News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Citigroup is considering offering custody services for stablecoin and crypto ETF collateral, exploring stablecoins as a viable option to improve payment systems.

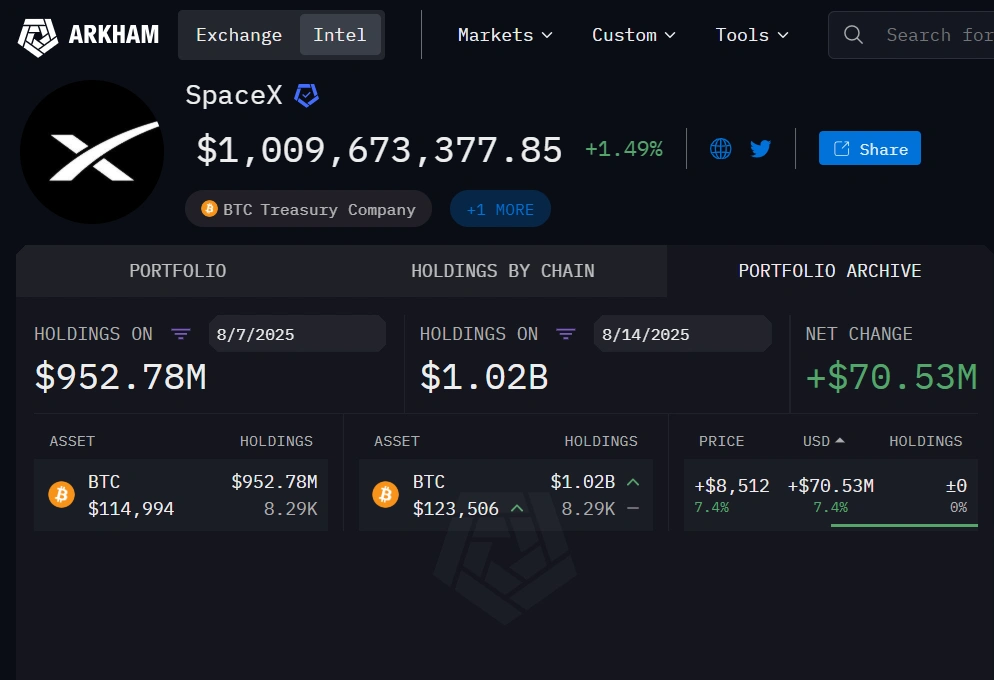

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

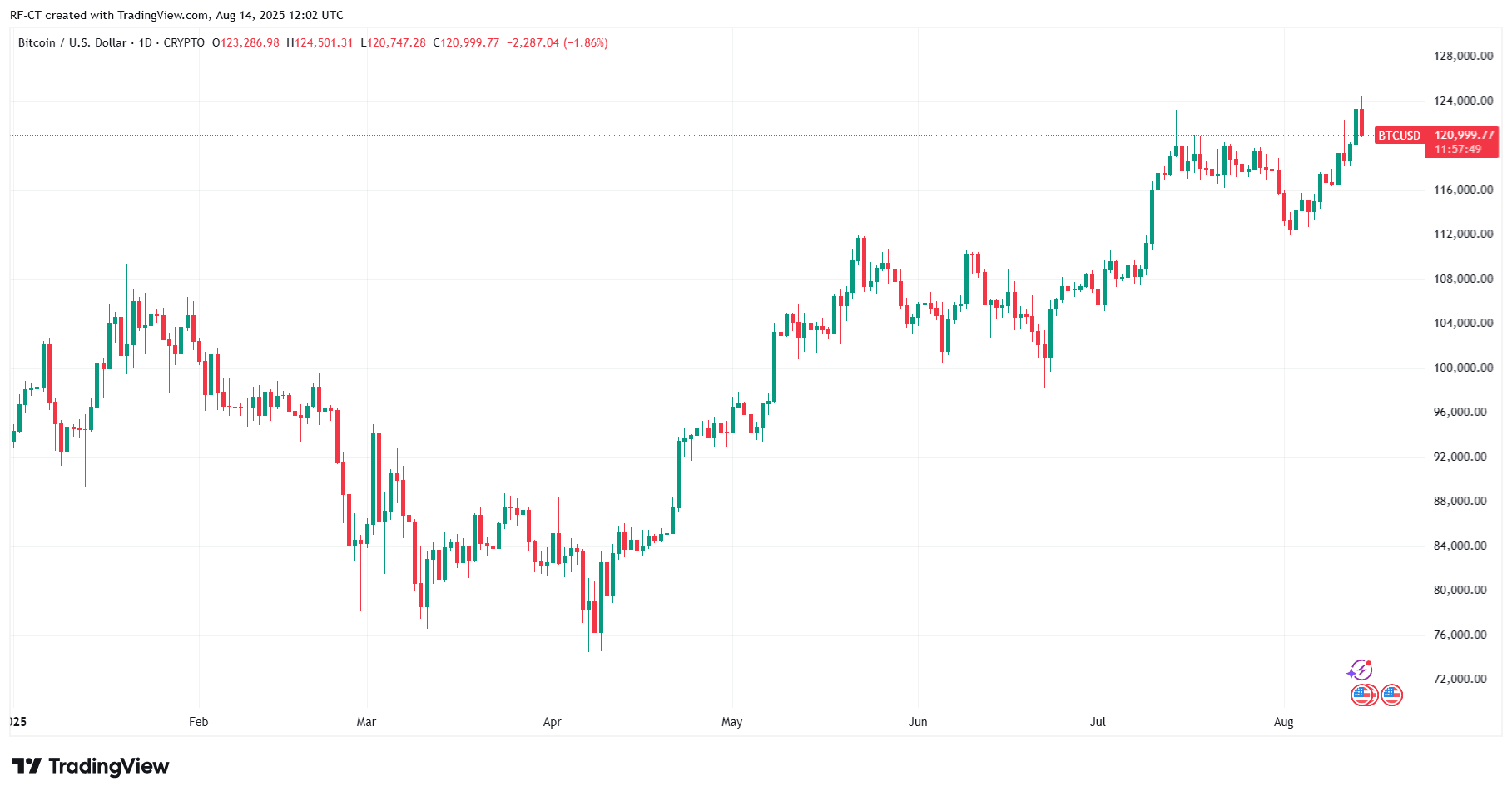

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.

Share link:In this post: The EU is preparing a 19th sanctions package against Russia, targeting next month for adoption. Trump will meet Putin in Alaska without Zelenskyy, raising concern among European and Ukrainian officials. Trump warned of “very severe consequences” if Putin refuses to pursue a ceasefire.

- 20:14All three major U.S. stock indexes closed higher.Jinse Finance reported that all three major U.S. stock indexes closed higher, with the Dow Jones Index up 0.43%, the S&P 500 Index up 0.27%, and the Nasdaq Composite Index up 0.37%. Both the Nasdaq and S&P 500 indexes reached new closing highs. Apple closed down 1.48%.

- 19:41Nvidia launches new chip system to boost AI video and software generationJinse Finance reported that Nvidia announced plans to launch a new product designed to handle complex tasks such as video generation and software development, as the company's chips and systems remain at the core of the artificial intelligence computing boom. Nvidia stated that this product, named Rubin CPX, will be released by the end of 2026. It will come in the form of a card, which can be embedded into existing server computer designs or used in standalone computers capable of running in parallel with other hardware in data centers. The chip manufacturer said that this design is a derivative of the new Rubin product line to be launched next year, enabling certain types of AI workloads to be handled more efficiently.

