News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

HashKey Capital Secures $250M for New Multi-Strategy Crypto Fund

Coinpedia·2025/12/24 19:30

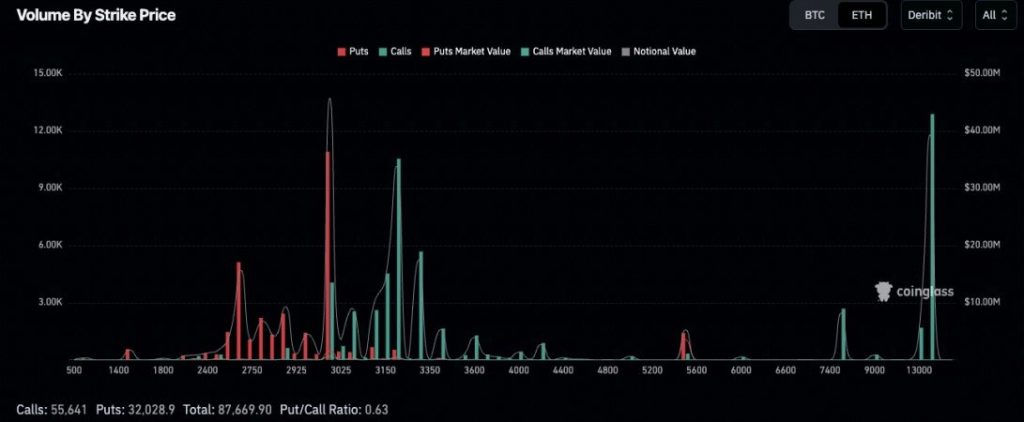

Why Ethereum (ETH) Price Is Likely to Consolidate Between $3,000 and $3,200 in Early 2026

