News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 10)|13.8 billion LINEA tokens unlock today; Trump will begin the final round of interviews for the next Federal Reserve Chair this week2Bitcoin’s back above $94K: Is the BTC bull run back on?3BlackRock Enters Ethereum Staking With a First-of-Its-Kind ETF

Dramatic Escape: How a Whale Avoided ETH Liquidation by a Mere $28

BitcoinWorld·2025/12/04 09:45

Revealed: Trump Family DeFi Project Makes Stunning $40.1 Million Move to Jump Crypto

BitcoinWorld·2025/12/04 09:45

Crucial Defense: Vitalik Buterin’s 3 Key Updates to Minimize Ethereum Attack Vectors

BitcoinWorld·2025/12/04 09:45

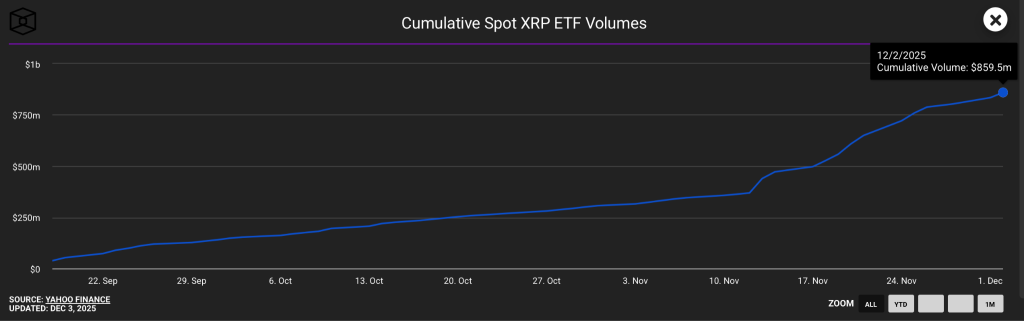

XRP ETF Flows Hit Record High—What It Means for XRP Price

Coinpedia·2025/12/04 09:15

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Coinpedia·2025/12/04 09:15

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts

Coinpedia·2025/12/04 09:15

Trump's CFTC, FDIC Picks Closer to Taking Over Agencies as They Advance in Senate

Cointime·2025/12/04 08:42

Glassnode: Is Bitcoin Showing Signs of 2022 Pre-crash? Watch Out for a Key Range

The current Bitcoin market structure closely resembles that of Q1 2022, with over 25% of on-chain supply in a state of unrealized losses. ETF fund flows and on-chain momentum are weakening, with price relying on a key cost basis area.

BlockBeats·2025/12/04 08:33

Flash

- 04:13Yilihua: ETH is severely undervalued, no more swing trading in the short termChainCatcher News, Liquid Capital (formerly LD Capital) founder Li Hua Yi stated, "For long-term spot investments, a difference of a few hundred dollars doesn't matter. ETH is currently significantly undervalued. From a macro perspective, this is due to expectations of interest rate cuts and ongoing crypto-friendly policies. From an industry perspective, there is long-term growth in stablecoins and a trend of financial assets moving on-chain. The fundamentals of ETH are now completely different, and these factors are also why I am heavily invested in WLFI/USD1." "After going all in, the rest is up to time; I won't be trading in the short term anymore. Finally, I want to reiterate that spot price fluctuations are already significant enough, so try not to play with contracts. First, most people lack the technical skills and psychological preparedness. Second, contracts are a game where nine out of ten lose, which drains your energy. That energy would be better spent expanding your off-exchange business."

- 04:13OpenAI, Anthropic, and Block establish the Agent AI Foundation (AAIF) and contribute the open-source AGENTS.md standardForesight News reported that OpenAI has announced the joint establishment of the Agentic AI Foundation (AAIF), under the Linux Foundation, together with Anthropic and Jack Dorsey's payment service provider Block, with support from Google, Microsoft, AWS, Bloomberg, and Cloudflare. AAIF aims to provide neutral governance for open and interoperable infrastructure, helping agentic AI systems move from the experimental stage to real-world production applications. As part of this initiative, OpenAI will contribute AGENTS.md (a simple, open format for providing project-specific instructions and background information to agents) to the foundation to ensure long-term community support and adoption. In addition to AGENTS.md, AAIF's co-founders will each contribute a project to the foundation: Anthropic's Model Context Protocol (MCP) and Block's goose.

- 04:12CertiK: Detected a suspicious Tornado Cash deposit transaction of 4,250 ETH related to the Babur hackForesight News reported that CertiK has detected a suspicious deposit transaction of 4,250 ETH (approximately $14 million) into Tornado Cash. These funds are related to an attack incident five days ago targeting an individual with the username "Babur", whose multiple large wallets have been confirmed to have lost $19.5 million.

News