News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | US-Japan-EU-Mexico Collaborate on Key Minerals Development; Nasdaq Introduces Fast Inclusion Rules; Software Stocks Continue Under Pressure (February 5, 2026)2Hyperliquid treasury seeks revenue boost using HYPE holdings as options collateral3Bitcoin drops following Treasury Secretary Bessent's statement that the US government cannot require banks to rescue crypto

AgentLISA tops the x402scan hot list, AI-driven smart contract security enters a period of rapid growth

AgentLISA's mission is to address this long-standing pain point in a real-time, scalable, and automated manner.

ForesightNews·2025/12/01 15:23

Bitcoin price slides to $85K: How low can BTC go in December?

Cointelegraph·2025/12/01 15:19

‘Inevitable’ $50K BTC price crash: 5 things to know in Bitcoin this week

Cointelegraph·2025/12/01 15:18

How Cardano plans to use $30M to bring real liquidity to the network

CryptoSlate·2025/12/01 15:00

Japan Ends Zero Interest Rate Policy: Risk Assets Face Their Worst Fear, the "Liquidity Turning Point"

From stocks and gold to Bitcoin, no asset can stand alone.

BlockBeats·2025/12/01 13:25

Prediction markets are coming to your brokerage

CryptoSlate·2025/12/01 12:00

After the Tide Recedes: Which Web3 Projects Are Still Making Money?

Most of them revolve around two things: trading and attention.

深潮·2025/12/01 11:46

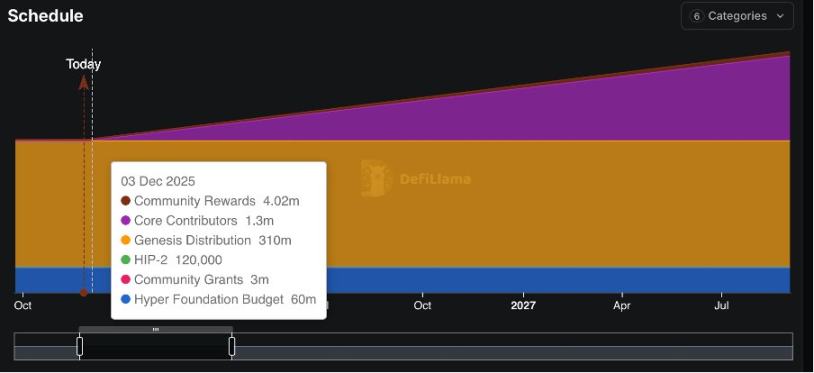

Why is HYPE not a good investment target right now?

Buybacks have always been a key mechanism supporting the price of HYPE; however, future token unlocks should not be overlooked.

深潮·2025/12/01 11:46

Looking at crypto Twitter, there is no longer a profit-making effect.

Looking at Crypto Twitter, there is no longer a profitable effect.

