News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Bitcoin Slips as January $100K Odds Fade on Polymarket Data

Cryptotale·2026/01/19 08:06

Bitcoin Prices Plummet as US-EU Tensions Escalate

Cointurk·2026/01/19 07:45

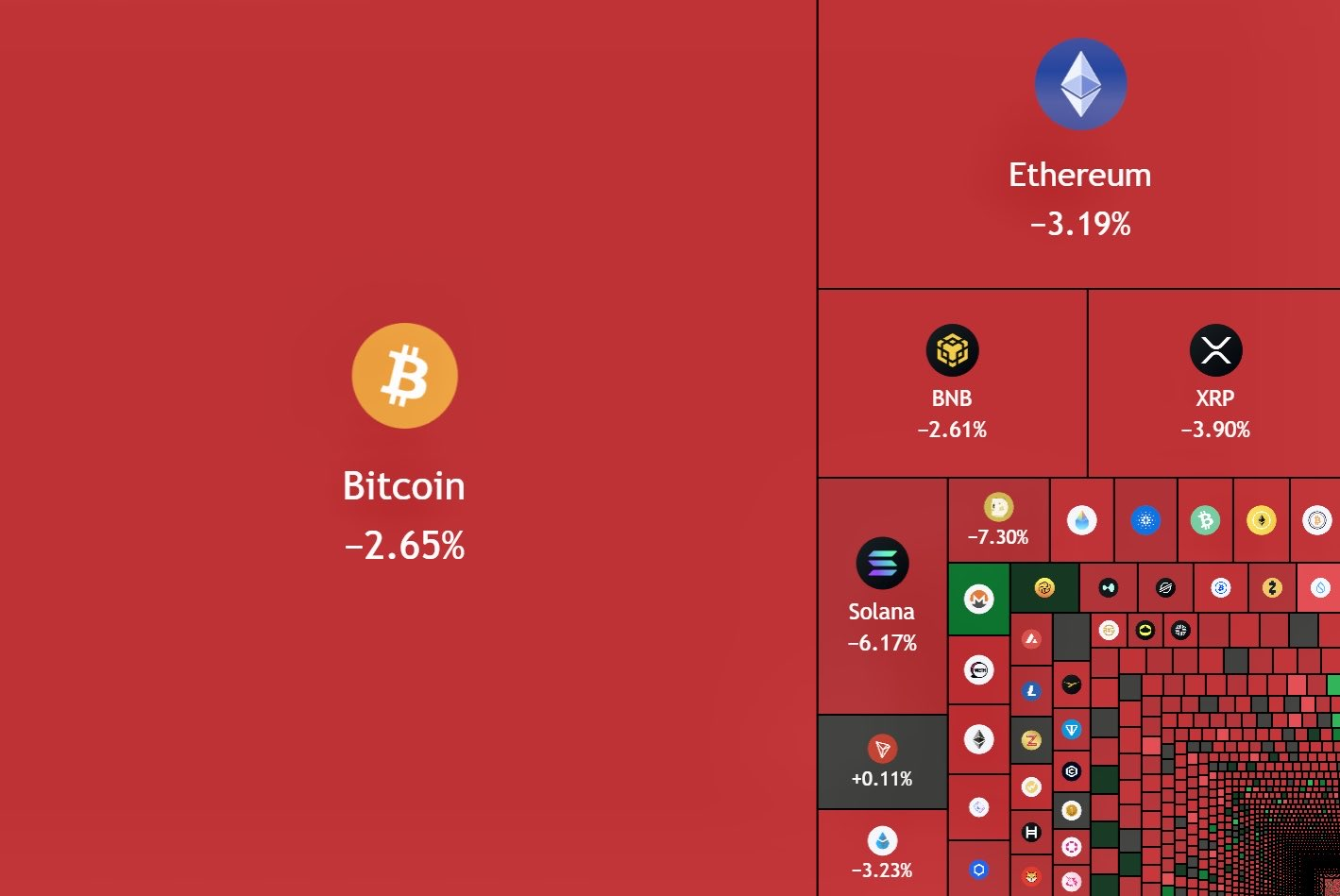

Gold Hits Record High as Crypto Market Loses $100 Billion in Hours

CoinEdition·2026/01/19 07:36

Vitalik Buterin Wants to Remove Ethereum’s Obsolete Code

Cointribune·2026/01/19 07:33

US Stablecoin Yield Ban Raises Dollar Competitiveness Fears

Cryptotale·2026/01/19 07:21

Tesla poised to be early winner as Canada opens door to Chinese-made EVs

101 finance·2026/01/19 07:06

Anti-coercion: The EU's Secret Weapon Against US Economic Threats

Cointribune·2026/01/19 07:00

Venus Protocol’s XVS Token Signals Bullish Breakout Following October Consolidation

BlockchainReporter·2026/01/19 07:00

Netflix (NFLX) Q4 Earnings Preview: Warner Merger Uncertainty and Ad Business Momentum

Bitget·2026/01/19 06:47

Flash

02:06

Total locked value has decreased by $7.3 billions since the liquidation event on October 10.Since the liquidation event on October 10, the total value locked (TVL) has decreased by $7.3 billion, with no further explanation provided. (Cointelegraph)

02:05

A new address is suspected to have accumulated 20,000 ETH worth $41.98 million about 4 hours ago.Jinse Finance reported that, according to on-chain analyst @ai_9684xtpa, a new address 0xBf0…47f52 is suspected to have accumulated 20,000 ETH four hours ago, valued at $41.98 million, with a withdrawal price of $2,098.87.

01:55

Abnormal Arweave network block data display caused by browser cache issuesPANews, February 8th – Active Arweave ecosystem member @mil_itia stated on X that since yesterday, outdated block data has been displayed for Arweave, making it appear as if the chain has stopped producing blocks. In reality, Arweave has been generating blocks normally and all transactions are being processed as usual. The issue is that the Viewblock explorer uses local cache counting instead of the actual network block height. The team is in contact with them to resolve this issue. Previous news: The Arweave network has not produced a block for over 24 hours.

News