News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | US-Japan-EU-Mexico Collaborate on Key Minerals Development; Nasdaq Introduces Fast Inclusion Rules; Software Stocks Continue Under Pressure (February 5, 2026)2Hyperliquid treasury seeks revenue boost using HYPE holdings as options collateral3Bitcoin drops following Treasury Secretary Bessent's statement that the US government cannot require banks to rescue crypto

Global Markets Brace as U.S. Tariffs Data and Fed Events Align

CoinEdition·2026/01/19 10:24

GBP: UK figures could strengthen Sterling as short covering occurs – ING

101 finance·2026/01/19 10:24

European stocks fall, gold climbs amid looming Greenland tariff concerns

101 finance·2026/01/19 10:21

Oil declines as tariff concerns trigger risk aversion – ING

101 finance·2026/01/19 10:21

Crypto Market to See $1B in Token Unlocks as AltSeason Index Sits at 27

Coinspeaker·2026/01/19 10:09

Hyperliquid Takes Lead over DEX Exchange Aster with $40.7 Billion Trading Volume

Coinspeaker·2026/01/19 10:03

Hoskinson Warns Senate Crypto Bill Hands Control to SEC After 137 Legislative Amendments

CoinEdition·2026/01/19 09:42

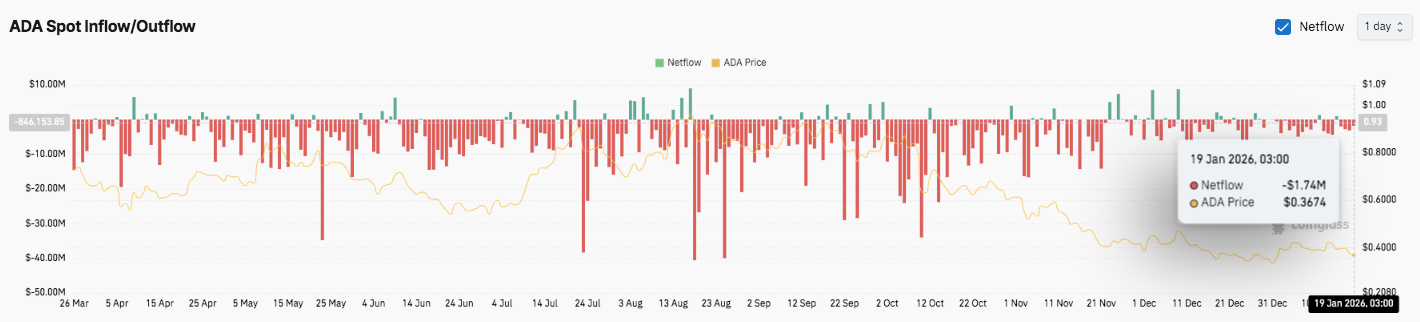

Cardano Price Prediction: ADA Bears Hold Control as Hoskinson Questions CLARITY Act Odds

CoinEdition·2026/01/19 09:42

Elliott Rejects Toyota Group Offer, Suggests Independent Strategy

101 finance·2026/01/19 09:30

Flash

09:43

CME Group to launch its own tokens and trade cryptocurrencies 24/7: Will $HYPER be the next to be listed?According to a report by Bijie Network: CME Group is exploring the launch of a digital token to enable round-the-clock trading and near-instant collateral transfers, marking a significant transformation in the institutional financial sector. Meanwhile, Bitcoin Hyper ($HYPER) is addressing Bitcoin's speed bottleneck by integrating the Solana Virtual Machine for high-performance Layer 2 execution, with its presale having raised over $31 million. This convergence highlights the growing demand for scalable infrastructure as traditional finance and the decentralized economy become increasingly intertwined.

09:38

Vitalik: No need for more copy-paste EVM chains; focus should be on application chains and institutional-grade L2sForesight News reported that Vitalik posted, "For about the past day and a half, I have been following everyone's reactions to my comments about L2. We don't need more copy-paste EVM chains, nor do we need more Alt L1s. What we need are products that can bring entirely new experiences. I gave some examples: privacy protection, application-specific efficiency, ultra-low latency, but my list is certainly far from complete. I think the second important thing is: regarding 'connection with Ethereum,' it feels like it needs to match the substance. Personally, I really like many things that can be called 'application chains.'" "Another extreme of 'application chains' would be, for example, convincing a government agency, social media platform, or gaming platform to deploy a Merkle root in its database and use STARK proofs to verify that every update is authorized, signed, and executed on-chain according to a predetermined algorithm. In my view, in terms of 'institutional-grade secondary security,' this is the most meaningful."

09:38

U.S. semiconductor and chip equipment stocks rise in pre-market tradingGelonghui, February 5th|US semiconductor and chip equipment stocks rose in pre-market trading, as Alphabet (GOOG.O) stated that its capital expenditures in 2026 may double. Broadcom (AVGO.O) rose 5%, while AMD (AMD.O) and Nvidia (NVDA.O) both gained over 2%.

News