News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Nominates Warsh and Sets 15% Growth Target; Alphabet Issues $20 Billion Bonds; US Tech Stocks Rebound (February 10, 2026)2Bitmine buys $84 million in ETH as Tom Lee calls market pullback 'attractive' entry point: onchain data3As Palantir Projects a 61% Increase in Revenue for 2026, Is Now the Time to Invest in Palantir Shares?

Chinese Antitrust Investigation Causes This Travel Stock to Tumble—Key Information for Investors

101 finance·2026/01/14 18:21

Crypto Security in 2025: Trust Wallet Hacked, Ledger Exposed Again – What Solutions to Protect Your Assets?

Cointribune·2026/01/14 18:06

Bitcoin : Bitdeer becomes No.1… by changing the rules of the game

Cointribune·2026/01/14 18:06

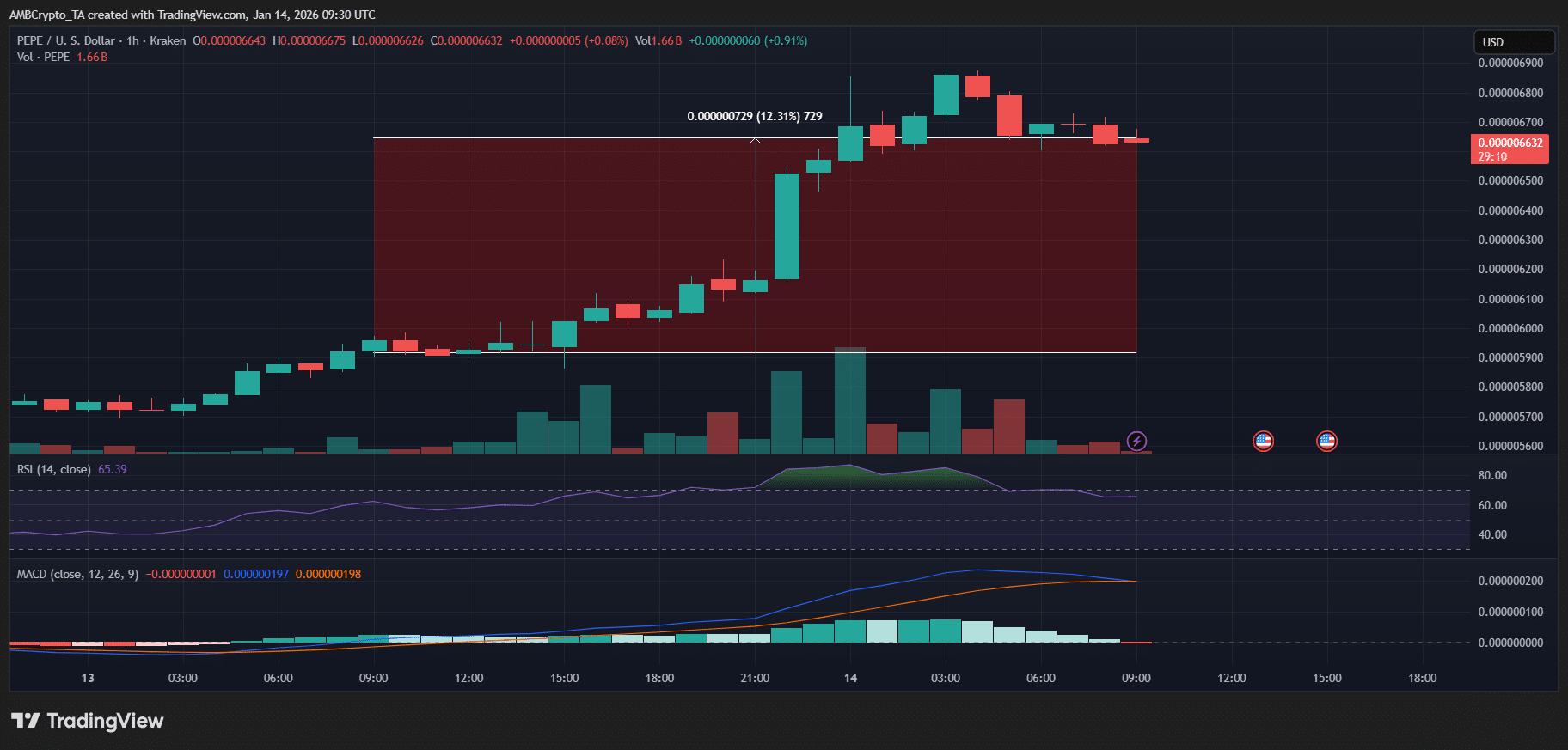

Why PEPE’s price is up 12% – KEY support, RSI surge & more…

AMBCrypto·2026/01/14 18:03

Dogecoin Price Prediction: New Crypto Law Draft Puts DOGE on Same Legal Tier as Bitcoin – Can DOGE 100x?

Coinspeaker·2026/01/14 18:03

Fed Member Discredits Cryptocurrencies as Bitcoin Surpasses $97,000

Cointurk·2026/01/14 18:03

BlockDAG’s Massive 120× ROI Gap Sparks the Biggest Buying Rush in Its Final Presale Days! Avalanche Soars & Stellar Breaks Out

BlockchainReporter·2026/01/14 18:00

Zero Knowledge Proof’s Daily Presale Auction Points to 10,000x ROI Potential, While Ethena & Chainlink Struggle

BlockchainReporter·2026/01/14 17:57

Hackers hit Aribtrum-based Futureswap again days after $400K exploit

Cointelegraph·2026/01/14 17:42

BNB Chain Successfully Activates Fermi Hard Fork for Sub-Second Blocks

CoinEdition·2026/01/14 17:33

Flash

16:00

Messari partners with Warden Protocol to launch AI research assistant for real-time crypto market analysisPANews reported on February 10 that crypto data platform Messari has partnered with Warden Protocol to launch the Messari Deep Research Agent. This AI assistant integrates on-chain data, market analysis, social sentiment, and fundamental research to provide users with real-time insights into the crypto market. Through Warden Protocol, users can conduct research, analysis, and trading operations directly within the platform, eliminating the need to switch between multiple tools or interfaces. Previously, Exchange Alpha listed Warden Protocol (WARD) on February 4.

15:49

Malicious MEV has become a persistent problem for Ethereum, causing users to lose over $2 million every monthResearch shows that because transactions are visible before execution, bots and validators can engage in frontrunning, sandwiching, and transaction reordering. Approximately 2,000 sandwich attacks occur daily, causing users to lose over $2 million each month. Mempool encryption is one mitigation path, but early designs had data leakage issues. Flash Freezing Flash Boys (F3B) proposes a new method of encrypting each transaction, allowing transaction privacy to be maintained until final confirmation. However, due to execution layer complexity, it has not yet been deployed.

15:48

Robinhood Chain testnet goes live, allowing developers to experiment with real-world asset tokenizationAccording to Odaily, Robinhood has officially launched the Robinhood Chain public testnet, an Ethereum Layer 2 network focused on the tokenization of real-world and digital assets, aiming to accelerate the development of on-chain financial services. Developers can now build and validate applications based on the core infrastructure, with multiple infrastructure service providers already integrated, and more partners set to join during the early stages of the testnet. Robinhood stated that the public testnet lays the foundation for developers to explore potential and validate applications in advance, preparing for the mainnet launch and promoting the tokenization of real-world assets and the integration of DeFi liquidity. Reportedly, Robinhood Chain will support 24/7 trading, cross-chain bridging, and self-custody, covering application scenarios such as tokenized asset platforms, lending protocols, and perpetual contract exchanges.

News