News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- MemeCore, a meme-inspired cryptocurrency, surged 93% to a $1.10 all-time high, driven by social media buzz and institutional interest. - The token's growth highlights renewed market legitimacy for meme coins, supported by community engagement and transparent governance efforts. - Analysts note strong on-chain metrics but caution about inherent volatility, emphasizing the need for broader use cases and regulatory clarity. - MemeCore's sustained post-ATH stability suggests evolving dynamics in community-dr

- XRP's $2.83 support level in August 2025 faces critical technical and institutional tests amid regulatory clarity post-SEC lawsuit resolution. - A breakdown risks 5% decline to $2.66, while rebound could push to $3.70–$5.00 if $3.20 resistance is overcome. - Whale accumulation of $3.8B at $3.20–$3.30 and seven pending XRP ETF applications (87–95% approval chance) signal institutional bullish positioning. - Regulatory reclassification as commodity and RLUSD's $650M market cap reinforce XRP's utility in cr

- xAI sues Apple and OpenAI for anticompetitive practices in AI chatbot markets, alleging violations of U.S. antitrust laws through data and distribution control. - EU intensifies AI antitrust enforcement via AI-assisted collusion detection and mandates like the Digital Markets Act, targeting algorithmic dominance and data monopolies. - Cloud infrastructure concentration by AWS, Google, and Microsoft raises antitrust risks, prompting U.S. legislation to enforce competitive bidding for defense contracts. -

- U.S. Department of Commerce partners with Chainlink and Pyth to deliver on-chain economic data, sparking divergent market reactions. - Pyth’s PYTH token surges 70% vs. Chainlink’s 5% gain, despite Chainlink’s $20T Total Value Enabled and broader infrastructure. - Chainlink’s institutional adoption and cross-chain scalability position it as a cornerstone for U.S. blockchain strategy, contrasting Pyth’s speculative focus. - Market underappreciation of Chainlink’s fundamentals creates a contrarian opportuni

- Sharps Technology raised $400M to build a Solana treasury, shifting from medical devices to a dual-income model combining staking yields and equity appreciation. - This aligns with Solana’s institutional adoption, leveraging scalability, low costs, and 6.86% staking yields to attract capital amid $1.8B Strategic Solana Reserve growth. - Solana’s TVL reached $11.7B in Q3 2025, but its price remains below the 2025 high, highlighting undervaluation amid regulatory clarity efforts and ETF speculation. - Shar

- MAGACOIN FINANCE emerges as a post-Ethereum asymmetric crypto opportunity with projected 18,000% ROI by 2025. - Its deflationary tokenomics, institutional-grade security, and whale-backed liquidity differentiate from speculative meme coins. - The PATRIOT50X bonus offers 50x multiplier for early presale investors amid rapid sellout rates and capital reallocation trends. - Projected to outperform Ethereum's 14,000% historical ROI, it combines meme-like virality with technical infrastructure resilience.

- CFTC's 2025 settlement reclassified XRP as a commodity, resolving a 3-year legal battle and enabling U.S. institutional trading. - XRP ETF applications (e.g., ProShares' $1.2B Ultra XRP ETF) signal $5-8B potential inflows, with 95% approval probability. - Post-settlement XRP surged to $3.32, showing strong institutional support through futures volume and whale accumulation. - Regulatory clarity and cross-border payment innovations position XRP as a strategic asset for diversified crypto portfolios.

