News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 24)|Ethereum achieves real-time L1 block proof; Solmate surges 40% after $300M financing; Stable’s $825M pre-deposit raises insider concerns2Bitcoin falls below $115,000—is this a delayed reaction to the sale of 80,000 BTC?3Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

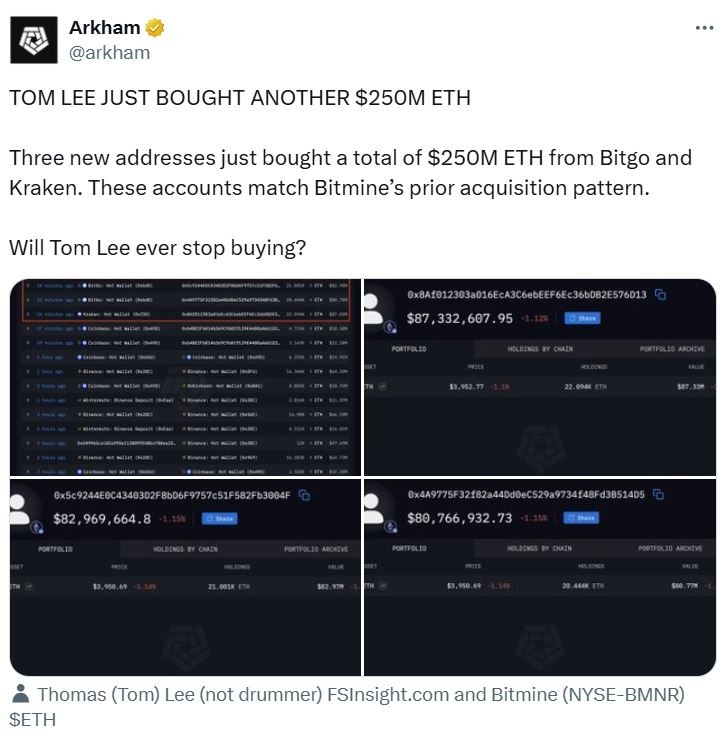

BitMine's Lee says Ether's 'price dislocation' is a signal to buy

CryptoNewsNet·2025/10/21 02:57

Bitcoin Finds Footing Near $107K While Regional Bank Fears Return

Cointribune·2025/10/21 02:54

Bitcoin Mining Eases Slightly, but Record Hashrate Keeps Pressure on Miners

Cointribune·2025/10/21 02:54

Bulls anticipate a reversal, bears await a crash—who will be proven right?

BTC_Chopsticks·2025/10/21 02:52

Bitcoin’s Profit Supply Shrinks as Price Fails to Breach 2-Week Downtrend

Bitcoin shows capitulation signals as profit-taking collapses and selling accelerates. BTC remains below $108,000, but reclaiming $110,000 could spark recovery toward $112,500.

BeInCrypto·2025/10/21 02:52

Injective news: 21Shares files for a new INJ ETF

Coinjournal·2025/10/21 02:39

Bitcoin Hits Key Support; Analysts Warn of Deeper Correction

Bitcoin has retreated to a critical $107,000 level, defined by on-chain analysis as a pivot point for a medium-term correction. Derivatives data shows a fragile market balance tilting toward selling.

BeInCrypto·2025/10/21 02:03

Tether’s $181B paradox: How USDT keeps growing as its market share collapses under MiCA

CryptoSlate·2025/10/21 02:00

Flash

- 11:46Next Week's Macro Outlook: The Federal Reserve Will Announce Its Interest Rate Decision on Thursday, Followed by a Press Conference by PowellChainCatcher news, according to Golden Ten Data, next week, due to the continued U.S. government shutdown, there will be fewer important data releases from the United States, but several central banks will hold interest rate meetings, including the Federal Reserve, the European Central Bank, and the Bank of Japan. The following are the key points that the market will focus on in the new week (all times are in GMT+8): Thursday 02:00, the Federal Reserve announces its interest rate decision; Thursday 02:30, Federal Reserve Chairman Powell holds a monetary policy press conference; Friday 01:15, 2026 FOMC voting member and Dallas Fed President Logan delivers a speech; Friday 21:30, 2026 FOMC voting member and Dallas Fed President Logan delivers a speech; Before gaining a clearer understanding of inflation and the labor market, it is unlikely that Powell will significantly change his wording on the future policy path while announcing a 25 basis point rate cut. Therefore, considering the recent tensions in trade relations and the ongoing government shutdown, Powell and his colleagues may sound slightly dovish in their statements on Thursday, but the extent may not be significant. Even dovish members like Waller are unwilling to pre-commit to a series of rate cuts. If the Federal Reserve questions the market-expected path of another 100 basis points of rate cuts after October, the risk of disappointment among traders will increase.

- 11:05Ferrari plans to launch the digital token "Token Ferrari 499P"ChainCatcher reports that the world-renowned racing and sports car brand Ferrari has announced plans to launch a digital token called “Token Ferrari 499P,” allowing fans to bid for the Le Mans endurance race champion model Ferrari 499P. This token will be available to Hyperclub members, and holders will be able to trade with each other and participate in exclusive auctions.

- 09:29Data: A newly created wallet withdrew 276,030 LINK, worth $4.95 million, from a certain exchange.According to ChainCatcher, Onchain Lens has detected that a newly created wallet withdrew 276,030 LINK from an exchange, worth 4.95 million US dollars. Currently, this whale still holds 1,619,000 LINK.