News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 12)|World launches a “super app” featuring payments and chat; US initial jobless claims reach 236,000; Satoshi Nakamoto statue installed at the NYSE2Ether vs. Bitcoin: ETH price poised for 80% rally in 20263Prediction markets bet Bitcoin won’t reach $100K before year’s end

Central Bank Data Confirms Massive Crypto Usage In Russia

Cointribune·2025/10/11 11:57

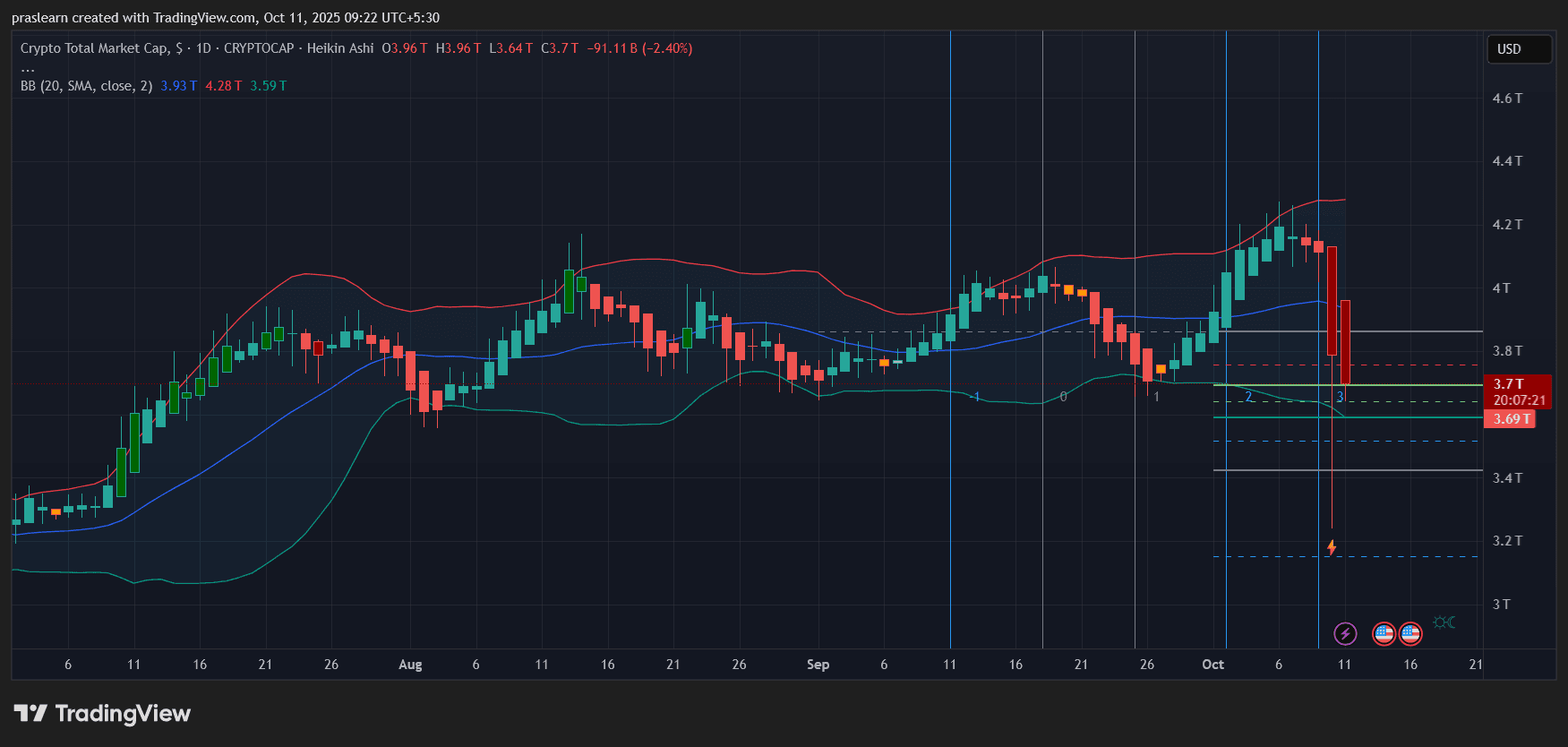

Crypto Market Chaos: $19B Liquidations Leaves Traders Facing Massive Losses

CoinsProbe·2025/10/11 11:54

US–China Tariff War: Can Crypto Market Survive the New Trade War?