- Civil law jurisdictions like Quebec mandate public beneficial ownership registries, boosting ESG scores and investor trust in platinum producers. - Common law regions face higher volatility due to opaque governance, exemplified by South African producers lagging 18% in risk-adjusted performance. - The 2025 platinum-to-gold ratio surge reflects legal regime impacts, with Quebec firms insulated from tariffs and regulatory shocks. - Investors are advised to prioritize civil law-compliant firms and hedge aga

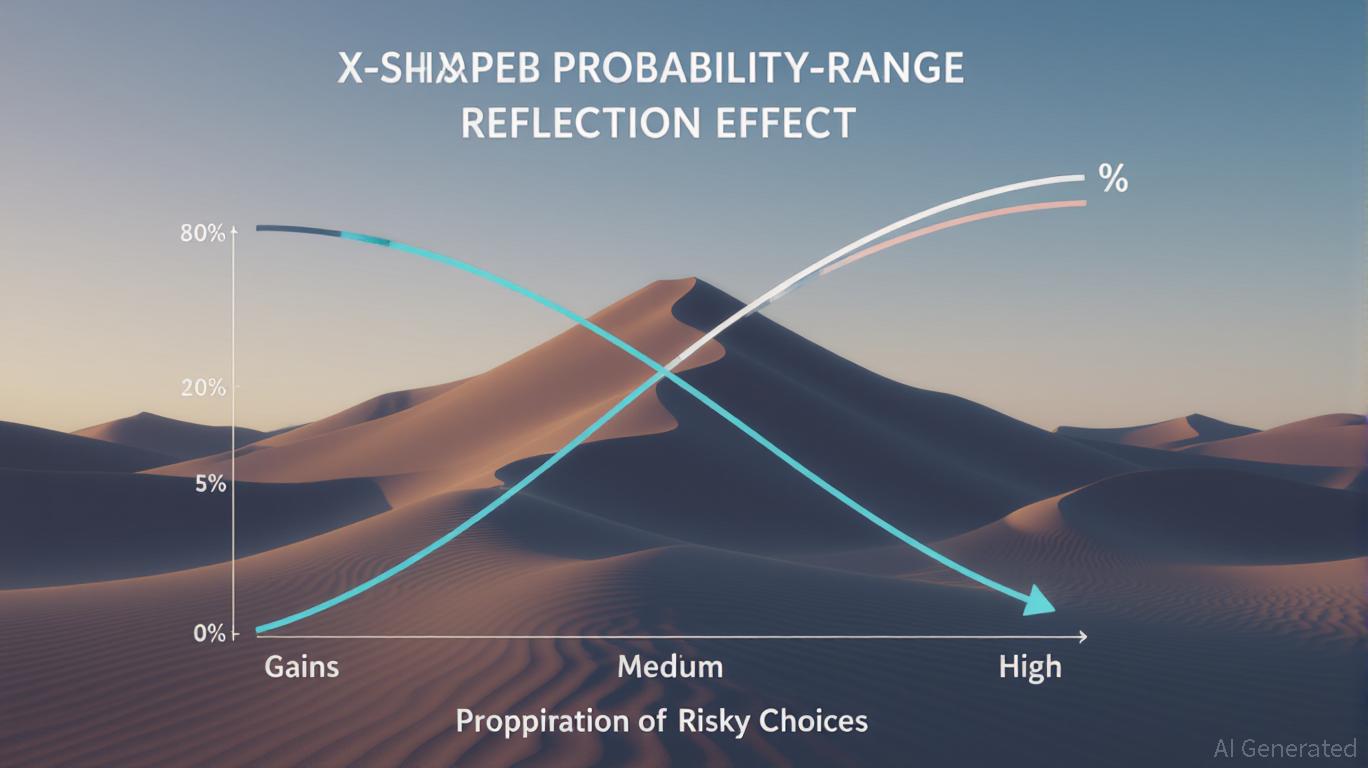

- The reflection effect explains how investors show risk aversion in gains and risk-seeking in losses, reshaping portfolio strategies for assets like SLV and MSTY. - MSTY's 2025 volatility highlights behavioral shifts: risk-averse selling during gains and risk-seeking buying during 30% declines, aligning with prospect theory predictions. - Tactical approaches like hybrid portfolios (MSTY + TIPS) and RSI-based trading reduced volatility, generating 42.22% returns vs. 37.32% benchmarks in 2022-2025. - A 2025

