News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low2Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)3Review of Major Institutions' Bitcoin Price Predictions for 2025: Almost All Failed

Bitcoin miner Hut 8 secures $7 billion Google-backed AI data center lease

币界网·2025/12/17 16:51

Shiba Inu Price Prediction: CoinGecko Attributes Meme Coin Volatility to Political Tokens as DeepSnitch AI Eyes Major Upswing

BlockchainReporter·2025/12/17 16:50

DTCC begins limited onchain Treasury test on Canton Network after SEC greenlight

The Block·2025/12/17 16:48

Aave to Enter 2026 With a Master Plan, SEC Ends 4-Year Investigation

Coinspeaker·2025/12/17 16:42

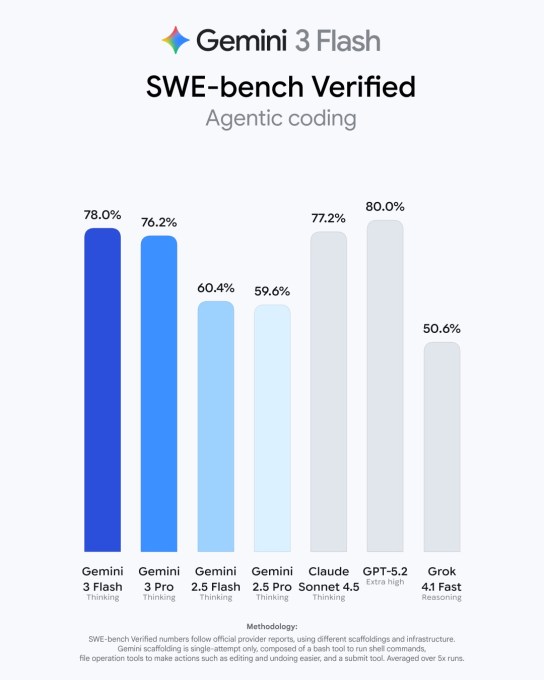

Google launches Gemini 3 Flash, makes it the default model in the Gemini app

TechCrunch·2025/12/17 16:33

Michael Saylor says quantum will “harden” Bitcoin, but he’s ignoring the 1.7 million coins already at risk