深潮·2025/12/01 11:46

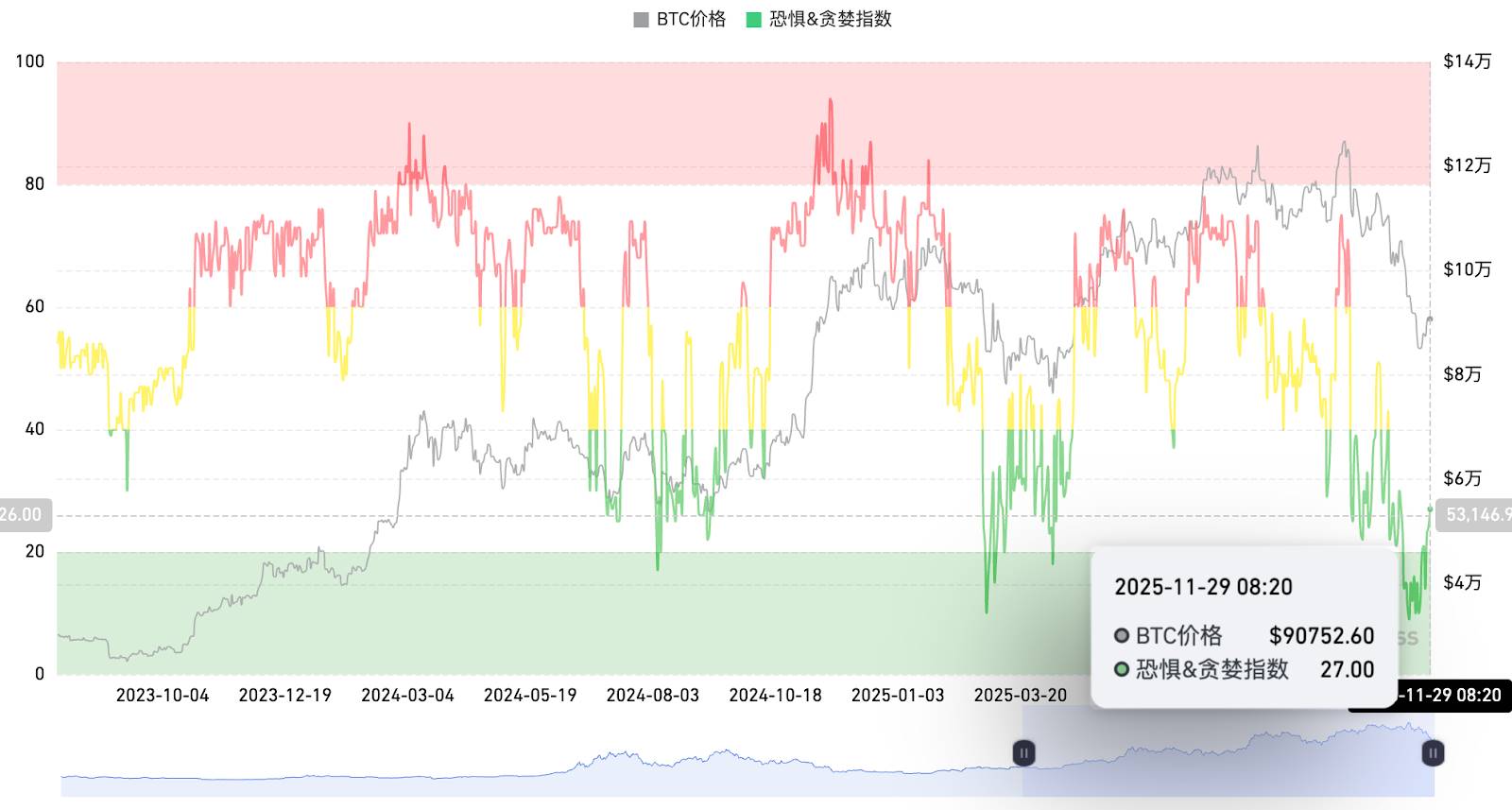

When the market falls into extreme fear, who is buying the dip against the trend?

For active traders: In the current volatile market, consider taking small long positions near support levels and reducing positions or considering short positions near resistance levels. Always set stop-loss orders for all trades.

深潮·2025/12/01 11:45

Flash

22:24

Due to unrealized losses of $8 billion in Ethereum holdings, BitMine's stock price plummeted.According to CoinWorld, as the price of Ethereum fell to around $1,932, BitMine Immersion Technologies (BMNR) saw its unrealized losses expand to approximately $8 billion, with its share price dropping 11% to about $18.05, hitting a seven-month low. Chairman Tom Lee defended the company's strategy, stating that such losses are inherent to the company's Ethereum-tracking strategy and are not a flaw, while reiterating his confidence in Ethereum's future. The company holds more than 3.5% of Ethereum's circulating supply and recently increased its holdings by 41,788 Ethereum.

22:15

BNB is currently priced at $613.9, with a 24-hour drop of 6.8%.CoinWorld News: According to CoinWorld, ME News reported that on February 6 (UTC+8), CoinMarketCap market data shows that BNB is currently priced at $613.9, with a 24-hour decline of 6.8%.

22:11

All three major U.S. stock indexes closed lower, with popular tech stocks falling across the board.Glonghui, February 6th|All three major U.S. stock indexes closed lower, with the Dow Jones down 1.2%, the Nasdaq down 1.59%, and the S&P 500 down 1.23%. Popular tech stocks fell across the board: Super Micro Computer and Qualcomm dropped more than 8%, Microsoft fell nearly 5%, Amazon dropped more than 4%, AMD fell more than 3%, Tesla dropped more than 2%, and Nvidia fell more than 1%. In terms of sectors, semiconductor equipment and materials, as well as healthcare stocks, rose, with Conte Technology up more than 6% and Applied Materials up more than 2%. Precious metals, cryptocurrency concepts, and weight-loss drug concepts led the declines. A certain exchange fell more than 13%, Robinhood dropped more than 9%, Pan American Silver, Novo Nordisk, and Circle fell more than 8%, and Newmont Corporation and Eli Lilly dropped more than 7%.

News