News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Pyth Pro aims to provide institutions with a transparent and comprehensive data perspective, covering all asset classes and geographic regions in global markets, eliminating inefficiencies, blind spots, and rising costs in the traditional market data supply chain.

How to build an all-weather cryptocurrency investment portfolio in both bull and bear markets?

Crypto is never about belief; it's merely a footnote to the cycle.

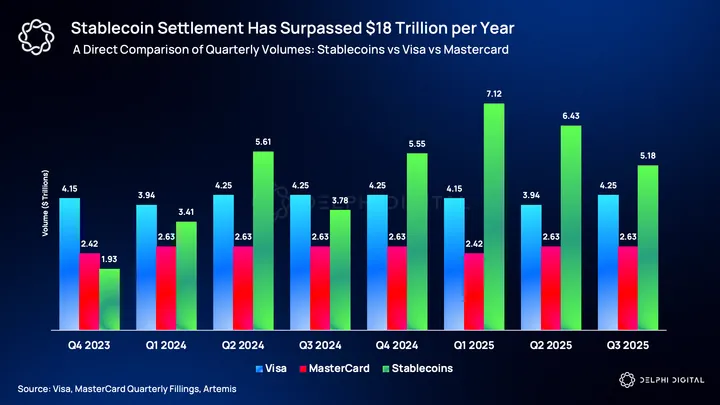

A zero-fee stablecoin public chain targets the trillion-dollar settlement market.

The coming months may present a good opportunity for wallet projects to launch their tokens.

$MASK could potentially reach a 12 billion USD FDV and bring about the largest airdrop in history.

Tether is building a crypto empire.

L2 "publicization" is already imminent.

Tether has launched a compliant stablecoin, USAT, which meets the requirements of the U.S. GENIUS Act while maintaining the original USDT's global market strategy, forming a dual-track operational model. Summary generated by Mars AI. The content generated by the Mars AI model is still in the iterative update stage in terms of accuracy and completeness.

- 00:16The European Commission proposes expanding the powers of the European Securities and Markets Authority (ESMA), raising licensing concerns.Jinse Finance reported that on Thursday, the European Commission released a package of proposals suggesting "direct supervision" of key market infrastructures, including Crypto Asset Service Providers (CASP), trading venues, and the European Securities and Markets Authority (ESMA) central counterparties. If the proposal is approved, the role of ESMA in supervising EU capital markets will become closer to the centralized framework of the U.S. Securities and Exchange Commission, a concept initially proposed by European Central Bank (ECB) President Christine Lagarde in 2023.

- 2025/12/06 22:41Pump.fun has cumulatively bought back over $200 million worth of PUMP tokens.According to Jinse Finance, data from fees.pump.fun shows that on December 5, Pump.fun spent 9,633.99 SOL (approximately $1.3391 million) to buy back 439.8 million PUMP tokens. Since the buyback began on July 15, a total of approximately $200 million worth of PUMP tokens have been repurchased, reducing the total circulating supply by 13.353%.

- 2025/12/06 22:04Ethereum treasury companies' total holdings surpass 6 million ETH, while Ethereum ETF total holdings exceed 6.3 million ETH.According to Jinse Finance, data from strategicethreserve shows that the total holdings of Ethereum treasury strategy companies have reached 6.47 million, accounting for 5.35% of the supply; the total holdings of Ethereum ETF have reached 6.31 million, accounting for 5.22% of the supply.