News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Hoskinson Hits Garlinghouse Over CLARITY Act Support: Report

Cryptotale·2026/01/19 13:27

US Louisiana State Employees Fund reports holding $3.2M of Saylor’s $MSTR shares

Cointelegraph·2026/01/19 13:24

BRICS CBDC Proposal: India’s Central Bank Unveils Ambitious Plan to Revolutionize Global Payments

Bitcoinworld·2026/01/19 13:21

Paradex Outage Sparks Critical Examination of Crypto Exchange Infrastructure Reliability

Bitcoinworld·2026/01/19 13:21

Perle Labs’ Revolutionary Blockchain AI Data Platform Launches Season 1 to Build Trustworthy AI

Bitcoinworld·2026/01/19 13:21

Global stock markets decline as investors seek safe assets following Trump’s tariff warnings

101 finance·2026/01/19 13:06

Micron Plans $1.8 Billion Acquisition of Taiwanese Facility

101 finance·2026/01/19 13:06

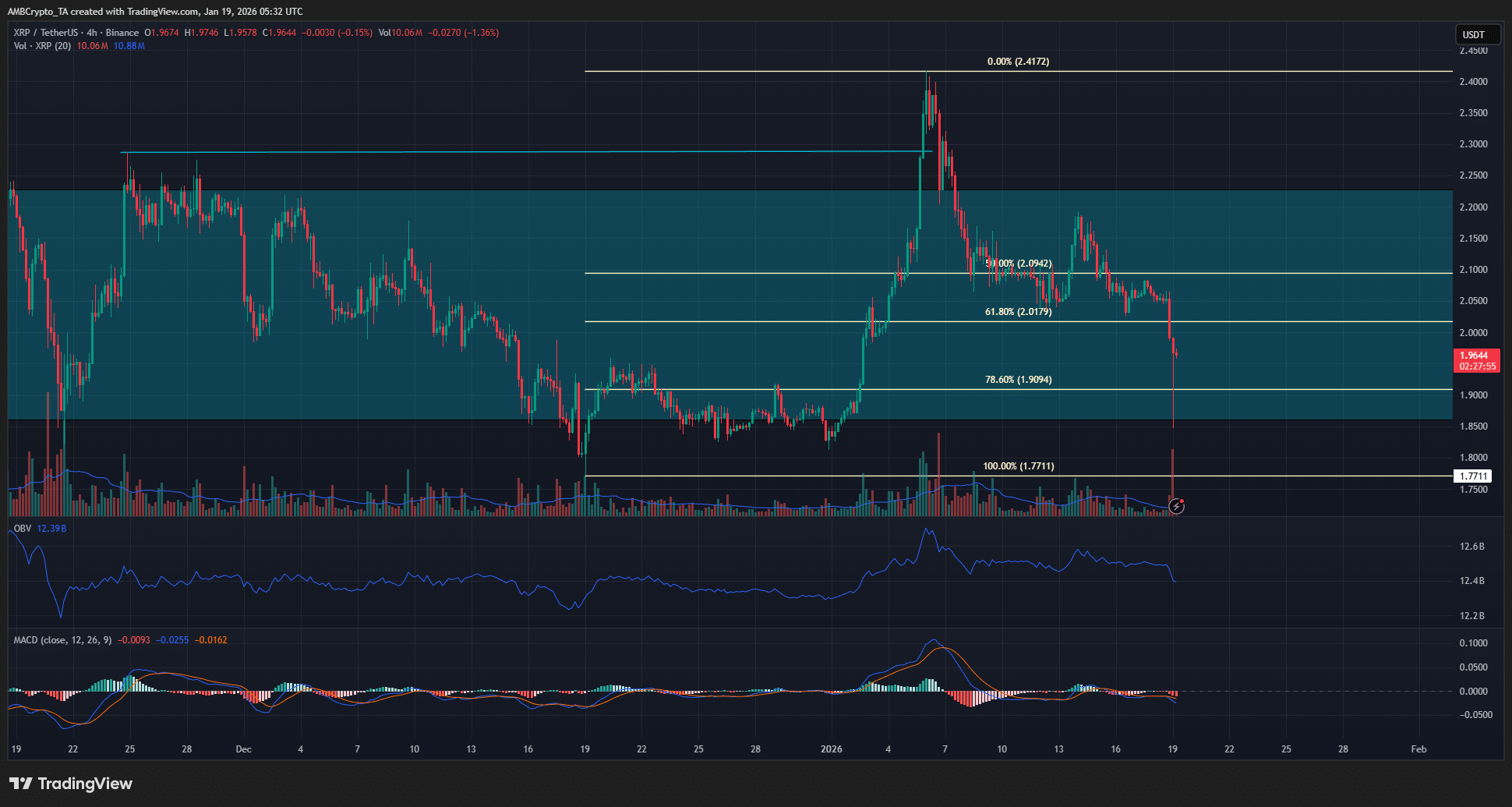

XRP price prediction: Will $40mln in liquidations spark a rebound?

AMBCrypto·2026/01/19 13:03

Flash

22:25

The total on-chain holdings of US spot Bitcoin ETFs have surpassed 1.47 million BTC.Jinse Finance reported, according to Dune data, the total on-chain holdings of US spot bitcoin ETFs have surpassed 1.47 million BTC, currently reaching approximately 1.471 million BTC, accounting for 7.36% of the current BTC supply. The on-chain holding value has fallen below $150 billions, now valued at $149.4 billions.

22:17

Jack Dorsey’s Block plans to lay off up to 10% of its workforce to improve efficiencyGelonghui, February 8th|Jack Dorsey's Block is notifying hundreds of employees during its annual performance review period that their positions may be eliminated, as the payments company is currently undergoing a broader business overhaul. According to sources familiar with the matter, up to 10% of Block's employees are at risk of being laid off. A senior executive previously stated that as of late November, the company had fewer than 11,000 employees. Block is scheduled to release its financial report after the U.S. stock market closes on February 26. Analysts expect the company's adjusted profit for the fourth quarter to be $403 million, with earnings per share of $0.68 and revenue reaching $6.25 billion.

22:00

BlackRock IBIT holdings market value drops to $51.7 billionJinse Finance reported that, according to official data from BlackRock, as of February 5, the market value of IBIT holdings reached $51,740,165,902.64, with a holding amount of 761,915.17 BTC.

News