News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

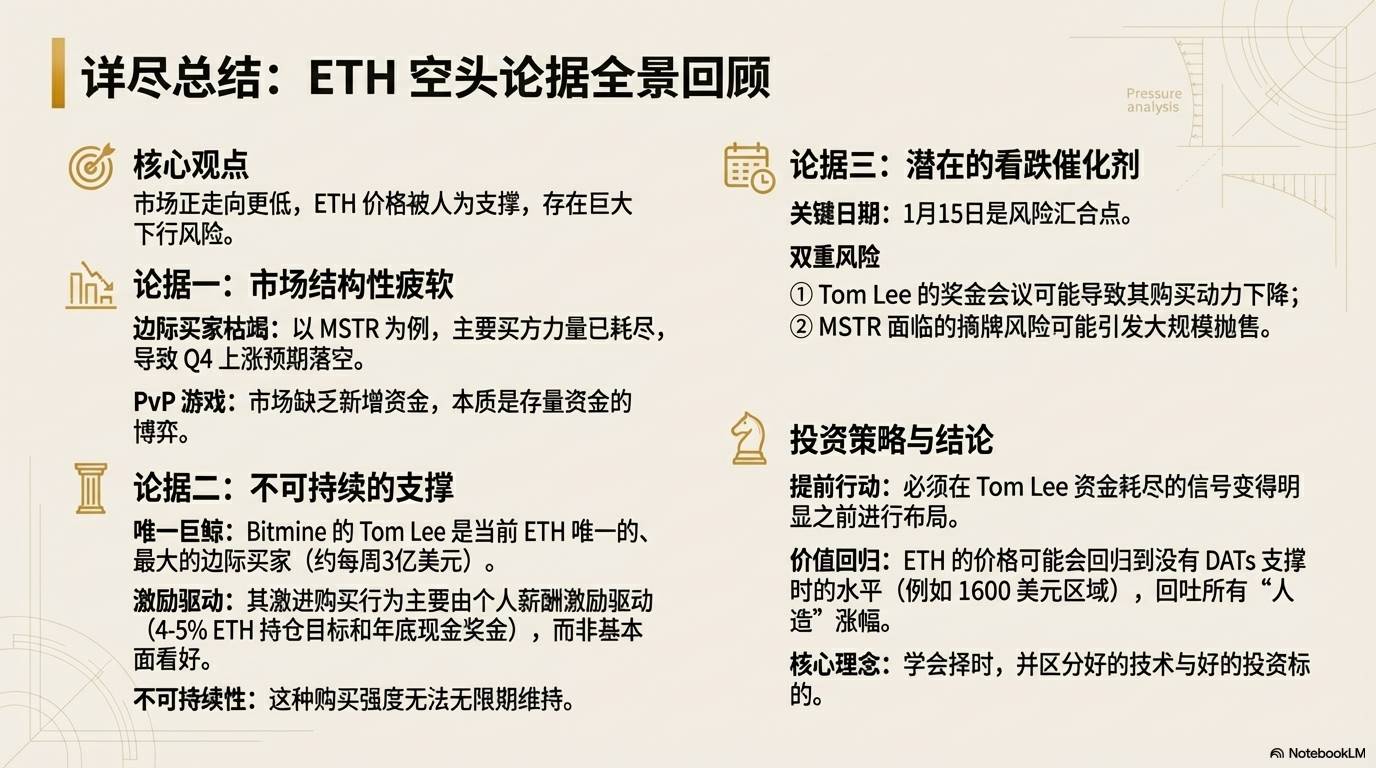

After making a profit of $580,000, I went all in again with $1 million to short ETH

TechFlow深潮·2025/12/18 11:22

Cardano Price Prediction as Senate Crypto Talks Stall and DeepSnitch AI Presale Builds

BlockchainReporter·2025/12/18 11:15

When AI Makes Candlestick Charts Speak

AIcoin·2025/12/18 11:03

Ethereum Bearish Pressure Intensifies: 3 Critical Factors Threatening ETH’s Price

