News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Nominates Warsh and Sets 15% Growth Target; Alphabet Issues $20 Billion Bonds; US Tech Stocks Rebound (February 10, 2026)2Bitmine buys $84 million in ETH as Tom Lee calls market pullback 'attractive' entry point: onchain data3As Palantir Projects a 61% Increase in Revenue for 2026, Is Now the Time to Invest in Palantir Shares?

McGinley Dynamic Indicator: A Comprehensive Trading Manual

101 finance·2026/01/14 18:42

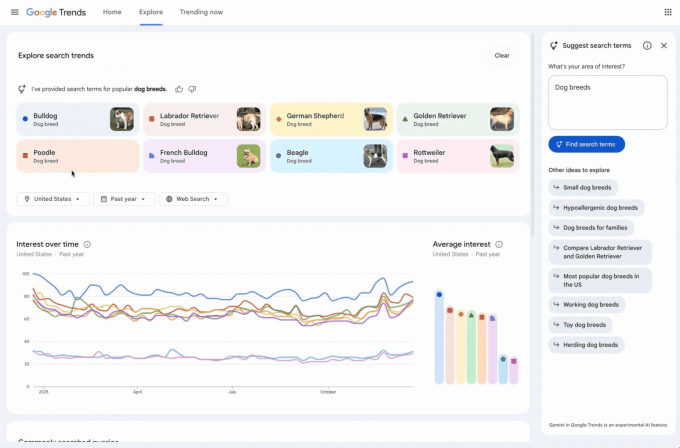

Google’s Trends Explore page now features enhanced Gemini functionality

101 finance·2026/01/14 18:42

Visa crypto chief bets on stablecoin settlement, sees volumes growing

101 finance·2026/01/14 18:33

Cardano Gains Buying Demand as It Retests $0.43 Resistance: What’s Next for ADA Price?

Coinpedia·2026/01/14 18:30

Monero Price Prediction 2026, 2027 – 2030: Privacy Coin Growth Ahead

Coinpedia·2026/01/14 18:30

XRP Price Holds $2.10 as Bulls Eye Next Breakout

Coinpedia·2026/01/14 18:30

Bitcoin Surges After CPI — Here’s What The Tariff Ruling And Clarity Act Could Mean For Crypto Markets

Coinpedia·2026/01/14 18:30

PEPE Price Prediction: Can the Memecoin Extend Its Bounce to $0.00001 After Breaking the Downtrend?

Coinpedia·2026/01/14 18:30

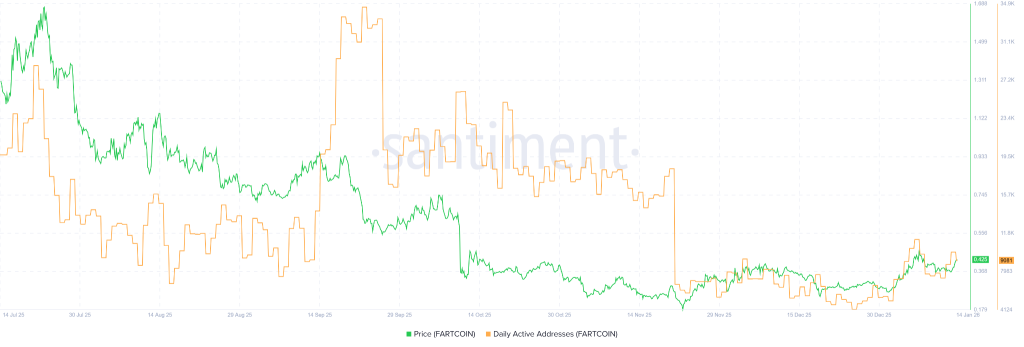

Fartcoin Price Jumps 13%: Is a Break Above $0.4800 Imminent?

Coinpedia·2026/01/14 18:30

Chainlink (LINK) Price Stuck at $15: What’s Preventing a Breakout?

Coinpedia·2026/01/14 18:30

Flash

03:34

ZachXBT warns of address poisoning causing users to lose 3.5 WBTCOn-chain detective ZachXBT posted on social platform X that a user lost 3.5 WBTC due to an "address poisoning" issue. This scam exploited the Phantom wallet interface's failure to effectively filter spam transactions, causing the user to mistakenly copy a wrong address with a similar beginning. ZachXBT called on Phantom to promptly fix the related security vulnerability and published the theft address and transaction hash.

03:34

The tokenized US Treasury market surpasses $10 billion.PANews reported on February 10 that, according to Cointelegraph monitoring, the size of the tokenized U.S. Treasury market has surpassed $10 billion, with Ondo Finance, Securitize, Circle, and Superstate as the main issuers.

03:33

White House: India to purchase over $500 billions worth of U.S. energy, information and communication technology, agriculture, coal, and other productsGelonghui, February 10th|The White House: India will purchase more than $500 billion worth of U.S. energy, information and communication technology, agriculture, coal, and other products. India will eliminate or reduce tariffs on all U.S. industrial goods as well as a variety of food and agricultural products, including dried distillers grains. India will also eliminate or reduce tariffs on sorghum, tree nuts, fresh and processed fruits, certain pulses, soybean oil, wine, and spirits. India will abolish its digital services tax and commit to negotiating a robust set of bilateral digital trade rules.

News