News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 19)|First US Spot Dogecoin ETF Launched; Global Crypto Market Cap Rises to $4.1 Trillion; SEC Accelerates Spot Crypto ETF Approvals2Dive into the Crypto World: PUMP and WLFI Coins Soar with Unmatched Potential3Bitcoin Holds Above $115K Support as Analysts Outline $137K Resistance and $93K Downside

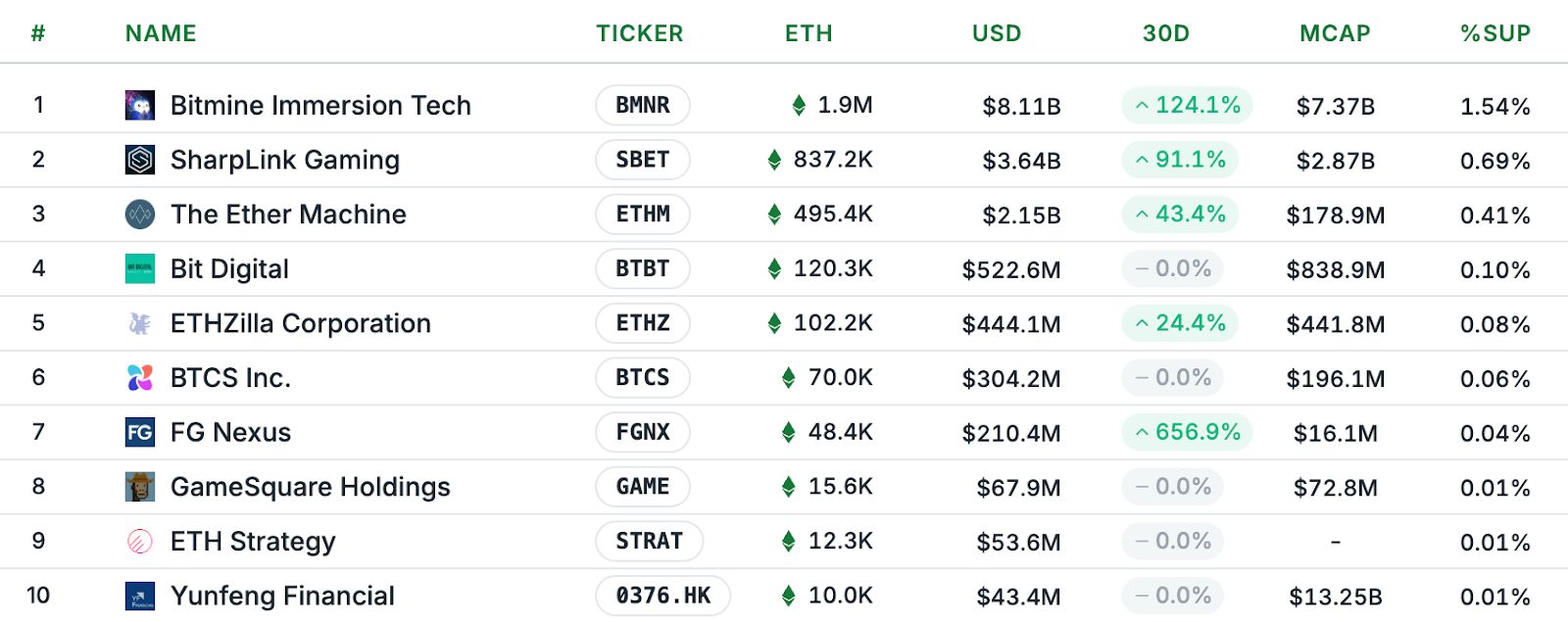

Yield-chasing ETH treasury firms are most at risk: Sharplink Gaming CEO

CryptoNewsNet·2025/09/03 06:05

XRP Ledger’s Entire Carbon Footprint Equals Just 1 Transatlantic Flight: Research