Cryptoticker·2025/10/11 11:39

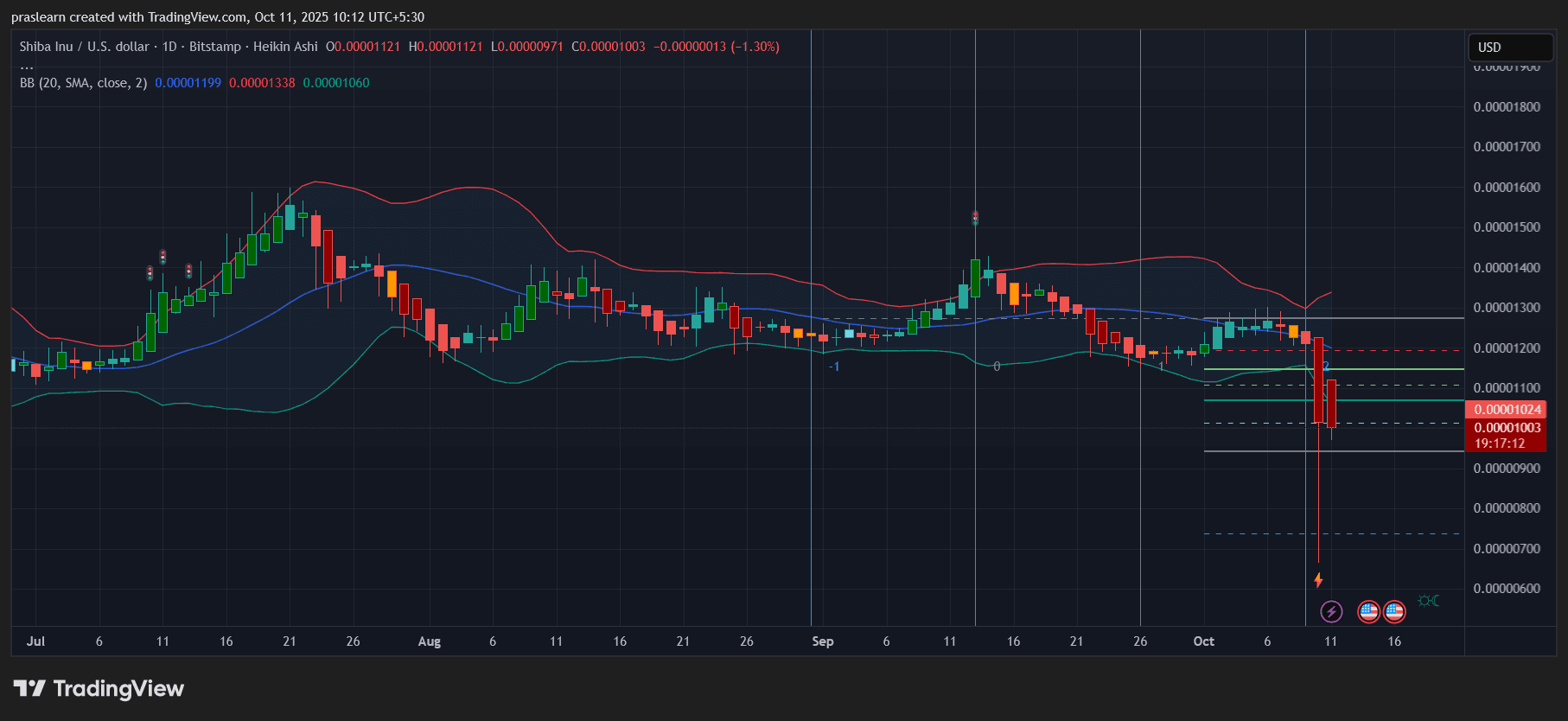

Will SHIB Price Crash to 0 After Trump’s 100% Tariff Threat?

