News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Russia plans to relax the investment threshold for digital assets, Texas allocates $5 million to Bitcoin ETF, an Ethereum whale sells 20,000 ETH, Arca's Chief Investment Officer says MSTR does not need to sell BTC, and the S&P 500 Index may rise by 12% next year. Summary generated by Mars AI. The accuracy and completeness of this summary produced by the Mars AI model are still being iteratively updated.

Switchboard is an oracle project within the Solana ecosystem and proposes to provide a data service layer for the x402 protocol. It adopts a TEE technology architecture, is compatible with x402 protocol standards, supports a pay-per-call billing model, and removes the API Key mechanism, aiming to build a trusted data service layer. Summary generated by Mars AI. The accuracy and completeness of this content, generated by the Mars AI model, is still in an iterative update phase.

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.

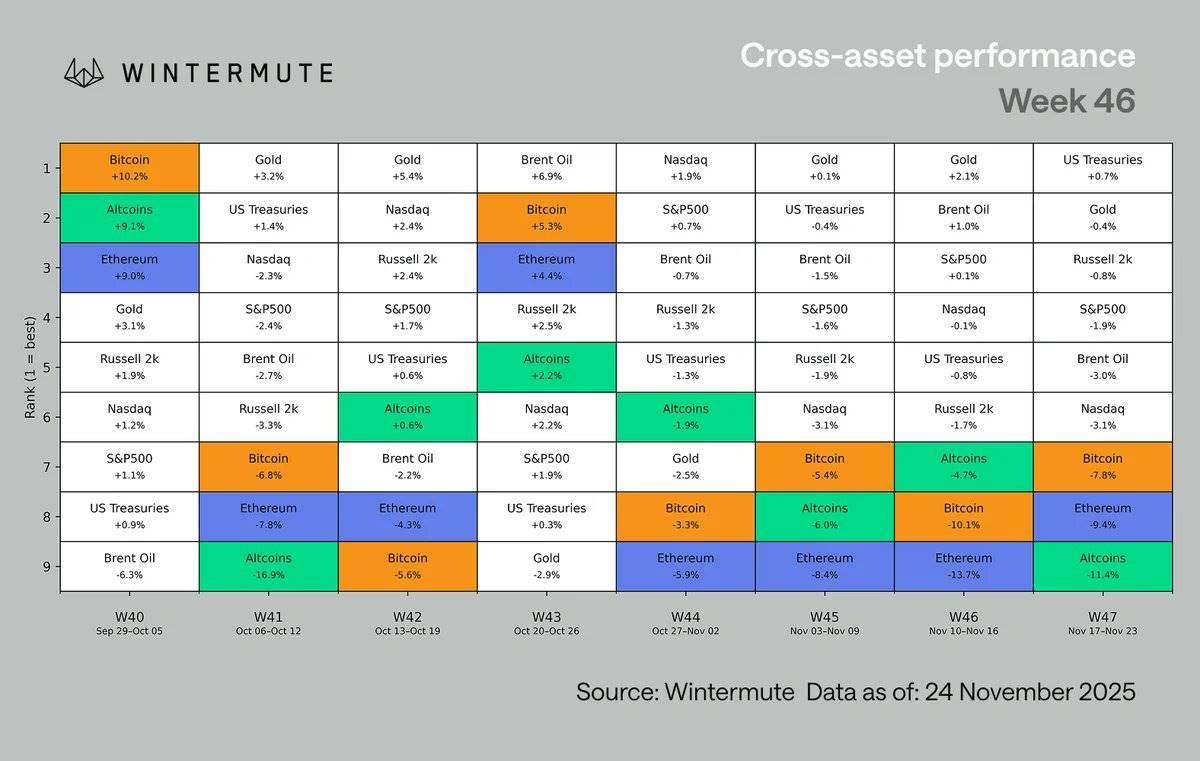

This week, risk appetite deteriorated sharply, and the AI-driven stock market momentum finally stalled.

Former a16z partner Benedict Evans pointed out that generative AI is triggering another ten-to-fifteen-year platform migration in the tech industry, but its final form remains highly uncertain.

The most shorted stock in the United States is Bloom Energy, with other companies on the list including Strategy, CoreWeave, Coinbase, Live Nation, Robinhood, and Apollo.