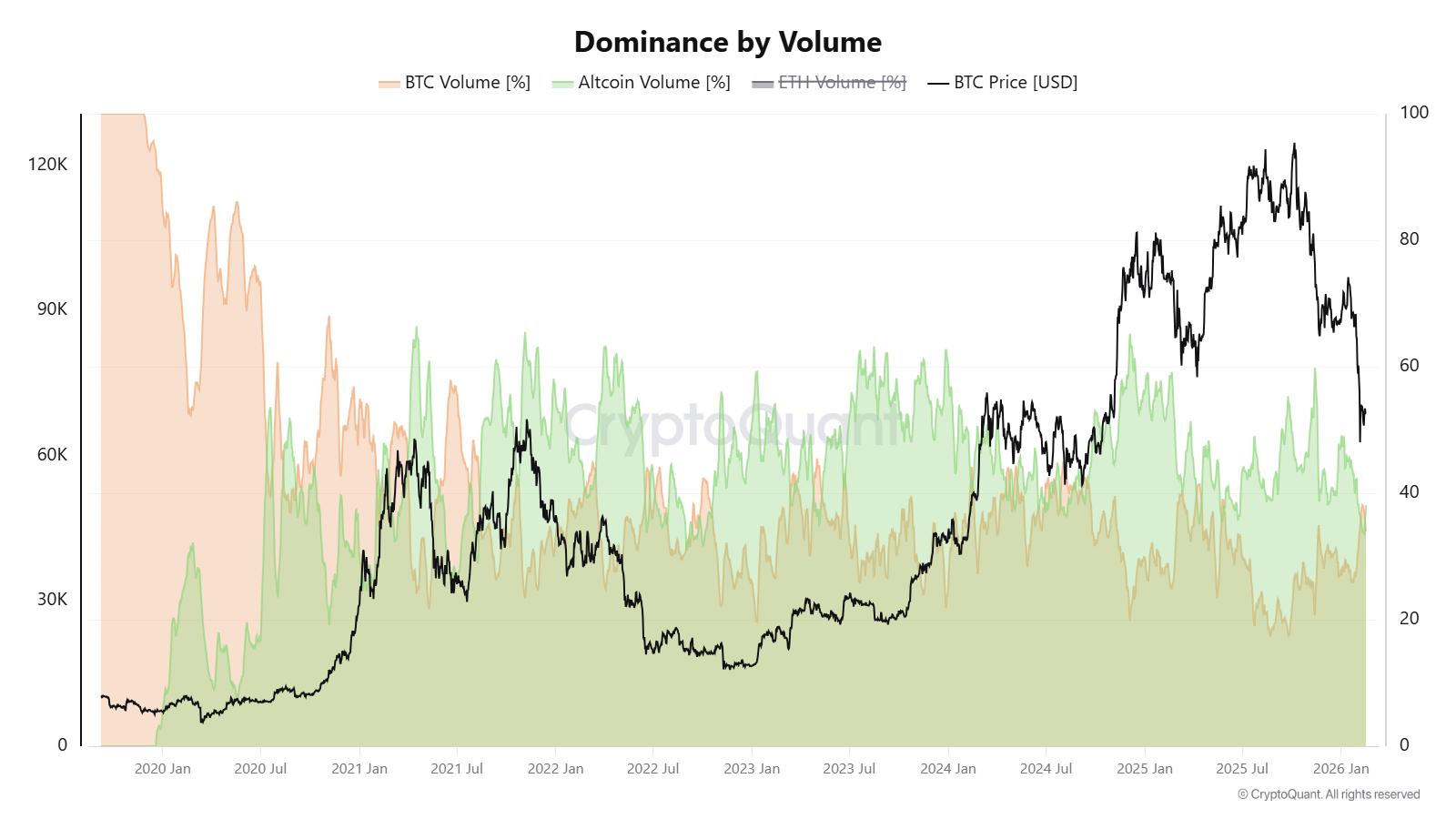

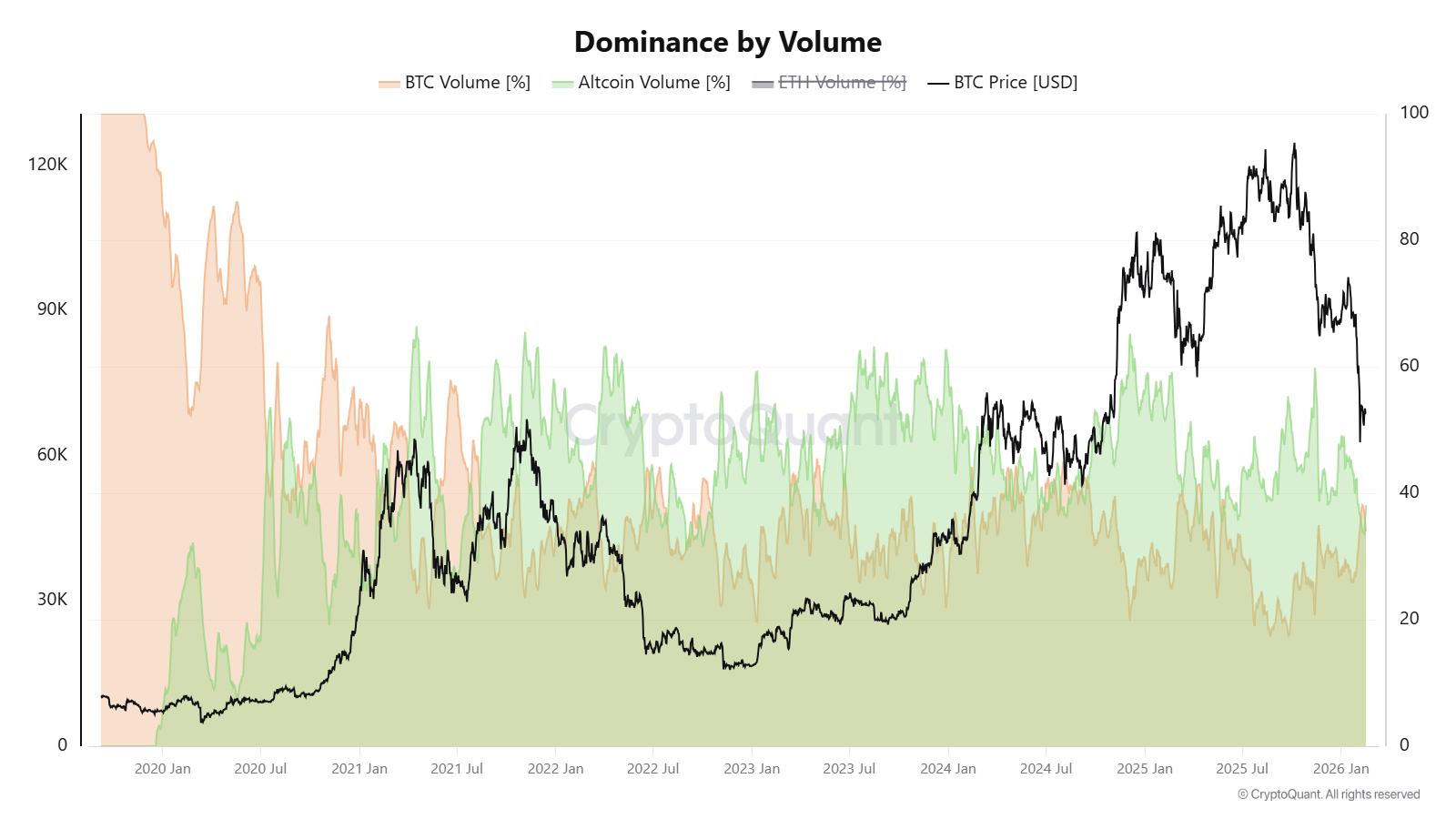

$209B exited altcoins over the last 13 months: Did traders rotate into Bitcoin?

Cointelegraph·2026/02/18 21:03

$209B exited altcoins over the last 13 months: Did traders rotate into Bitcoin?

Cointelegraph·2026/02/18 21:03

Why Is CoStar (CSGP) Stock Soaring Today

Finviz·2026/02/18 21:03

Flash

20:11

Tools for Humanity partners with Gap, Visa, and Tinder to promote the World ID human verification productJinse Finance reported that, according to The Wall Street Journal, OpenAI founder Sam Altman's Tools for Humanity is partnering with Gap, Visa, and Tinder to promote the World ID human verification product (an identity verification technology that distinguishes between humans and robots).

20:05

Elevance Health recently announced a management restructuring planAccording to the latest appointments, current Chief Financial Officer Mark Kaye will, in addition to maintaining his existing responsibilities, take on the strategic management of the Carelon business segment. Meanwhile, Felicia Norwood has been appointed as the head of the newly integrated health benefits organization, which has been formed through the restructuring of several of the company’s health benefits businesses. This management adjustment aims to optimize the allocation of the company’s strategic resources and strengthen the overall delivery capability of healthcare services through deep collaboration between the finance and business segments. As a key business unit of Elevance Health, Carelon focuses on medical technology services and clinical solutions, while the newly integrated health benefits division will oversee the management of member benefit plans and insurance product systems. Analysts believe that this personnel arrangement reflects Elevance Health’s strategic intention to enhance its overall market competitiveness by strengthening the synergy between financial management and business operations amid the transformation of the healthcare industry. The reallocation of management responsibilities is expected to foster a closer synergy between financial control and business innovation.

19:40

Federal Reserve official Bowman: Regulators will release revised bank capital reform proposals by the end of MarchJinse Finance reported that Michelle Bowman, Vice Chair for Supervision at the Federal Reserve, stated that regulators are about to release a revised version of the U.S. bank capital reform proposal, namely the highly anticipated Basel III endgame plan. Bowman said at a Senate Banking Committee hearing on Thursday: "We are working closely with the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) to ensure the proposal is launched by the end of March." When asked whether the officials had reached a consensus on the plan, she gave an affirmative answer.

News