Cryptoticker·2025/10/11 11:39

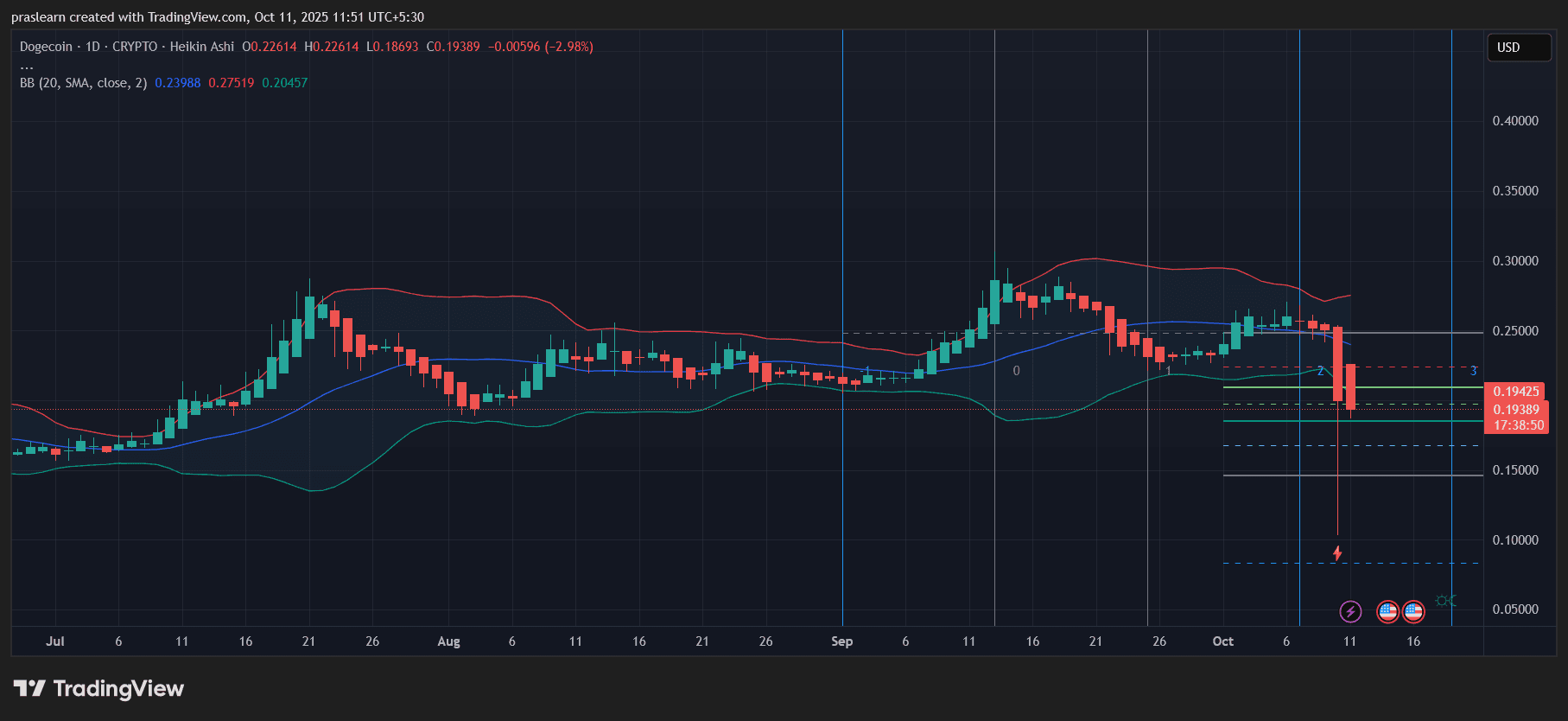

Trump’s 100% Tariffs: Is This the End for Dogecoin?

Cryptoticker·2025/10/11 11:39

Whales and Retail Back Cardano (ADA) Price Rebound Despite Bearish Signals

Cardano (ADA) is down nearly 20% in 24 hours, but whales and retail traders are quietly adding to their positions. On-chain data shows growing conviction even as technical indicators flash warning signs. Can these two groups overpower bearish signals and drive the next ADA price rebound?

BeInCrypto·2025/10/11 11:38

BTC, ETH, XRP, SOL Face Slow Bottoming Process After $16B Liquidation Shock

Cointime·2025/10/11 11:36

Russia Acknowledges Crypto’s Popularity With Its Citizens as Central Bank Weighs Bank Involvement

Cointime·2025/10/11 11:36

How much Bitcoin will you need to retire? This new calculator will tell you

CryptoSlate·2025/10/11 11:13

What Crypto Whales Are Buying After Trump’s 100% China Tariffs Crashed The Market

After Donald Trump’s 100% China tariff announcement triggered $19 billion in crypto liquidations, whales turned buyers instead of sellers. Chainlink whales added over $30 million Uniswap whales picked up $4 million, and Dogecoin mega holders bought $156 million — hinting that smart money is betting on a rebound across these three tokens.

BeInCrypto·2025/10/11 11:00

Flash

- 02:10Vanguard executive: Bitcoin is a speculative asset, but may have practical applications during inflation or turmoilChainCatcher news, according to a report by Cointelegraph, John Ameriks, Global Head of Quantitative Equity at Vanguard, stated that bitcoin is purely a speculative asset, similar to collecting toys. Although John Ameriks expressed criticism, he also noted that in cases of high inflation in fiat currencies or political turmoil, this cryptocurrency could find real-world use cases beyond market speculation.

- 02:10A certain whale address spent 539.6 BNB to purchase 1.65 million RAVE tokens.According to ChainCatcher, monitored by Lookonchain, a whale address starting with 0x2ee6 spent 539.6 BNB (approximately $476,000) to purchase 1.65 million RAVE tokens 8 hours ago. The current value has reached $950,000, with an unrealized profit of over $474,000 and a return rate close to 100%. .

- 02:10An exchange: The Federal Reserve's "stealth QE" will support the crypto market, and the policy environment may be more accommodative than expected.ChainCatcher news, a certain exchange posted on social media stating that the Federal Reserve's announcement of a 25 basis point rate cut this week was in line with market expectations, but its plan to implement Treasury reserve management purchases within the next 30 days can at least be seen as a positive signal. The specific arrangements for this plan are as follows: · Initial operation size of $4 billion · Launch date is December 12. This liquidity injection comes earlier than expected, and reserve growth may continue until April 2026. We believe that the Federal Reserve's shift from balance sheet reduction to net injection can be regarded as "mild quantitative easing" or "stealth QE," which may provide support for the cryptocurrency market. Considering the reserve management purchase plan and the federal funds futures market's expectation of two more rate cuts (a total of 50 basis points) in the first nine months before 2026, the policy environment may be more accommodative than expected.

News