News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.24)|Bitmine Buys Over $200M Worth of ETH Again; U.S. Q3 Real GDP (Annualized) at 4.3%; $200M in Long Liquidations Across the Crypto Market2Bitget US Stock Daily Report | S&P Hits Closing Record High; Gold Breaks $4500 for the First Time; US Q3 GDP Grows 4.3% (December 24, 2025)3Solana: Short-term pain, long-term hope? SOL faces liquidation test

XRP Price Bounces off From Crucial Support, Analyst Predicts Upside to $5.85

Coinspeaker·2025/12/16 14:54

Bitcoin Price Prediction December 2025: Stablecoins Dominate in Venezuela While DeepSnitch AI Presale Climbs Past $800K

BlockchainReporter·2025/12/16 14:51

Morning Minute: Decrypt Names Trump as Crypto Person of the Year

Decrypt·2025/12/16 14:47

Maji Big Brother's Leverage Game: Where Does the "Never-ending" Money Come From?

TechFlow深潮·2025/12/16 14:41

2025, Trump's Year of Money-Making

TechFlow深潮·2025/12/16 14:40

Analyst Warns XRP Investors: We May See a Drop to $1.56. Here’s why

·2025/12/16 14:33

Cloud Mining Industry Outlook 2026: Market Trends, Platforms, and Participation Models

CryptoNinjas·2025/12/16 14:33

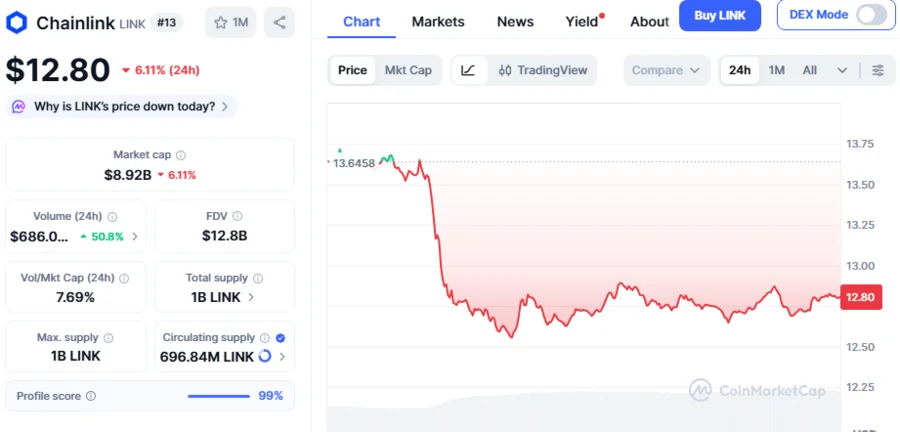

Chainlink Whales Accumulate 20.46M Tokens as LINK Consolidates at $12.69, Is Market Rally Coming?

BlockchainReporter·2025/12/16 14:31

Flash

11:32

Data: DeFi leverage cools down, Aave lending volume has dropped by about 70% since AugustForesight News reported, citing CryptoQuant data, that DeFi leverage is fading, with Aave's lending volume dropping by about 70% since August due to reduced risk appetite as prices decline.

11:32

UK FCA approves Sling Money to provide crypto payment services, stablecoin cross-border transfers gain regulatory recognitionAccording to TechFlow, on December 24, CoinDesk reported that the UK Financial Conduct Authority (FCA) has approved Avian Labs' crypto payment app Sling Money to provide crypto services in the UK, making it one of the crypto payment companies to receive regulatory support in major jurisdictions. The app is currently in closed testing in the UK and has previously obtained regulatory approval in the Netherlands and the United States.

11:31

Jurrien Timmer, Research Director at Fidelity: Bitcoin may enter a "consolidation year" in 2026, with support at $65,000. although Bitcoin reached a historic high of over $126,000 on October 6, it subsequently experienced a $19 billion liquidation event, and the current trading price is about $87,000. The market is divided on future trends; 50T Funds founder Dan Tapiero believes the bull market is still in the "mid-term phase," while Fidelity's research director predicts that 2026 may be a "consolidation year" for Bitcoin, with support levels between $65,000 and $75,000.Analysts point out that Bitcoin's four-year cycle is gradually evolving into a broader long-term trend driven by fundamental factors such as global liquidity and sovereign adoption. Currently, tracking data shows that most top traders hold a short-term bearish stance on mainstream cryptocurrencies.

News