News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Crypto Biz: A Bitcoin treasury shareholder revolt

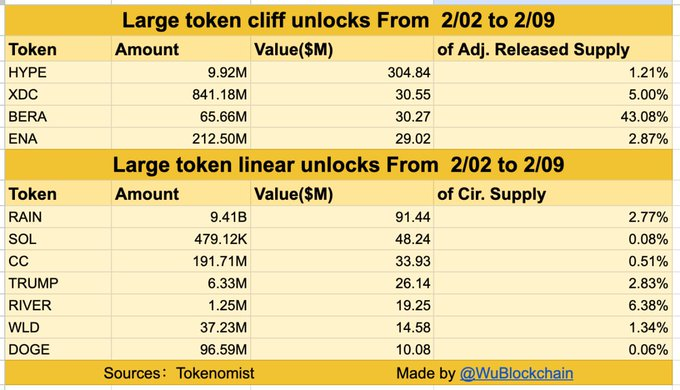

Over $1 Billion in Token Unlocks Hit a Weak Crypto Market This Week

CoinEdition·2026/02/02 13:15

U.S. Regulators Cooperate on Developing Crypto Regulation

Coinspaidmedia·2026/02/02 13:09

Broadcom and TSMC set to become major beneficiaries amid the surge in demand for custom AI chips

101 finance·2026/02/02 13:06

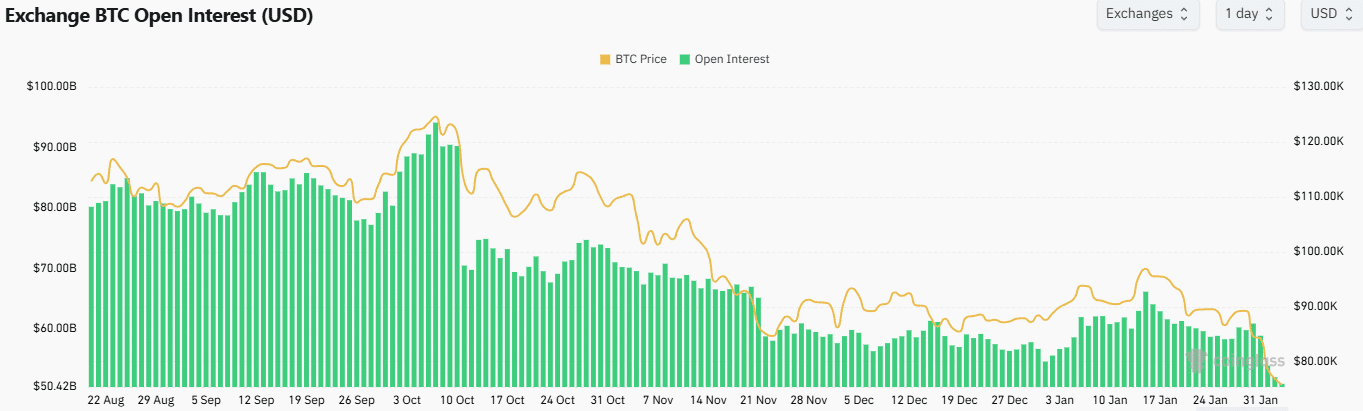

Bitcoin drops 16% in 5 days: Massive market stress ahead?

AMBCrypto·2026/02/02 13:04

Crypto-related stocks decline in pre-market hours while bitcoin holds steady near $77,000

101 finance·2026/02/02 12:45

Target’s newly appointed CEO is confronted with declining sales and unrest in Minneapolis

101 finance·2026/02/02 12:42

EURUSD erased all last week's gains on broad US Dollar strength. Start of a bearish trend?

101 finance·2026/02/02 12:39

Institutions Return to Crypto Funding as Infrastructure Takes Center Stage

Cointribune·2026/02/02 12:39

Palantir Reports Earnings at a Time When Its Shares Could Benefit from Positive Developments

101 finance·2026/02/02 12:36

Napco (NASDAQ:NSSC) Surpasses Q4 CY2025 Revenue Projections

101 finance·2026/02/02 12:33

Flash

21:20

The probability of Khamenei stepping down before March 31 surges to 93% on PolymarketChainCatcher news, according to Polymarket data, the probability of "Khamenei stepping down as Iran's Supreme Leader before March 31" has surged sharply to 93% today, up 85 percentage points from before, with a total market trading volume reaching $30.43 million.

20:54

OpenAI recently announced that it has signed a cooperation agreement with the U.S. Department of Defense, allowing Dow Jones Index constituent companies to fully utilize its artificial intelligence systems in compliance with relevant laws and regulations.The protocol provides clear guidance for listed companies to legally deploy AI technology within the legal framework.

20:28

BTC surpasses $67,000Jinse Finance reported that according to market data, BTC has surpassed $67,000 and is now quoted at $67,003.6, with a 24-hour increase of 2.15%. The market is experiencing significant volatility, so please ensure proper risk control.

News