News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Remarks Boost Gold Prices; S&P Hits Record High; Storage Stocks Shine in Earnings (January 28, 2026)2Crypto products on CME reached record activity at the end of 20253Bitcoin Achieves Remarkable Stability as a Macro Asset, New Analysis Reveals

Solana ETFs Attract $23.6M, Reaching Their Highest Level in Four Weeks

101 finance·2026/01/15 13:06

Top Rated Stock: Non-AI Winners Ready to Break Out

AInvest·2026/01/15 13:06

OpenServ and Neol Advance Enterprise-ready AI Reasoning Under Real-world Constraints

DeFi Planet·2026/01/15 13:03

Matthew McConaughey Says It's Not "Alright, Alright, Alright" for AI to Misuse His Voice

Decrypt·2026/01/15 12:57

With Saks going bankrupt, Macy’s is gaining some momentum

101 finance·2026/01/15 12:57

XRP Price Prediction: Luxembourg License And $10.6M ETF Inflows Meet Falling Open Interest

CoinEdition·2026/01/15 12:51

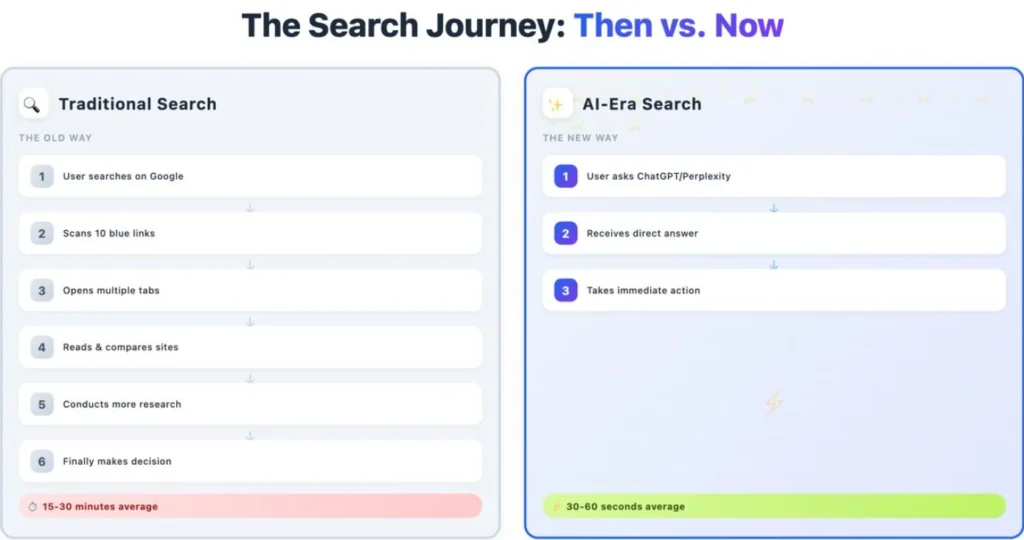

What Happens When You Treat ChatGPT Like a Search Engine? How One Crypto Exchange Grew by 688% in AI Search

BlockchainReporter·2026/01/15 12:51

Goldman: Fourth Quarter Earnings Overview

101 finance·2026/01/15 12:42

USD/CHF Price Outlook: Testing resistance near the 0.8020 level

101 finance·2026/01/15 12:42

Flash

19:07

Federal Reserve FOMC statement: The committee approved the interest rate decision by a vote of 10-2.According to Odaily, the Federal Reserve FOMC statement: The committee approved the current interest rate decision by a vote of 10-2. (The previous meeting was 9-3)

19:06

The Federal Reserve raises its assessment of economic activity, describing the pace of expansion as solid.ChainCatcher News, according to Golden Ten Data, the Federal Reserve FOMC statement has raised its assessment of economic activity, stating that it is expanding at a "solid" pace.

19:06

The US Dollar Index (DXY) surged by 1.00% intraday, now trading at 96.72BlockBeats News, January 29th: The US Dollar Index (DXY) surged by 1.00% intraday to now stand at 96.72.

The Federal Reserve stayed put as expected, and spot silver rose by $1.20 in a short period, now trading at $22.42 per ounce. (FXStreet)

News