News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 10)|13.8 billion LINEA tokens unlock today; Trump will begin the final round of interviews for the next Federal Reserve Chair this week2Bitcoin’s back above $94K: Is the BTC bull run back on?3BlackRock Enters Ethereum Staking With a First-of-Its-Kind ETF

US Banks Abruptly Drain $25,000,000,000 From Federal Reserve’s Lifeline for Lenders

Daily Hodl·2025/12/05 16:00

Best Crypto Presale Opportunities After the Altcoin Drawdown: Why Mono Protocol’s Approach Stands Out

Cryptodaily·2025/12/05 16:00

Crypto Treasury Underwriter Clear Street Eyes $12B IPO Led By Goldman Sachs

Clear Street targets a $12B IPO led by Goldman Sachs as crypto-treasury underwriting demand reshapes U.S. equity and debt markets.

Coinspeaker·2025/12/05 16:00

French Bank BPCE Offers Direct Crypto Access for Millions of Clients

France’s second-largest bank, BPCE, will begin offering direct crypto purchases next week, emphasizing a trend of improved regulatory sentiment in Europe.

Coinspeaker·2025/12/05 16:00

Strategy CEO Says No Bitcoin Sale till 2065 Despite BTC Losing $90K SupportBitcoin Price Forecast: Cup-and-Handle Intact, Can BTC Reclaim $100k to Co

Bitcoin dipped below $90,000 after heavy liquidations. Strategy’s CEO vows not to sell.

Coinspeaker·2025/12/05 16:00

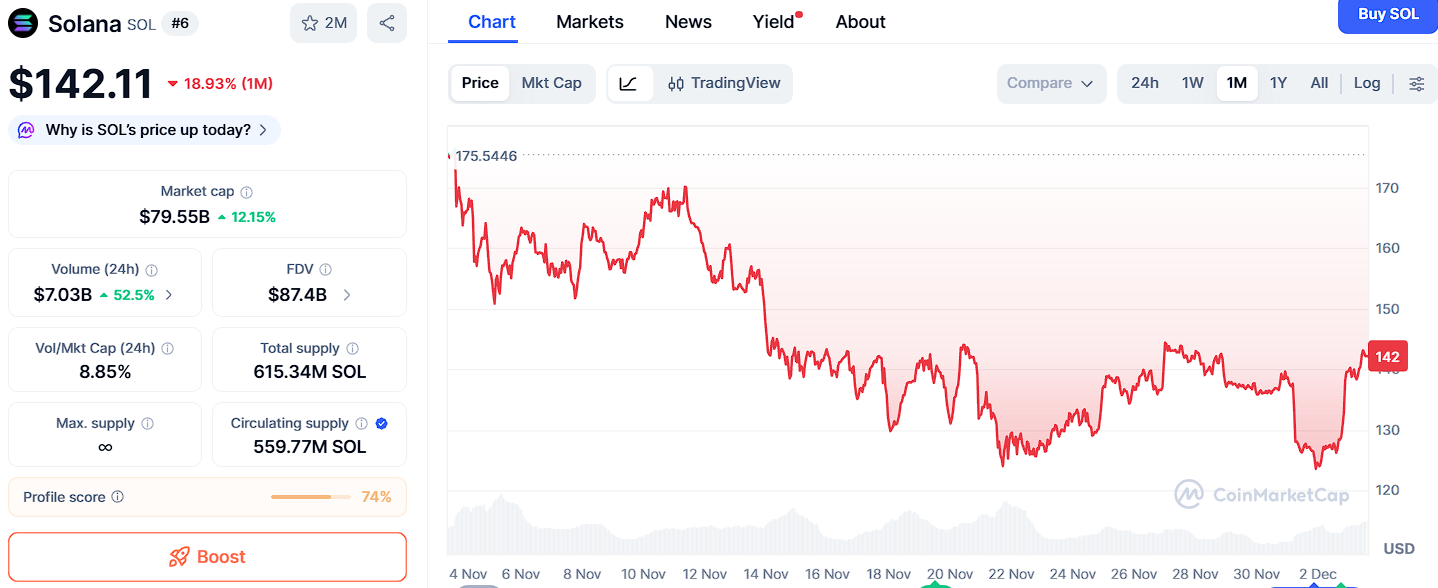

Top 3 Breakout Coins Before 2026: Ozak AI, BNB, and Solana Show Explosive Signs

Cryptodaily·2025/12/05 16:00

Polymarket’s New Play: Betting Against Its Own Users. Wait, What?

Kriptoworld·2025/12/05 16:00

Eric Trump’s Wealth Surges With His Family-Backed Crypto Companies

Eric Trump’s wealth has surged as crypto becomes the Trump family’s fastest-growing financial engine. Major stakes in American Bitcoin and World Liberty Financial have added hundreds of millions to his net worth. Eric remains committed to crypto as traditional Trump businesses expand globally.

CoinEdition·2025/12/05 16:00

Flash

- 21:54Analyst: The Fed's statement is dovish, expected to cut rates by 100 basis points next yearJinse Finance reported that analyst Anna Wong stated: "My assessment is that the overall tone of the policy statement and the updated forecasts is dovish—although there are also some potentially hawkish messages. On the dovish side, the committee significantly raised the growth trajectory, lowered the inflation outlook, and kept the 'dot plot' unchanged. The Federal Open Market Committee also announced the start of reserve management purchases. On the other hand, a signal in the policy statement indicates that the committee tends to pause rate cuts for a longer period." She continued: "Although the 'dot plot' shows only one rate cut in 2026—while the market expects two—our view is that the Federal Reserve will ultimately cut rates by 100 basis points next year. This is because we expect weak employment growth, and currently see no clear signs of inflation reigniting in the first half of 2026."

- 21:47The Federal Reserve's interest rate cut meets expectations, with a weakening labor market as the main reason.According to Golden Ten Data, Angeles Investments Chief Investment Officer Michael Rosen stated that this rate cut was within expectations, and the 25 basis point cut passed by a 9-to-3 vote was also anticipated. The statement emphasized the weakness in the labor market, which was the main reason for the 25 basis point rate cut, suggesting that the Federal Reserve may continue to ease policy. However, the current expectation of only one 25 basis point rate cut next year has not changed.

- 21:37Institutions assess Powell's speech: Nothing about "hawkish rate cuts"Jinse Finance reported that Informa Global Markets commented on the latest speech by Federal Reserve Chairman Jerome Powell: so-called "hawkish rate cuts" are just like this. Powell pointed out that there is tension between the Fed's dual mandate, but also admitted that there has not been much change since the last meeting. His remarks were generally similar to previous ones. The most memorable sentence from this press conference was: "The current economy is not like an overheated economy that would trigger labor-driven inflation."

News