- 19:03Frax: The proportion of USDH yield buybacks will be determined by the community, and ecosystem data will remain transparentBlockBeats News, September 9 — Sean Kelley, Vice President of Communications at Frax, stated at the "USDH Stablecoin Roundtable" hosted by Hyperliquid that regarding "whether there are plans to allocate funds from yields for buybacks," he believes the specific allocation ratio should be decided by the community, and Frax absolutely hopes to resolve this issue through governance. A balance may need to be found between allocating part of the funds for buybacks to support further growth of USDH and improving other areas of the ecosystem considered weaker. The specific percentage should ultimately be determined by the community. As for the transparency of yield distribution, Frax places great emphasis on data visualization and wants to ensure that fund flows can be transparently tracked. Data will be published on the dashboard for users to access, essentially tracking everything on-chain within the ecosystem. Regarding buyback allocation, Frax believes that conducting it once per quarter may be reasonable, and all operations will be executed through smart contracts. BlockBeats previously reported that last Friday, Hyperliquid announced the launch of a "USD stablecoin that prioritizes Hyperliquid, aligns with Hyperliquid's philosophy, and is compliant," and reserved the USDH token code for this purpose. Subsequently, several stablecoin issuers, including Paxos, Frax Finance, Ethena Labs, and Agora, have quickly entered the competition for the right to issue the USDH stablecoin.