News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

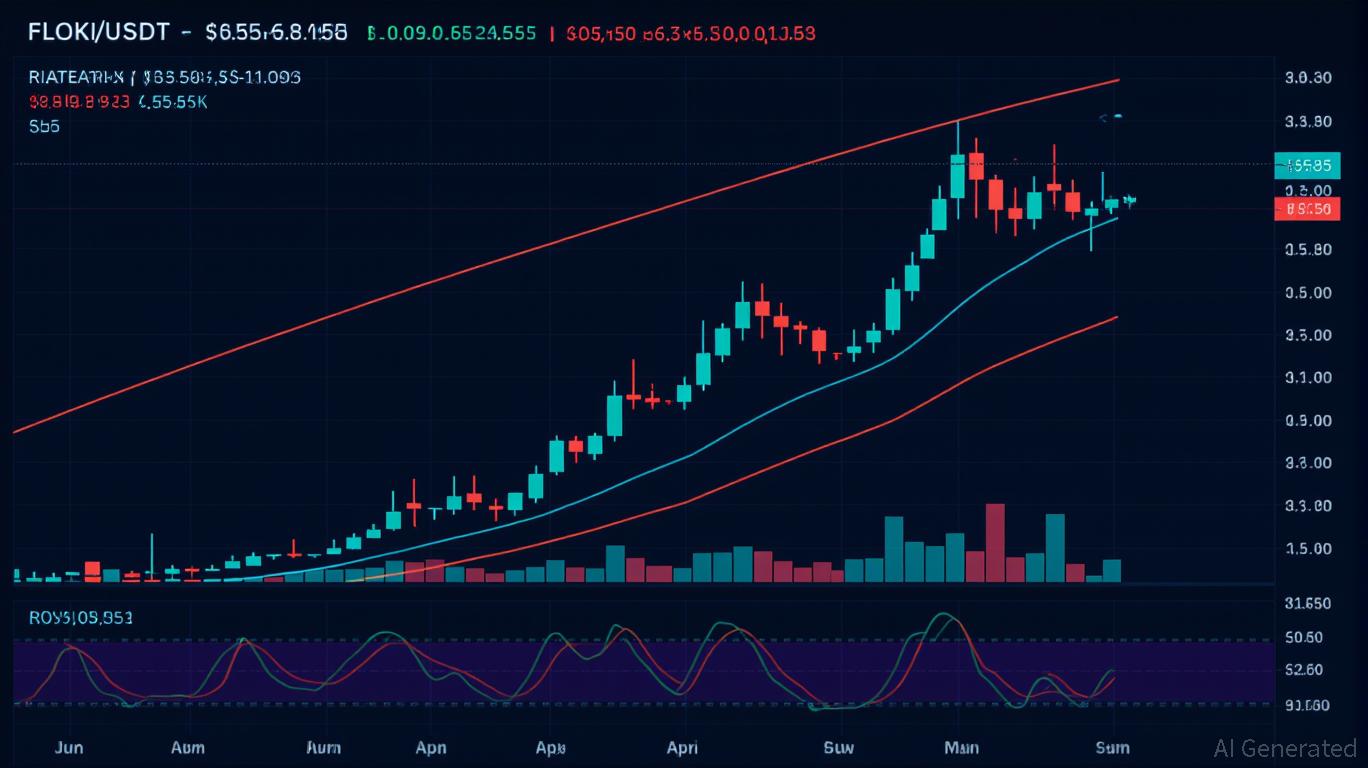

- FLOKI's August 2025 technical setup shows a potential breakout after forming a rounded bottom pattern and key Fibonacci support at $0.00009620. - Mixed moving averages and balanced RSI indicate volatility, with Bollinger Bands signaling momentum but warning of overbought risks near $0.00010553. - Traders face a 12% upside potential if support holds, but bearish pressure could trigger an 8% decline if resistance fails, requiring strict risk management. - Breakout scalping and range trading strategies are

- Stellar Lumens (XLM) forms a 60-70% successful inverse head-and-shoulders pattern, with a potential $1 target if the $0.50 neckline breaks decisively. - Institutional accumulation at $0.39 support and $440M+ in tokenized assets, plus PayPal/Franklin Templeton partnerships, reinforce XLM's macroeconomic tailwinds. - Protocol 23's 5,000 TPS upgrade on Sept 3 and regulatory clarity in major markets create a virtuous cycle of demand, positioning XLM as a high-probability breakout candidate. - Strategic entry

- Over 170 public companies now hold Bitcoin as treasury assets, with firms like KindlyMD and Sequans Communications raising billions via equity to accumulate BTC. - Strategic logic includes Bitcoin's inflation resistance and potential to boost shareholder value through Bitcoin-per-share metrics, though equity dilution risks persist. - Corporate Bitcoin buying pressures institutional demand, tightening supply post-2024 halving while creating feedback loops that could destabilize altcoin markets. - Risks in

- Celebrity-backed memecoins like YZY Money and EMAX exhibit extreme volatility, driven by centralized tokenomics and influencer hype, causing retail investor losses. - Platforms like Polymarket aggregate real-time sentiment on celebrity events (e.g., Taylor Swift pregnancy odds), correlating with consumer behavior and merchandise sales trends. - Sentiment-driven trading strategies leverage prediction market data to forecast cultural trends, linking celebrity endorsements to stock movements and event-drive

- 18:27Gold prices rise as the Federal Reserve's policy path draws attentionJinse Finance reported that gold prices rose on Friday and are set to record gains for the fifth consecutive week, as the market focuses on further clues following the Federal Reserve's announcement of its first rate cut of the year. The Federal Reserve previously lowered its benchmark interest rate by 25 basis points but issued warnings about persistent inflation, causing the market to have doubts about the pace of future easing. After the decision was announced, spot gold briefly touched a record high of $3,707.40 before retreating in volatile trading. Bob Haberkorn, market strategist at RJO Futures, stated, "Gold prices remain quite strong, only pausing slightly after the Fed's rate cut. The bullish trend is unchanged, new highs are inevitable, and we may see $4,000 before the end of the year." Spot silver rose more than 2.2%, and spot platinum increased by 1.4%. Haberkorn said, "What I see is that many investors are now turning to platinum and silver because they are cheaper than gold."

- 16:57A certain whale spent 7.3 million USDC to buy 1 billion PUMP in the past 20 hours.According to Jinse Finance, monitored by Lookonchain, whale 8RHiqy spent 7.3 million USDC to purchase 1 billion PUMP at an average price of $0.007246 in the past 20 hours.

- 16:57New Federal Reserve Governor Milan Clarifies Communication with Trump, Emphasizes Independence in Rate Cut StanceJinse Finance reported that the new Federal Reserve Governor, Stephen Milan, made a public clarification on Friday regarding his communication with U.S. President Trump, emphasizing that his voting decision at this week's monetary policy meeting was made independently and was not subject to any political interference. Previously, the Federal Reserve announced a 25 basis point rate cut, but Milan cast a dissenting vote in this rate decision, advocating for the rate cut to be expanded to 50 basis points. He explained after the meeting that this decision was based on his independent judgment of the economic situation. In response to public concern, Milan stated that prior to the announcement of this rate decision, he had only a brief exchange with President Trump. He revealed, "He (Trump) called me on Tuesday morning just to offer congratulations, that's all." Milan emphasized that the two "never discussed how I should vote, nor did they mention my position on the 'dot plot' in the Federal Reserve's Summary of Economic Projections."