News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Circle and Finastra join forces to integrate USDC into Global PAYplus, modernizing $5 trillion in daily cross-border flows, cutting costs, and positioning stablecoins as institutional-grade tools amid regulatory scrutiny and global adoption.

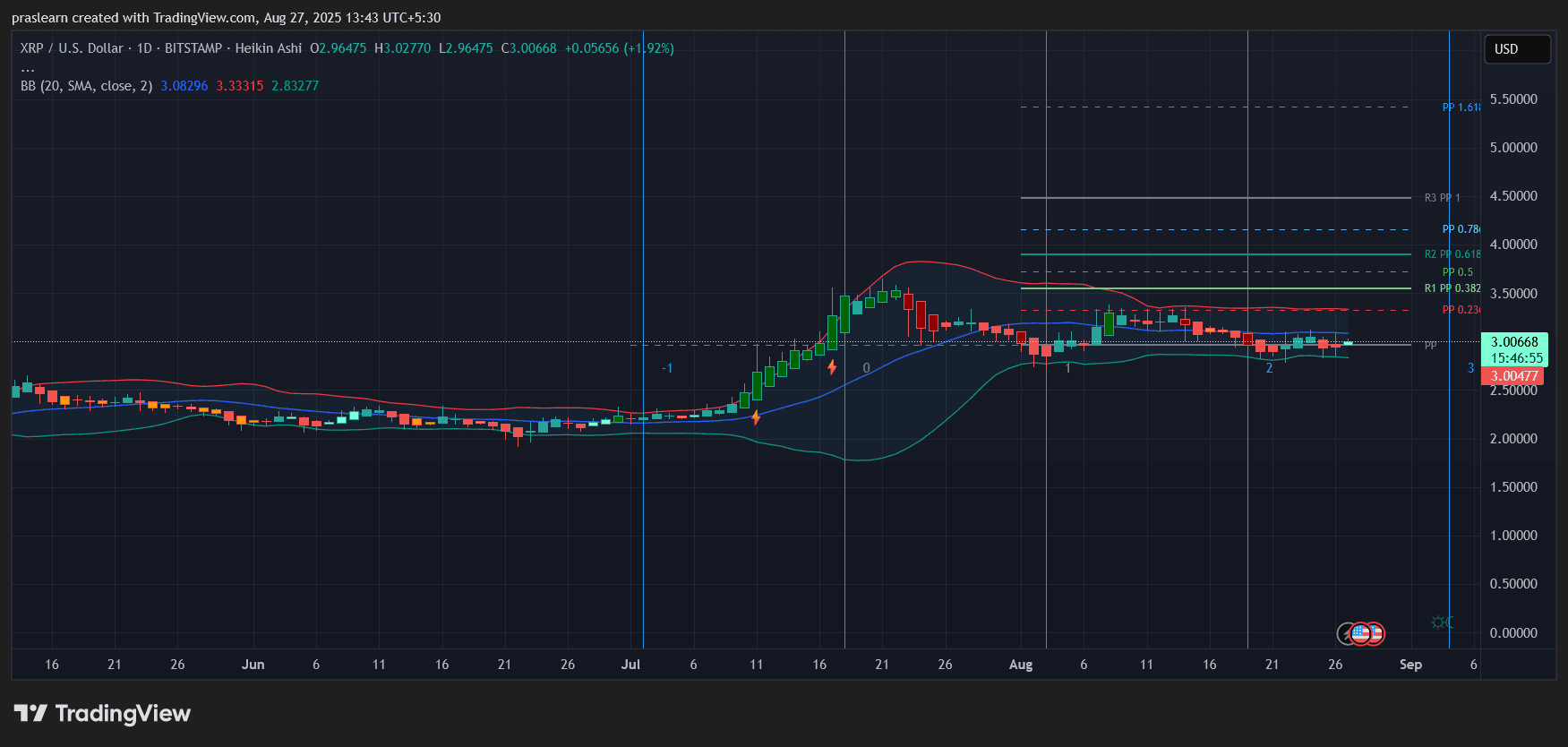

- BlockDAG's $383M 2025 presale and 2,660% ROI highlight infrastructure-driven growth via 2.5M users, 19k ASIC miners, and 300+ dApps. - XRP relies on uncertain ETF approvals ($2.96 price) while HBAR ($0.19) gains from enterprise partnerships but faces governance centralization risks. - Analysts prioritize projects with audited scalability (BlockDAG's DAG-PoW) over speculative bets, emphasizing operational metrics over regulatory outcomes.

- Political-aligned cryptocurrencies like TRUMP Token and World Liberty Financial (WLFI) surged in 2025, blending ideology with speculative growth and institutional backing. - WLFI's $550M token sales and USD1 integration highlight hybrid models merging political influence with regulatory credibility, though 60% family control raises governance concerns. - Risks include regulatory gray areas (SEC's 2025 meme coin reclassification) and reputational volatility, as political fortunes or policy shifts could er

In August 2025, two heavyweight figures from the Ethereum ecosystem—BitMine CEO Tom Lee and ConsenSys CEO Joseph Lubin—publicly expressed interest in the memecoin project Book of Ethereum (BOOE), sparking widespread market discussion. BOOE builds its community economy through a religious narrative, launching related tokens such as HOPE and PROPHET to form a "Trinity of Faith" system. An anonymous whale, fbb4, has promoted BOOE and other memecoins through a long-term holding strategy, but this approach, which relies heavily on market sentiment, carries risks of regulation and bubbles. While institutional endorsements have increased attention, investors are advised to rationally assess the project’s value and associated risks. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved by the Mars AI model.