- CME Group's May 2025 XRP Futures launch institutionalized digital assets, offering regulated liquidity and validating XRP's financial role. - SEC's August 2025 ruling cleared XRP's legal status, enabling $17M reallocation from Bitcoin to XRP by Gumi Inc. and boosting institutional adoption. - XRP Futures' $1.6B July 2025 notional volume and transparent pricing mechanism demonstrate growing utility-driven demand over speculation. - Experts project $2.80 XRP price by 2025, citing ETF approval potential, Ri

- 09:24Ant Group's self-custody wallet TOPNOD has entered the public testing phase overseas, allowing users to buy and sell cryptocurrencies through third-party platforms.BlockBeats News, October 27, according to the Hong Kong Economic Times, Ant Group's self-custody wallet TOPNOD has entered the public testing phase overseas, allowing users to buy and sell cryptocurrencies through third-party platforms. The application has been launched on the App Store and Google Play in regions such as Singapore. Currently, TOPNOD is not available on the Hong Kong app store, and the website also restricts direct access from Hong Kong users. Previously, it was reported that Advanced New Technologies, a subsidiary of Ant Group, submitted a registration application for ANTCOIN on June 18. On the same day, the group also applied to register a series of trademarks including BRHKD, BRUSD, ATHKD, AIHKD, AIUSD, and BETTRCOIN.

- 09:244E: Decline in Bitcoin Illiquid Supply May Suppress Price ReboundOn October 27, according to 4E's observation, SharpLink Gaming previously raised $76.5 million through a stock placement on October 17 and purchased 19,271 ETH at an average price of $3,892, rather than making another recent purchase. The company currently holds a total of 859,853 ETH, with a total value of approximately $3.58 billion, an average cost of $3,609, and an unrealized profit of about $480 million. On the other hand, according to Glassnode data, since mid-October, about 62,000 BTC (approximately $7 billion) have flowed out from long-term inactive wallets, marking the largest outflow in the second half of this year. The reduction in illiquid supply may weaken the upward momentum of bitcoin prices. The report points out that while whales have continued to accumulate recently, medium-sized holders have been selling, momentum buying has weakened, and insufficient spot demand may put pressure on prices. In terms of market sentiment, an exchange chairman, Tom Lee, stated that ETH is still in a "super cycle," with strong fundamentals for Ethereum, and record highs in stablecoin demand and on-chain transaction volume may become the driving force for a new round of price increases. In addition, Michael Saylor once again hinted that Strategy may disclose bitcoin accumulation data next week; U.S. Treasury Secretary Bessent stated that the overall U.S. inflation rate has declined since Trump took office. 4E reminds investors: capital flows and on-chain supply and demand are reshaping the market structure, with ETH fundamentals strengthening and BTC liquidity declining, showing divergence. In the short term, focus on the continuity of whale holdings and institutional accumulation signals.

- 09:24"AI Crypto Trading Competition": DeepSeek Surpasses Qwen3 to Lead Again with a 125% ReturnAccording to on-chain AI analysis tool CoinBob (@CoinbobAI_bot) monitoring, as the market has recently rebounded, the returns of the six major AI models have shown significant divergence. Among them, DeepSeek has surpassed Qwen3 to take the top spot, with a total account value of $22,592 and a return rate of 125.92%. Qwen3 follows closely with a return rate of 108.10%. Both Claude and Grok have also returned to positive gains, while Gemini and GPT5 remain in deep loss. During this round of overall market rally, DeepSeek adopted a strategy of simultaneously establishing 10x leveraged long positions in six mainstream cryptocurrencies. Currently, all of its positions are showing unrealized profits. Among them, the BTC long position has the most significant return, with an unrealized profit of approximately 43%. Among realized profits, the SOL long position has the highest profit, reaching $1,486. Ranking by total account value is currently as follows: DeepSeek ($22,592), Qwen3 ($20,810), Claude ($12,328), Grok ($11,362), Gemini ($4,329), and GPT5 ($4,089).