News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Circle and Finastra join forces to integrate USDC into Global PAYplus, modernizing $5 trillion in daily cross-border flows, cutting costs, and positioning stablecoins as institutional-grade tools amid regulatory scrutiny and global adoption.

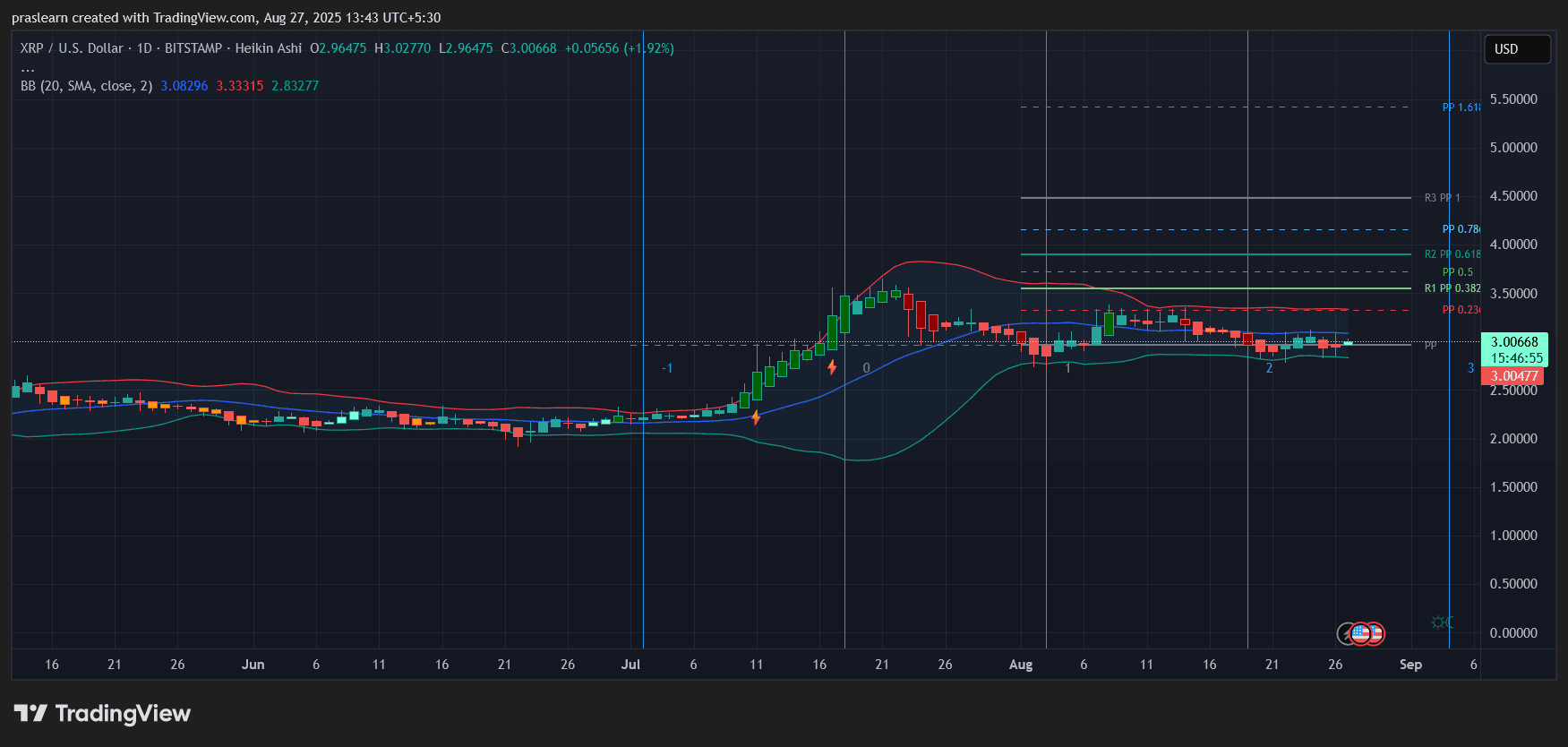

- BlockDAG's $383M 2025 presale and 2,660% ROI highlight infrastructure-driven growth via 2.5M users, 19k ASIC miners, and 300+ dApps. - XRP relies on uncertain ETF approvals ($2.96 price) while HBAR ($0.19) gains from enterprise partnerships but faces governance centralization risks. - Analysts prioritize projects with audited scalability (BlockDAG's DAG-PoW) over speculative bets, emphasizing operational metrics over regulatory outcomes.

- Political-aligned cryptocurrencies like TRUMP Token and World Liberty Financial (WLFI) surged in 2025, blending ideology with speculative growth and institutional backing. - WLFI's $550M token sales and USD1 integration highlight hybrid models merging political influence with regulatory credibility, though 60% family control raises governance concerns. - Risks include regulatory gray areas (SEC's 2025 meme coin reclassification) and reputational volatility, as political fortunes or policy shifts could er

In August 2025, two heavyweight figures from the Ethereum ecosystem—BitMine CEO Tom Lee and ConsenSys CEO Joseph Lubin—publicly expressed interest in the memecoin project Book of Ethereum (BOOE), sparking widespread market discussion. BOOE builds its community economy through a religious narrative, launching related tokens such as HOPE and PROPHET to form a "Trinity of Faith" system. An anonymous whale, fbb4, has promoted BOOE and other memecoins through a long-term holding strategy, but this approach, which relies heavily on market sentiment, carries risks of regulation and bubbles. While institutional endorsements have increased attention, investors are advised to rationally assess the project’s value and associated risks. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved by the Mars AI model.

- 20:10All three major U.S. stock indexes closed higher, reaching new record highs.Jinse Finance reported that all three major U.S. stock indexes closed higher and reached new closing highs. The Dow Jones closed up 0.38%, the Nasdaq closed up 0.72%, and the S&P 500 closed up 0.49%. This week, the S&P 500 rose by 1.22%, the Nasdaq rose by 2.21%, and the Dow Jones rose by 1.05%. Major technology stocks generally rose, with Oracle up more than 4%, Apple up more than 3%, and Tesla up more than 2%. Intel, which surged 22% yesterday, closed down 3% today.

- 19:46Securities fund managers increased their net long positions in the S&P 500 to 891,634 contracts.ChainCatcher news, according to Golden Ten Data, data from the U.S. Commodity Futures Trading Commission (CFTC) shows that as of the week ending September 16, securities fund managers increased their net long positions in the S&P 500 Index CME by 9,074 contracts, reaching 891,634 contracts. Meanwhile, securities fund speculators increased their net short positions in the S&P 500 Index CME by 55,766 contracts, reaching 475,397 contracts.

- 19:08Spot silver rises above $43 per ounce, the first time since September 2011Jinse Finance reported that spot silver has reached $43 per ounce, marking its first time at this level since September 2011, and has risen nearly 49% so far this year.