Bitcoinworld·2025/12/18 10:57

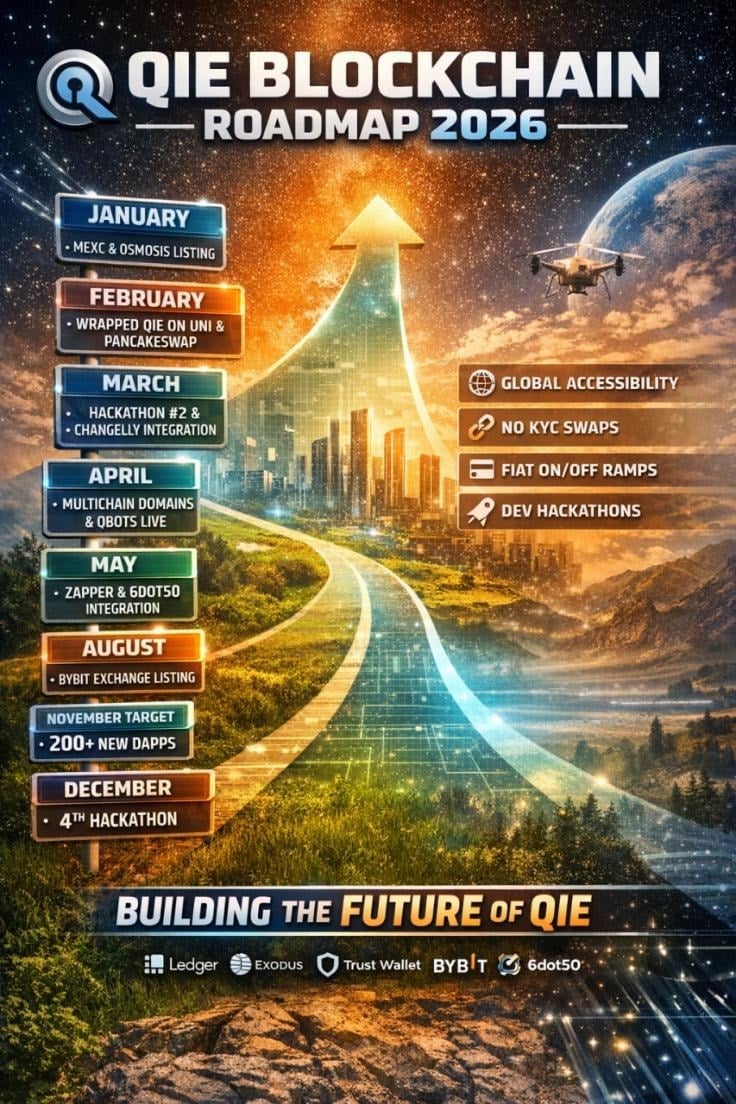

QIE 2026 Roadmap: Building the Infrastructure for Real Web3 Use

Cryptodaily·2025/12/18 10:42

Ripple advances protocol safety with new XRP Ledger payment engine specification

Cryptonomist·2025/12/18 10:36

Tempo Introduces Crypto-Native Transactions to Scale Stablecoin Payments On-chain

DeFi Planet·2025/12/18 10:33

Noah and Fin.com revolutionize global transfers: virtual accounts and stablecoins for hundreds of thousands of users

Cryptonomist·2025/12/18 10:22

Uniform Labs revolutionizes the liquidity of tokenized assets with Multiliquid

Cryptonomist·2025/12/18 10:22

Flash

17:21

Bitcoin falls below $79,000, with $650 million liquidated in the crypto market in the past hourBitcoin price fell below $79,000, and a total of $650 million in crypto assets were liquidated in the past 60 minutes. (Watcher.Guru)

17:17

Bitcoin falls below key support level as long-term holders accelerate sellingBitcoin price dropped by 7.3%, falling to $82,700, while the CoinDesk 20 Index saw a 10.3% decline over seven days. According to Santiment data, market panic sentiment has reached an extreme, and negative sentiment may become a historical indicator for a potential price rebound. Long-term Bitcoin holders are selling at the fastest pace since August, and some industry observers believe the market may be approaching a bear market bottom.

17:15

BTC falls below $79,000Jinse Finance reported that according to market data, BTC has fallen below $79,000, currently quoted at $78,993.78, with a 24-hour decline of 4.71%. The market is experiencing significant volatility, please ensure proper risk control.

News