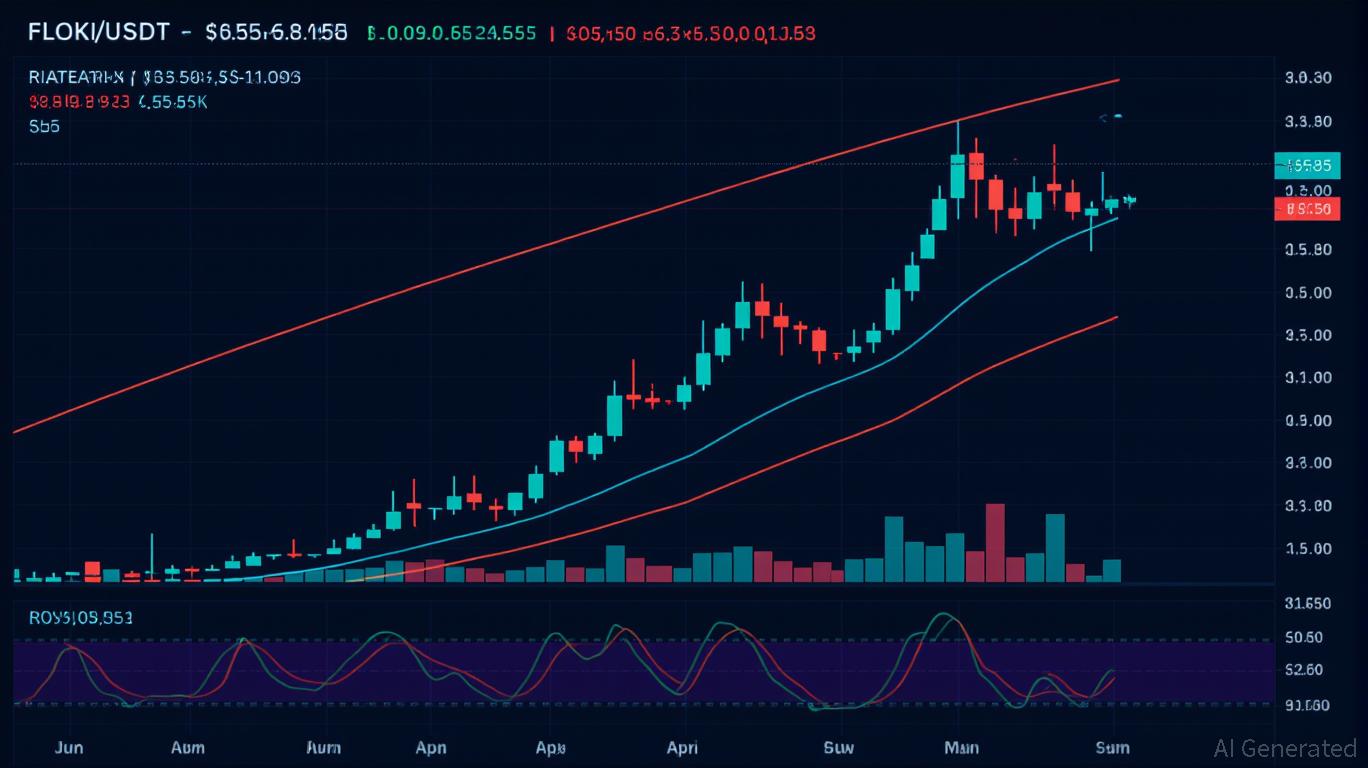

- FLOKI's August 2025 technical setup shows a potential breakout after forming a rounded bottom pattern and key Fibonacci support at $0.00009620. - Mixed moving averages and balanced RSI indicate volatility, with Bollinger Bands signaling momentum but warning of overbought risks near $0.00010553. - Traders face a 12% upside potential if support holds, but bearish pressure could trigger an 8% decline if resistance fails, requiring strict risk management. - Breakout scalping and range trading strategies are

- Stellar Lumens (XLM) forms a 60-70% successful inverse head-and-shoulders pattern, with a potential $1 target if the $0.50 neckline breaks decisively. - Institutional accumulation at $0.39 support and $440M+ in tokenized assets, plus PayPal/Franklin Templeton partnerships, reinforce XLM's macroeconomic tailwinds. - Protocol 23's 5,000 TPS upgrade on Sept 3 and regulatory clarity in major markets create a virtuous cycle of demand, positioning XLM as a high-probability breakout candidate. - Strategic entry

- Over 170 public companies now hold Bitcoin as treasury assets, with firms like KindlyMD and Sequans Communications raising billions via equity to accumulate BTC. - Strategic logic includes Bitcoin's inflation resistance and potential to boost shareholder value through Bitcoin-per-share metrics, though equity dilution risks persist. - Corporate Bitcoin buying pressures institutional demand, tightening supply post-2024 halving while creating feedback loops that could destabilize altcoin markets. - Risks in