News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- U.S. adoption of UCC Article 12 redefines digital asset collateral rules, prioritizing "control" (e.g., private key possession) over traditional filing for perfection. - Transition periods ended in key states (e.g., Delaware by July 2025), leaving lenders relying on legacy filings at risk of losing priority to control-based creditors. - 32 states have adopted the 2022 UCC amendments, but uneven implementation requires multi-jurisdictional compliance strategies, especially with non-adopting states like Ne

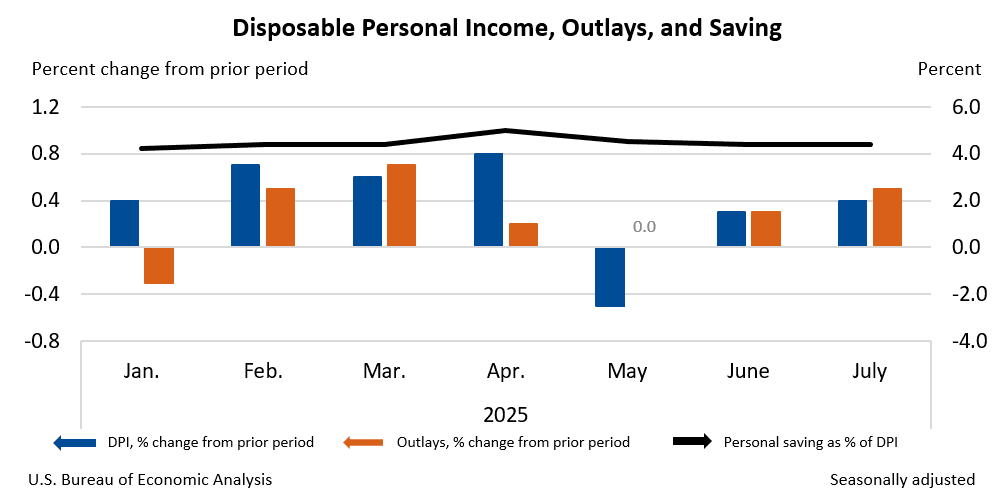

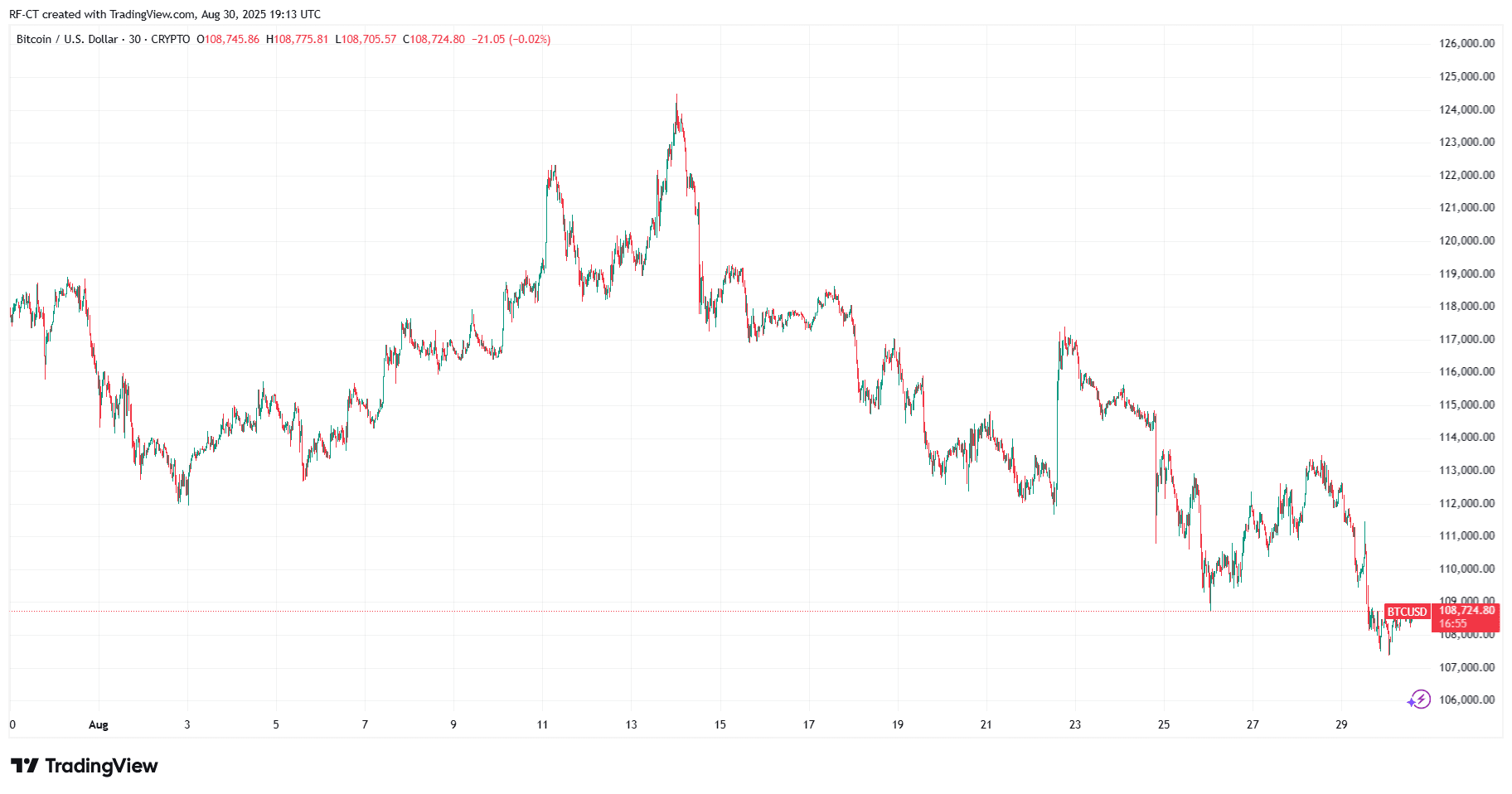

- Ethereum ETFs saw $164.6M net outflow on Aug 29, 2025—the largest since launch—driven by profit-taking amid inflation concerns and geopolitical risks. - Institutional capital temporarily shifted to Bitcoin ETFs as BlackRock/Fidelity injected $129M, reflecting Bitcoin's "safe haven" appeal during Fed rate delay uncertainty. - Ethereum's fundamentals remain strong: 71% YTD gains, 94% reduced Layer 2 fees post-Dencun/Pectra, and $223B DeFi TVL despite short-term outflows. - ETF inflows ($3.87B in August) ou

- 2025 crypto market splits between speculative meme coins (e.g., PEPE) and utility-driven projects (e.g., RTX) with real-world applications. - PEPE faces 30% 2026 growth forecasts but risks 50% short-term price drops, driven by social media sentiment and geopolitical volatility. - RTX targets 7,500% returns via low-cost remittances, institutional audits, and deflationary tokenomics, contrasting PEPE's lack of utility or governance. - Analysts highlight RTX's $19T market alignment and 0.1% fee model as sus

