News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Raises Tariffs on South Korea; Precious Metals Hit Record Highs; Nvidia Adds AI Investment (January 27, 2026)2Cardano whales bag 454M ADA while small wallets exit3Bitcoin Risk-Off Asset: CryptoQuant CEO Reveals Critical Market Misunderstanding in 2025 Analysis

The strengthening of the Chinese yuan may support bitcoin prices

币界网·2025/12/17 11:34

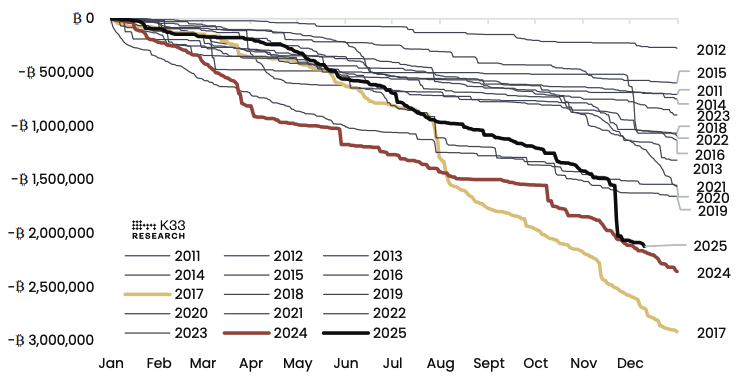

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

The Block·2025/12/17 11:21

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

Bitcoinworld·2025/12/17 11:12

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX

DeFi Planet·2025/12/17 11:09

BlackRock moves 47K Ethereum in a day: But the real story isn’t a sell-off

AMBCrypto·2025/12/17 11:03

$110M XRP Moved from Australia’s Top Exchange. Here’s the Destination

TimesTabloid·2025/12/17 10:57

Space Announces Public Sale of its Native Token, $SPACE

BlockchainReporter·2025/12/17 10:42

The Fed "successor" reverses course: From "loyal dove" to "reformer"—has the market script changed?

Odaily星球日报·2025/12/17 10:41

Flash

04:11

Midday Key Developments on January 277:00 (UTC+8) - 12:00 (UTC+8) Keywords: Vitalik, Bitmine, Ethereum 1. The Federal Reserve stated that the interest rate meeting will be held as scheduled; 2. Ethereum network fees have dropped to their lowest level since May 2017; 3. Base co-founder: The core team will not secretly pump Base ecosystem tokens behind the scenes; 4. Vitalik: The core difficulties of blockchain scaling are, in order, computation, data, and state; 5. Bitmine's Ethereum staking volume has reached 2 million ETH, with annualized returns possibly exceeding $164 million; 6. The Bank of Korea: Considering allowing domestic institutions to issue virtual assets, but stablecoins remain controversial; 7. Democratic aides say they are willing to return to the negotiating table, and there is a breakthrough in crypto legislation consultations at the Senate Agriculture Committee.

04:04

Felix announces the launch of spot stock trading functionalityBlockBeats news, on January 27, Hyperliquid ecosystem trading protocol Felix Protocol announced the launch of its spot stock trading feature, offering more than 100 US stocks and ETFs. By enabling permissionless trading and accessing off-chain liquidity, it achieves low slippage and efficient on-chain execution.

04:02

Matrixport: Bitcoin is still rarely included in central banks’ reserve diversification strategies at the public disclosure levelForesight News reported that Matrixport tweeted, "Gold continues to rise. The market generally believes that the key driver of this upward trend is the renewed concern over the weakening purchasing power of the US dollar. After Trump once again pushed for tariffs on Europe, these concerns have intensified, putting pressure on the dollar. Meanwhile, discussions about the possibility of overseas central banks reducing their holdings of US Treasuries and shifting more foreign exchange reserves into gold are gradually increasing. The relative strength of gold is closely related to demand from official sectors. Central banks around the world continue to increase their holdings, especially the People's Bank of China (PBoC), whose accumulation pace is drawing more market attention and providing sustained buying support for gold prices. In contrast, bitcoin still rarely appears in the public disclosures of central bank reserve diversification strategies. For policymakers, gold remains a more mainstream asset and better fits the existing reserve management framework; bitcoin has not yet been widely included in official foreign reserve frameworks. This divergence may to some extent explain the strong performance of gold relative to the weaker performance of bitcoin."

News