News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 15)|Hassett stresses Fed independence, says Trump’s views “carry no weight”; Bitcoin OG increases ETH long positions, total exposure reaches $676 million2Bitcoin will ‘dump below $70K’ thanks to hawkish Japan: Macro analysts3Bitcoin ‘extreme low volatility’ to end amid new $50K BTC price target

National Bitcoin Reserve Could Rock BTC Prices and Dollar Stability, Warns Crypto Executive

Cointribune·2025/09/28 18:09

Bitcoin Derivatives Stay Active as $110K Resistance Shapes Market Sentiment

Cointribune·2025/09/28 18:09

Ethena (ENA) Slides Lower – Could This Emerging Pattern Spark a Bounce Back?

CoinsProbe·2025/09/28 18:03

Aster (ASTER) Holds Key Support – Will This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/09/28 18:03

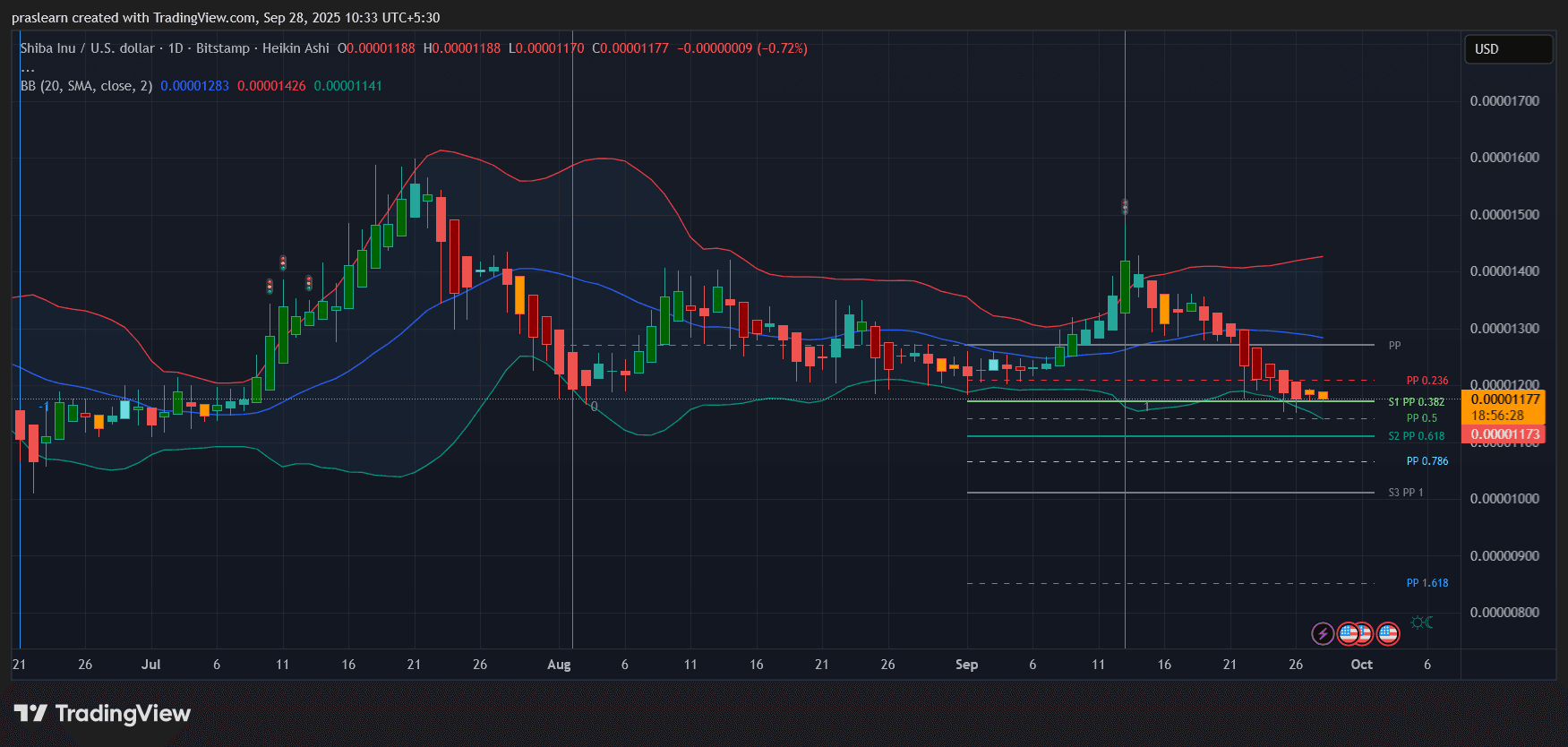

SHIB Price Meltdown: Why the Worst May Be Yet to Come?

Cryptoticker·2025/09/28 17:54

XRP Price Prediction: Break Above $3 Could Signal Start of a New Bull Run

Cryptoticker·2025/09/28 17:54

Cardano News: ADA Price Stuck Below $0.80 as Bears Test Key Supports

Cryptoticker·2025/09/28 17:54

Hypervault Deletes X Account Amid Alleged $3.6M Rug Pull

Coinlineup·2025/09/28 17:12

As Cardano Goes Sideways and HYPE Cools Off, BlockDAG Shatters Records With $410M+ Presale Momentum!

Coinlineup·2025/09/28 17:12

Disrupting Ethereum! Anoma aims to build a truly "decentralized operating system" so users no longer have to worry about cross-chain issues

Anoma co-founder Adrian shared his journey from academic research to founding Anoma. Anoma aims to break the current bottlenecks in Web3 by addressing fragmentation through an intent-centric, decentralized operating system, offering a hybrid consensus mechanism that is more decentralized than bitcoin and faster than solana. Summary generated by Mars AI. This summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

MarsBit·2025/09/28 16:54

Flash

- 11:41Data: 2,000 ETH transferred from BitKan to an exchange, worth approximately $6.3171 millionAccording to ChainCatcher, Arkham data shows that at 19:27 (UTC+8), 2,000 ETH (worth approximately $6.3171 million) were transferred from BitKan to a certain exchange.

- 11:41American Bitcoin increases holdings by 261 BTC, total now reaches 5,044 BTCAccording to Jinse Finance, data from BitcoinTreasuries.NET shows that the BTC holdings of American Bitcoin Corp, a bitcoin mining company supported by the Trump family, have increased to 5,044 BTC, an increase of 261 BTC.

- 11:41VISA launches stablecoin consulting services to keep up with the crypto waveJinse Finance reported, citing Fortune magazine, that Visa has announced the launch of its stablecoin consulting services, aimed at assisting fintech companies, banks, and other enterprises in formulating and implementing stablecoin strategies. Since President Trump signed the "Genius Act" in July, many traditional financial companies have embraced stablecoins. Visa currently has dozens of clients, including Navy Federal Credit Union, VyStar Credit Union, and Pathward Financial Institution. Visa pointed out that the service will support clients' strategies, technology, and operations, jointly promoting the application of stablecoins in cross-border and inter-company transactions.

News