- BlockDAG (BDAG) raised $386M in presale, selling 25.5B tokens across 30 batches at $0.03 each, projecting 30x returns if token hits $1 post-launch. - Hybrid DAG-PoW architecture and EVM compatibility attracted 4,500 developers to build 300+ dApps, while 3M users mine via X1 app and 19,000 ASICs sold. - 25% referral rewards and Dashboard V4's real-time data drive community growth, contrasting bearish trends in SHIB/ARB and speculative hype in TAO/RNDR. - Analysts highlight BDAG's pre-mainnet infrastructur

- 09:29Data: A newly created wallet withdrew 276,030 LINK, worth $4.95 million, from a certain exchange.According to ChainCatcher, Onchain Lens has detected that a newly created wallet withdrew 276,030 LINK from an exchange, worth 4.95 million US dollars. Currently, this whale still holds 1,619,000 LINK.

- 09:11An address profited $675,000 from trading PING within two daysAccording to Jinse Finance, monitored by Lookonchain, trader 0xe688 made a profit of $675,000 from trading $PING in less than two days. Previously, the trader spent $89,000 to purchase 13.42 million $PING, then sold 6.72 million $PING for a profit of $377,000, and currently still holds 6.72 million $PING (worth $387,000), with a total profit of $675,000 (+759%).

- 09:08PYUSD attestation report: total circulation surpasses 2.6 billion, reaching a new high with approximately 125.5% growth since AugustChainCatcher news, Paxos has released an attestation report for the stablecoin PYUSD, issued by KPMG, one of the "Big Four accounting firms." The report reveals that as of October 15, the total tokens outstanding for PYUSD had risen to 2,638,336,904, reaching a new all-time high. The nominal value of redeemable collateral in total net assets was $2,652,728,424, which is higher than the total tokens outstanding of PYUSD. It is reported that Paxos did not release an attestation report for September, while in August it disclosed that the total PYUSD in circulation was 1,169,714,720, indicating that the circulation has increased by approximately 125.5% over the past two months.