News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Google Cloud launches GCUL, a Layer-1 blockchain offering "credibly neutral" infrastructure for financial institutions to enable asset tokenization and wholesale payments. - Pilot with CME Group demonstrates GCUL's potential for 24/7 trading environments, with broader trials planned before 2026 launch. - GCUL differentiates via Python-based smart contracts, lowering entry barriers for institutions already using Python in finance and data science. - Permissioned design with KYC-compliant accounts ensures

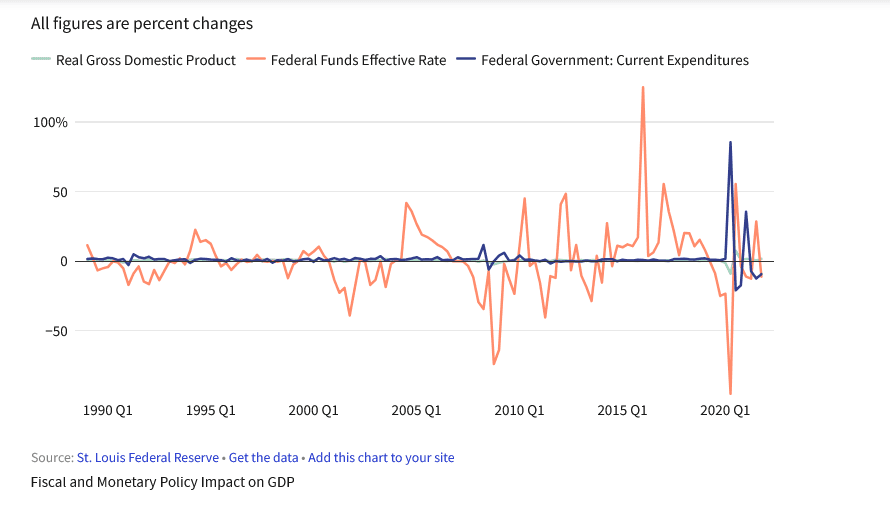

- MAGACOIN FINANCE's Ethereum-based presale nears completion as rapid sellouts highlight growing altcoin demand. - Project benefits from Ethereum's $2B staking unlock timing and Solana's supply consolidation, shifting liquidity to smaller-cap tokens. - Scarcity-driven tokenomics and strategic market positioning create urgency, aligning with broader crypto and financial narratives. - Upcoming Fed rate decisions and Ethereum's liquidity shift amplify MAGACOIN FINANCE's potential as a high-growth altcoin cand

- Blockchain-driven ESG tokenization is transforming capital markets by converting emission reduction assets into tradable digital tokens, with Blubird and Arx Veritas tokenizing $32B to prevent 400M tons of CO₂ emissions. - Platforms like Blubird’s Redbelly Network democratize ESG investing by fractionalizing illiquid environmental infrastructure, enabling real-time emissions tracking and automated compliance reporting via blockchain’s programmability. - Institutional demand is accelerating, with $500M+ i

- SPX6900 (SPX), a Solana-based meme coin, faces a 40% price drop and $41M daily volume decline in August 2025 amid bearish momentum. - Technical indicators show mixed signals: RSI/MACD suggest buyer interest, but price remains below 50-day EMA and within a rising wedge pattern. - Social media sentiment remains strong due to multi-chain interoperability, but on-chain metrics reveal hoarding by long-term holders and a 37% market cap drop. - Whale activity highlights fragility: $3.73M withdrawal from Bybit a

- TRON slashes network fees by 60% on August 29, 2025, aiming to boost accessibility and attract emerging market users by reducing energy unit prices. - Founder Justin Sun supports the move as a strategic trade-off, prioritizing long-term growth over short-term revenue from stablecoin transactions and user adoption. - Market reactions show initial TRX price dips and bearish momentum, but analysts highlight potential for increased transaction volumes and token burns to drive future value. - While fees remai

- 12:46Tesla Chairman Calls on Shareholders to Support Musk's Trillion-Dollar Compensation PlanJinse Finance reported that Tesla (TSLA.O) Chairwoman Robyn Denholm called on shareholders in a letter on Monday to vote in favor of CEO Elon Musk's nearly $1 trillion compensation package ahead of the annual shareholders' meeting. "If we fail to create an environment that motivates Elon to achieve great things through a fair performance-based compensation plan, we risk him stepping down from his executive role. Tesla could lose his time, talent, and vision, all of which are crucial for delivering outstanding shareholder returns," Denholm stated. As Tesla is striving to go beyond being "just a car company" and is focusing on full self-driving and the humanoid robot Optimus, Musk is vital to the company's future. Tesla's annual shareholders' meeting is scheduled for November 6 Eastern Time, with shareholder voting ending at 11:59 PM on November 5.

- 12:46BitMine increased its holdings by 77,000 ETH last week, bringing its total holdings to 3.31 million ETH.According to Jinse Finance, as of 7:00 PM Eastern Time on October 26, BitMine's cryptocurrency holdings include: 3,313,069 ETH (an increase of 77,055 ETH compared to last week), accounting for 2.8% of the ETH supply, 192 BTC, $88 million in Eightco Holdings shares, and $305 million in unrestricted cash.

- 12:46Chijet Motor completes $300 million cryptocurrency private placementJinse Finance reported that Nasdaq-listed company Chijet Motor Company, Inc. (stock code: CJET) announced today that it has successfully completed a private placement, raising the equivalent of $300 million in cryptocurrency funds. This issuance was targeted at non-U.S. institutional investors, with each unit consisting of one ordinary share (priced at the equivalent of $0.10) and three warrants (exercise price equivalent to $0.12).