CryptoNewsNet·2025/09/03 06:05

Bitcoin Correction Could Deepen Before Recovery as Only 9% of Supply at Loss

CryptoNewsNet·2025/09/03 06:05

XRP (XRP) Price Prediction: Analysts Eye $3.60 Breakout As ETF Speculation Heats Up

CryptoNewsNet·2025/09/03 06:05

Here is XRP Price by December 2025 if SEC Approves ALL Spot XRP ETFs by October

CryptoNewsNet·2025/09/03 06:05

Something unusual is building in $9.81 billion of Bitcoin futures flows and it could break either way

CryptoSlate·2025/09/03 06:01

US SEC, CFTC clear path for registered firms to trade spot crypto

Coinjournal·2025/09/03 06:00

SharpLink buys 39,008 ETH for $177M at an average price of $4,531

Cointribune·2025/09/03 05:55

EU stablecoin regulations leave Europe vulnerable, says ECB chief

CryptoSlate·2025/09/03 05:39

Trust Wallet Brings Tokenized Stocks & ETFs Onchain for 200M+ Users Worldwide

Trust Wallet, the world’s leading self-custody Web3 wallet with over 200 million users, today announced the launch of tokenized real-world assets (RWAs)—unlocking seamless access to tokenized versions of U.S. stocks and ETFs for users around the globe*. Users can now discover, hold, and swap tokenized RWAs* that track the prices of leading equities and major … <a href="https://beincrypto.com/trust-wallet-tokenized-stocks-etfs-onchain/">Continued</a>

BeInCrypto·2025/09/03 05:30

Flash

- 05:56A certain whale deposited approximately 685,000 USDC into Lighter and opened a 20x leveraged short position on ETH.According to ChainCatcher, as monitored by Lighter Lens, a whale deposited 685,513 USDC into Lighter and opened a 20x leveraged ETH short position.

- 05:56Analyst: Bank of Japan's Asset Sale Plan Signals Imminent Rate Hike in OctoberJinse Finance reported that analysts stated that after the Bank of Japan unexpectedly released a hawkish signal, the yen generally strengthened against G10 currencies and Asian currencies. Matt Simpson, Senior Market Analyst at StoneX, pointed out that although the central bank kept interest rates unchanged as expected, it announced the start of reducing its ultra-large ETF and REIT holdings. "This marks an important symbolic step in officially moving away from the ultra-loose policies of the Abenomics era," he said. "The key point is that the Bank of Japan has officially begun to reduce its unconventional asset holdings." Simpson added that this could also be a precursor to a rate hike by the central bank in October. (Golden Ten Data)

- 04:58Analysis: Bank of Japan statement paves the way for a possible rate hike as early as Q4, yen strengthens pushing USD/JPY towards the 147 levelAccording to ChainCatcher, citing Gelonghui, institutional analysis indicates that the Bank of Japan maintained its policy interest rate at 0.50% with a 7-2 vote, in line with broad market expectations. Policy board members Hajime Takata and Naoki Tamura voted against maintaining the rate, advocating for a 25 basis point rate hike. The policy statement is more detailed than before, reiterating the assessment that the economy is “showing mild recovery overall, despite some areas of weakness,” and emphasizing close monitoring of uncertainties affecting the financial and foreign exchange markets, Japanese economic activity, and prices. The Bank specifically pointed out that the outlook faces “multiple risks,” stating that “the evolution of trade and other policies in each jurisdiction, as well as overseas economic activity and price responses, remain highly uncertain.” Although a trade agreement has been signed between Japan and the US, the statement still highlights elevated uncertainty and clearly states that the tariff environment is less favorable for Japanese businesses compared to the zero-tariff era before the Trump administration. The USD/JPY continued its decline, hitting a new post-decision low of 147.28, while generally remaining around the 148.00 level during the Tokyo morning session. The yen led G10 currencies today, with the market interpreting the Bank of Japan’s statement as paving the way for a possible rate hike as early as the fourth quarter.