News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 28)|S. today. Trump nominates Michael Selig as CFTC Chairman. Stablecoin USD1 enters partnership with Enso.2Research Report|In-Depth Analysis and Market Cap of Common Protocol (COMMON)3Is Monero (XMR) Gearing Up for a Bullish Breakout? This Key Pattern Formation Suggest So!

Meteora TGE Sparks Hype But Raises Allocation Concerns

Meteora’s October MET TGE could mark a breakthrough for Solana DeFi, but risks from concentrated allocations and post-airdrop sell pressure loom large.

BeInCrypto·2025/09/10 20:33

China’s Hip-hop Base Begins DAT: Invests $33M in Bitcoin

China-based Pop Culture Group invests $33 million in Bitcoin, introduces crypto payments, and develops entertainment IP, reflecting integration of digital assets into treasury and cultural operations.

BeInCrypto·2025/09/10 19:45

Staking Crisis: Kiln Security Vulnerability Triggers Withdrawal of 2 Million ETH

Bitpush·2025/09/10 19:42

Polkadot Approaches Breakout as $4.07 Resistance Holds and $3.86 Support Remains Firm

Cryptonewsland·2025/09/10 19:15

Kiln begins expelling Ethereum validators after $40 million attack

Portalcripto·2025/09/10 19:15

BLS Review Wipes Out $60 Billion Cryptocurrency Market

Portalcripto·2025/09/10 19:15

Lukashenko urges Belarusian banks to use cryptocurrencies against sanctions

Portalcripto·2025/09/10 19:15

Ethena Proposes BlackRock-Backed USDH Stablecoin on Hyperliquid

DeFi Planet·2025/09/10 18:54

Employment Data Revision Triggers $60B Crypto Market Cap Loss

DeFi Planet·2025/09/10 18:54

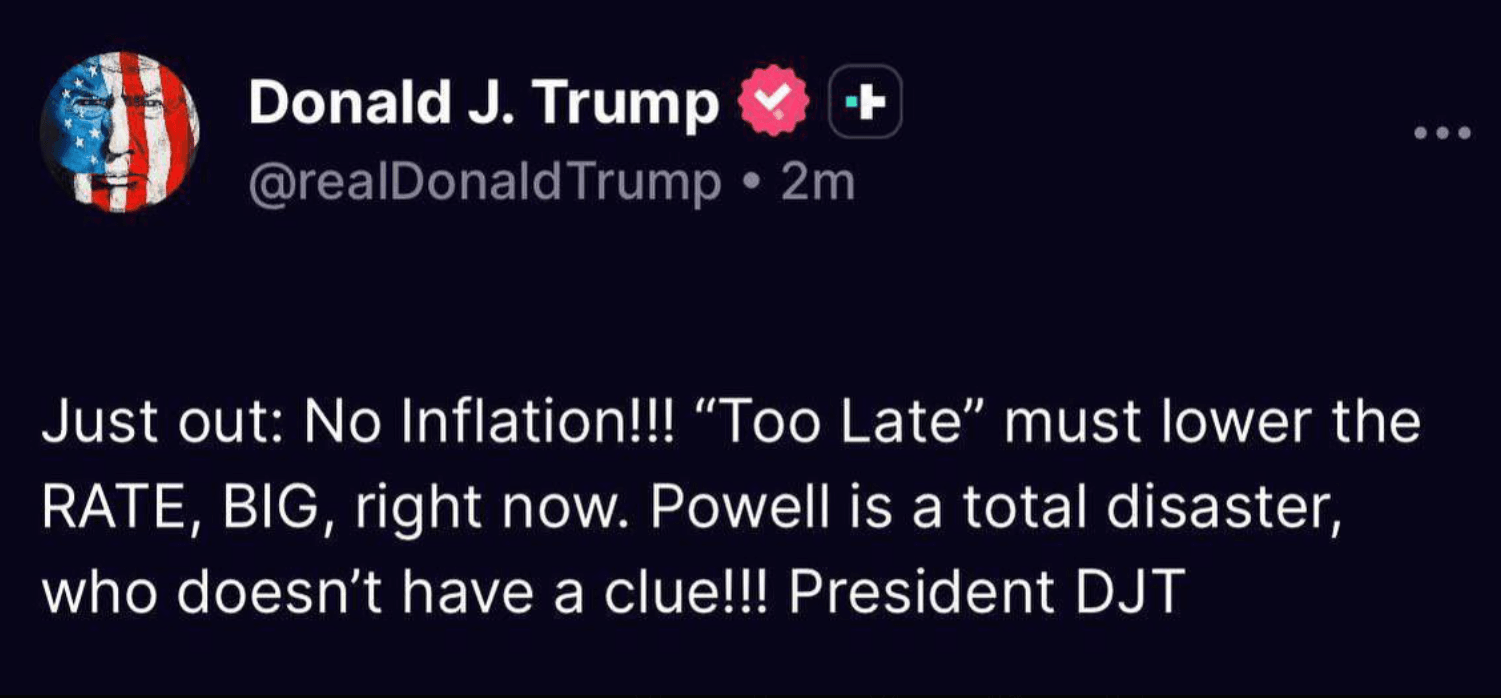

Breaking: Trump Slams Powell, Calls for Immediate Rate Cuts as Crypto Prices Turn Bullish

Cryptoticker·2025/09/10 18:39

Flash

- 09:29MegaETH token sale oversubscribed by 8.9 times, with subscription amount exceeding $450 millionAccording to ChainCatcher, MegaETH's token sale was oversubscribed by 8.9 times, with subscription amounts exceeding $450 million.

- 09:19The first Solana staking ETF, BSOL, will offer physical subscription and redemption functions.Jinse Finance reported that on October 28, Bitwise will launch the first 100% Solana staking ETF to be listed on the New York Stock Exchange, with the stock code BSOL. Bitwise plans to stake 100% of the SOL holdings of the Bitwise Onchain Solutions Staking BSOL Fund, supported by Solana staking technology provider Helius, with a staking yield of 7.34% and a management fee of 0.20%. For the first three months, the management fee for the first 1 billion USD in assets will be 0%. In addition, the Bitwise Solana Staking ETF will offer physical subscription and redemption functions.

- 09:19Matrixport: Bitcoin is still in a range-bound stateJinse Finance reported that Matrixport stated Bitcoin remains in a range-bound consolidation; in contrast, the US stock market has repeatedly reached new historical highs driven by the AI boom. There are certain similarities to the rhythm seen last year: after a prolonged period of low volatility consolidation, prices experienced a relatively rapid upward movement within about three weeks (historical review, not indicative of the future). The current narrow fluctuations place higher demands on traders' patience. The short-term outlook is mainly wait-and-see, while the mid-term pattern remains unchanged. If the Federal Reserve maintains a dovish stance and continues to cut interest rates, the market will mostly be waiting for clearer external driving signals. Historically, similar rhythms have often been observed: after a long period of consolidation, volatility tends to be released intensively within a short period.