CryptoSlate·2025/12/17 16:30

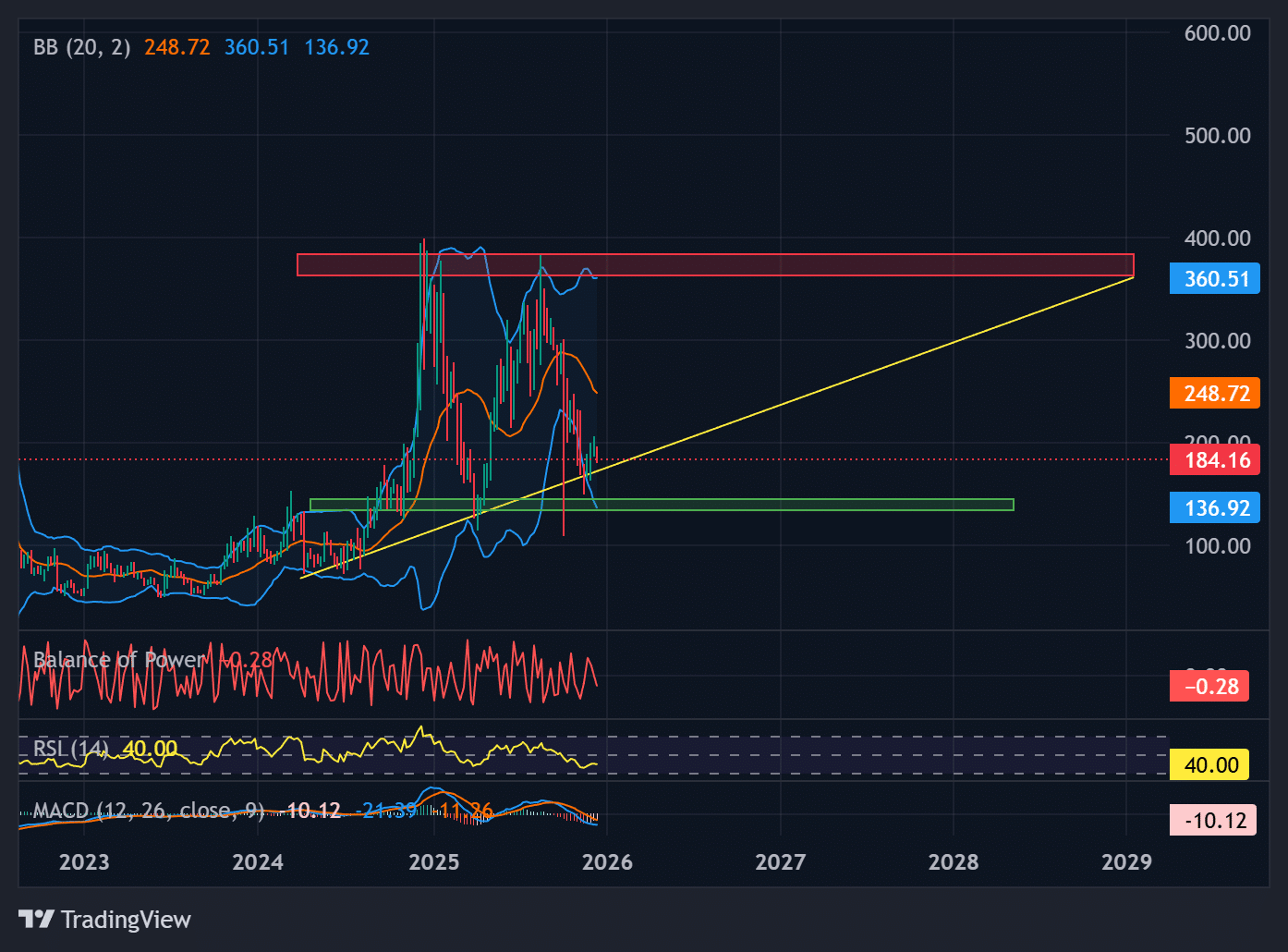

Buy or sell? What do technical indicators suggest for Shiba Inu (SHIB)?

币界网·2025/12/17 16:30

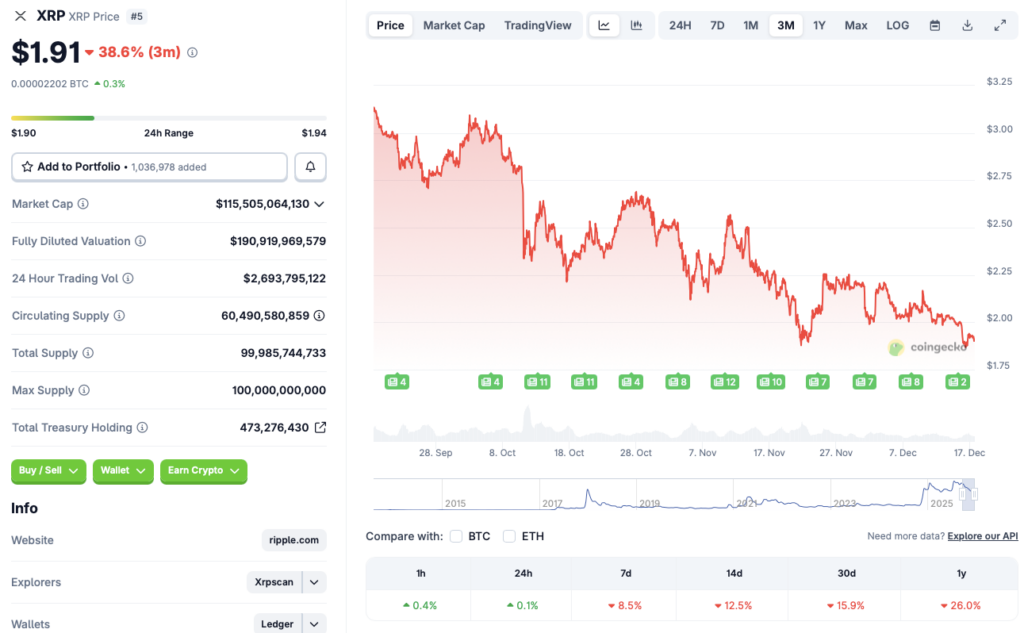

XRP may fall below $1 as whales sell: Here’s what you need to know

币界网·2025/12/17 16:29

Flash

08:40

Two whales deposited 5 million USDC into Hyperliquid to purchase HYPEForesight News reported, according to monitoring by Lookonchain, that in the past hour, two whales deposited 5 million USDC into Hyperliquid to purchase HYPE. Among them, the address starting with 0xDAeF currently holds 214,497 HYPE (worth approximately $5.44 million), and still has 5.52 million USDC available to buy more; the address starting with 0x3300 currently holds 102,460 HYPE (worth approximately $2.61 million), and still has 2.45 million USDC for further purchases.

08:33

Metaplanet approves comprehensive capital structure reform and issues preferred shares to raise funds from institutional investorsBlockBeats News, December 22, Metaplanet on Monday approved a comprehensive reform of its capital structure, allowing Japan's largest bitcoin digital asset treasury (DAT) company to raise funds by issuing dividend-paying preferred shares to institutional investors. The approved proposals include reclassifying capital reserves, doubling the authorized number of Class A and Class B preferred shares, and modifying the dividend structure to introduce floating and fixed dividends. Class A preferred shares will adopt a monthly floating dividend mechanism, while Class B preferred shares will offer quarterly dividends and be open to international institutional investors. Metaplanet currently holds approximately 30,823 bitcoins, valued at $2.75 billions, making it the largest bitcoin digital asset treasury (DAT) company in Asia. Metaplanet will also trade in the U.S. over-the-counter market through American Depositary Receipts, further expanding its global market presence.

08:25

Data: Hyperliquid and pump.fun become high-income DeFi projects outside of stablecoinsForesight News reported that, according to IntoTheBlock data, stablecoins are the most definitive revenue engine in DeFi, consistently occupying a dominant position in revenue rankings. Outside the stablecoin sector, Hyperliquid and pump.fun stand out as high-revenue projects.

News