News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 12)|World launches a “super app” featuring payments and chat; US initial jobless claims reach 236,000; Satoshi Nakamoto statue installed at the NYSE2Ether vs. Bitcoin: ETH price poised for 80% rally in 20263Prediction markets bet Bitcoin won’t reach $100K before year’s end

It’s foolish to pretend Bitcoin’s story doesn’t include $79k this year

CryptoSlate·2025/11/14 19:00

Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

Enter the Monad Arena.

深潮·2025/11/14 18:42

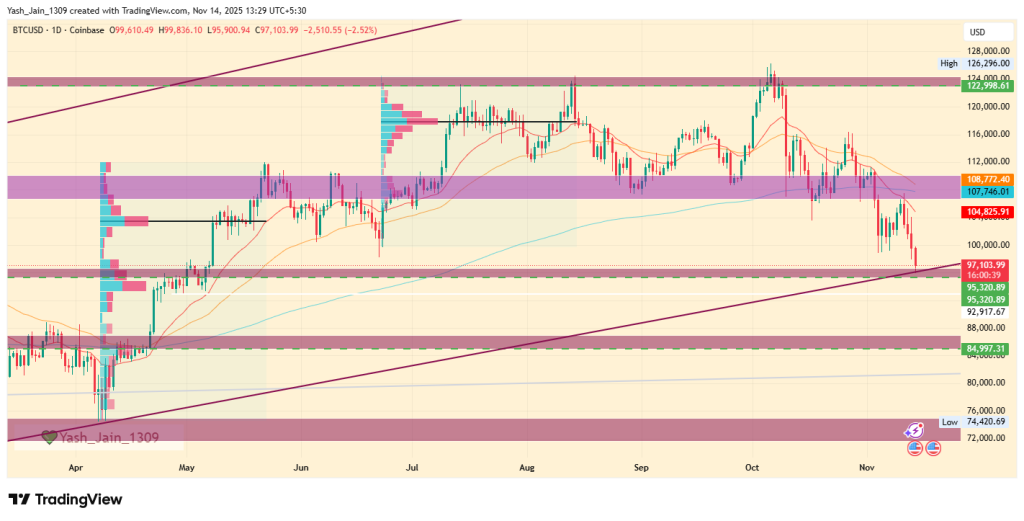

Comprehensive Data Analysis: BTC Falls Below the Critical $100,000 Level—Is the Bull Market Really Over?

Even if bitcoin is indeed in a bear market right now, this bear market may not last long.

深潮·2025/11/14 18:40

Options exchange Cboe enters the prediction market, focusing on financial and economic events

Options market leader Cboe has announced its entry into the prediction market. Rather than following the sports trend, it is firmly committed to a financially stable path and plans to launch its own products linked to financial outcomes and economic events.

深潮·2025/11/14 18:38

Grayscale formalizes its IPO filing

Cointribune·2025/11/14 18:06

Czech Bank Tests Crypto Assets In Pilot Program

Cointribune·2025/11/14 18:06

New XRP ETF Draws $58M Trading Volume, Tops This Year’s ETF Debuts

Cointribune·2025/11/14 18:06

Bitzuma Launches Research & Education Hub to Elevate Crypto Knowledge

DeFi Planet·2025/11/14 18:03

Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

Coinpedia·2025/11/14 17:42

![Why Crypto Is Down Today [Live] Updates On November 14,2025](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

Why Crypto Is Down Today [Live] Updates On November 14,2025

Coinpedia·2025/11/14 17:42

Flash

- 03:14The Bolivian Blockchain Association proposes to the government the tokenization of gold and other precious metals on Ethereum.According to ChainCatcher, citing CriptoNoticias, members of the Bolivian Blockchain Association plan to submit a proposal to the president aimed at tokenizing gold and other precious metals on the Ethereum network. The plan is to tokenize gold and other precious metals on Ethereum, enabling full traceability from mining to national reserves in order to curb corruption. The proposed model is inspired by the approach of the Kingdom of Bhutan, which issued a gold-backed token on the Solana network in December 2025, supported by its sovereign reserves.

- 03:02RootData: LISTA will unlock tokens worth approximately $6.33 million in one weekAccording to ChainCatcher, citing token unlock data from the Web3 asset data platform RootData, Lista DAO (LISTA) will unlock approximately 38.44 million tokens, worth about $6.33 million, at 00:00 on December 20 (UTC+8).

- 02:10Vanguard executive: Bitcoin is a speculative asset, but may have practical applications during inflation or turmoilChainCatcher news, according to a report by Cointelegraph, John Ameriks, Global Head of Quantitative Equity at Vanguard, stated that bitcoin is purely a speculative asset, similar to collecting toys. Although John Ameriks expressed criticism, he also noted that in cases of high inflation in fiat currencies or political turmoil, this cryptocurrency could find real-world use cases beyond market speculation.

News