News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | Fed Maintains Hawkish Stance on Rates; Trump Threatens Iran Leading to Gold and Silver Pullback; Storage Sector Strong with Seagate Up Over 19% (January 29, 2026)2Bitcoin companies keep buying as AI pulls capital away – Inside ABTC’s move3DePIN startups raise $1B, generate $72M in onchain revenue in 2025

Trump Ally Kevin Hassett Tipped To Lead The Fed

Cointribune·2025/11/26 08:54

Bitcoin : Are the conditions for a future bull run already met?

Cointribune·2025/11/26 08:54

Polkadot launches "KYC-free real person verification": A comprehensive analysis of Proof of Personhood!

PolkaWorld·2025/11/26 08:34

Triple Pressure on the Crypto Market: ETF Outflows, Leverage Reset, and Low Liquidity

In the recent cryptocurrency market downturn, the main factors include a slowdown in ETF inflows, deleveraging impacts, and liquidity constraints, placing the market in a fragile adjustment period amid macro risk-off sentiment.

BlockBeats·2025/11/26 08:08

US growth projected at 2.4% for 2026: Does this protect Bitcoin from harsh crypto winter?

CryptoSlate·2025/11/26 08:03

Research Report|In-Depth Analysis and Market Cap of Irys (IRYS)

Bitget·2025/11/26 07:45

Morning Brief | Bitcoin Sharpe Ratio Drops Below 0; Google Plans to Sell TPUs Directly to Meta; Paxos Announces Acquisition of New York Crypto Wallet Startup Fordefi

Overview of major market events on November 25.

Chaincatcher·2025/11/26 07:17

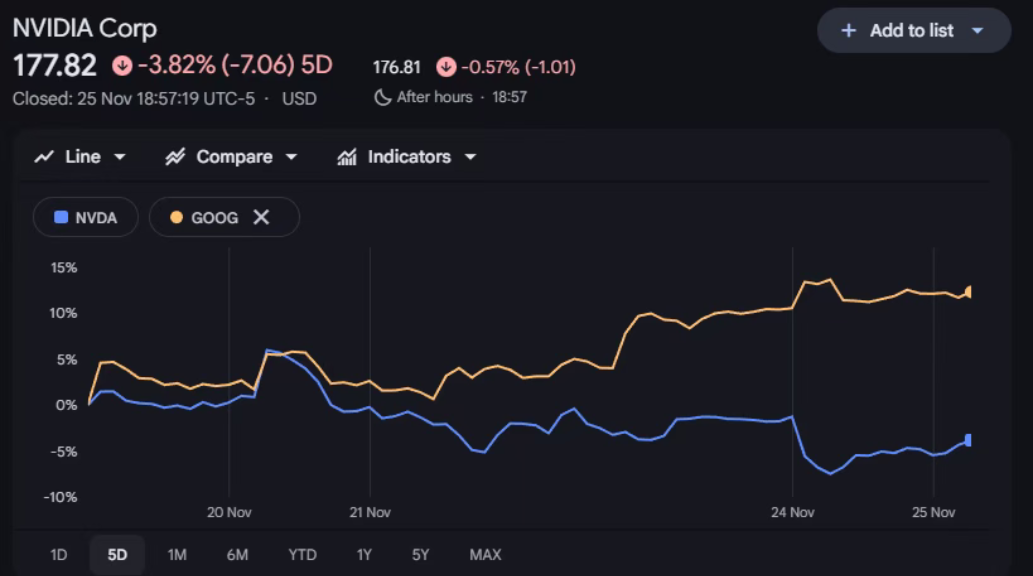

Is Nvidia getting anxious?

AICoin·2025/11/26 07:12

Bitcoin wavers under $88K as traders brace for $14B BTC options expiry

Cointelegraph·2025/11/26 05:15

Flash

06:38

Indonesia responds to MSCI investability warning: plans to double the free float requirement for listed companies to 15%Glonghui, January 29|Indonesia's financial regulatory authority stated on Thursday that it will double the free float requirement for listed companies to 15%. This is one of its responses to concerns raised by MSCI regarding the transparency of the Indonesia Stock Exchange, concerns which have triggered a large-scale market sell-off this week. The head of the financial regulatory authority said at a press conference that, in response to MSCI's concerns, several other measures will be taken, including initiatives aimed at making regulation more timely and effective.

06:37

Japanese stocks closed up 0.03%Gelonghui, January 29|The Nikkei 225 Index closed up 16.89 points, an increase of 0.03%, at 53,375.60 points.

06:36

Yesterday, the US Bitcoin Spot ETF saw a net outflow of $19.6 millionBlockBeats News, January 29, according to Farside data, yesterday the net outflow of the US Bitcoin spot ETF was $19.6 million, with a net outflow of $14.2 million for the BlackRock IBIT.

News