Coinpedia·2025/12/24 19:30

Bitcoin’s Christmas blues – Why BTC’s Santa rally can be cancelled

AMBCrypto·2025/12/24 19:03

Market Panic or Contrarian Signal? Strategy’s 65% Slide Stokes Bitcoin Debate

BlockchainReporter·2025/12/24 19:00

Navigate Crypto’s Twists and Turns with Real-Time Insights

Cointurk·2025/12/24 18:21

The European startup market’s data doesn’t match its energy — yet

TechCrunch·2025/12/24 18:18

Ethereum – Why $69B remains locked in DeFi despite weak ETH prices

AMBCrypto·2025/12/24 18:03

Cryptocurrency Market Adapts to Strategic Thinking for 2025

Cointurk·2025/12/24 17:51

Crypto Gainers – PIPPIN Up 25%, Canton 6% as AI and RWAs Drive Market

BlockchainReporter·2025/12/24 17:00

Waymo is testing Gemini as an in-car AI assistant in its robotaxis

TechCrunch·2025/12/24 16:36

Flash

13:56

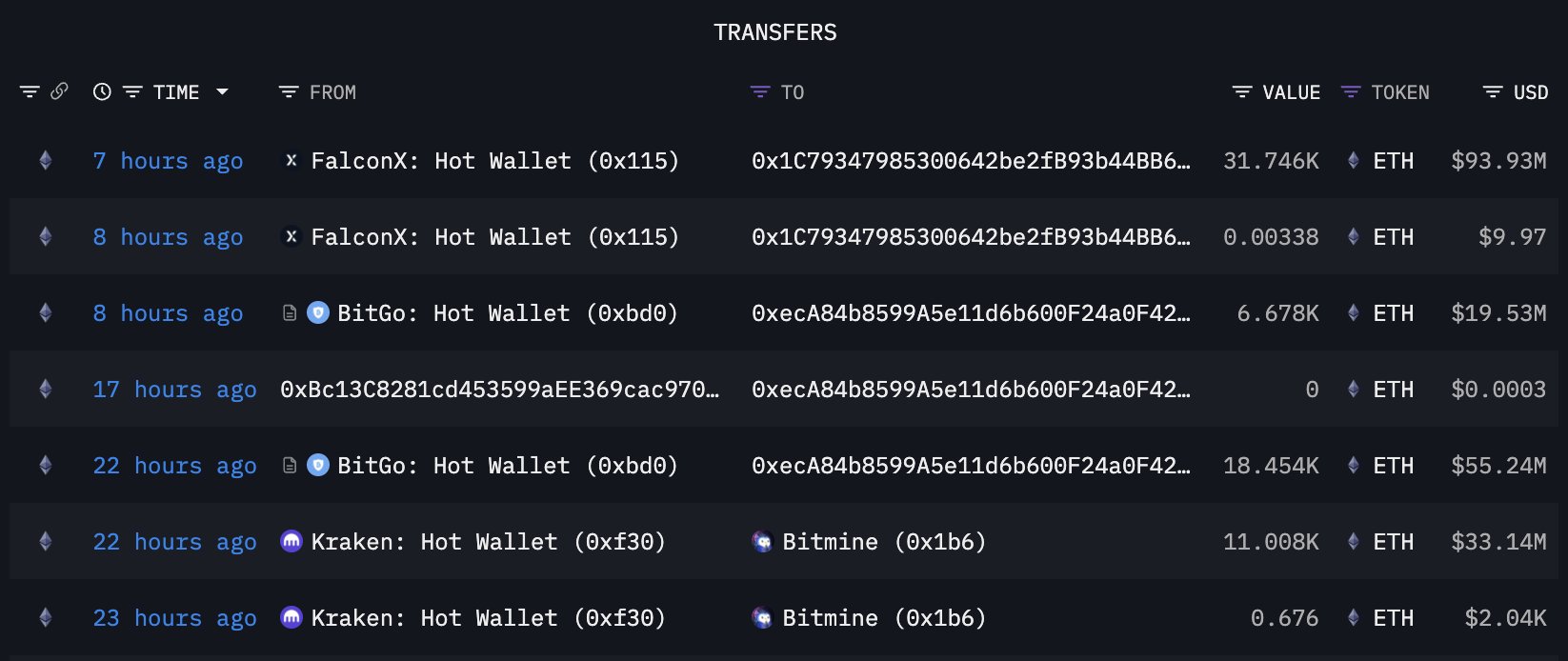

Cryptocurrency investors lose over $12 million worth of Ethereum to "address poisoning" scamAccording to a report by Bijie Network: A cryptocurrency investor lost 4,556 ETH (approximately $12.4 million) in an "address poisoning" attack. The scammer used an address extremely similar to the victim's wallet address to trick them into transferring funds. The fraudulent address had identical starting and ending characters as the legitimate address, exploiting the common practice of only checking part of the address. A similar $50 million theft occurred last month, highlighting ongoing security vulnerabilities in wallet interfaces and transaction verification processes.

13:56

The whale who accumulated 54.731 million W three weeks ago has reportedly sold all holdings and is facing a loss of about $650,000.According to Odaily, Arkham monitoring shows that a certain whale has just transferred all 54.731 million W tokens into a certain exchange's hot wallet address, with a total value of approximately $1.36 million. These tokens were accumulated by the whale three weeks ago, when they were worth over $2.016 million. If sold this time, the whale would incur a loss of $653,800.

13:40

SHIB developer makes a surprising analogy, Shiba Inu community eagerly awaits the latest updateAccording to a report by Bijie Network: Shiba Inu developer Kaal Dhairya broke his silence to speak out on the X issue, drawing parallels with misunderstood artists such as Van Gogh and Yayoi Kusama, and responding to recent criticism. He reminded critics that SHIB was also regarded as a joke before reaching its peak in 2021, and warned those spreading panic not to "test" the SHIB army. Dhairya emphasized that building an ecosystem is not just about price speculation. Currently, the community is eagerly awaiting a "highly important" two-hour speech by Chief Ambassador Yayoi Kusama, which will be delivered on Sunday.

News