News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | US-Japan-EU-Mexico Collaborate on Key Minerals Development; Nasdaq Introduces Fast Inclusion Rules; Software Stocks Continue Under Pressure (February 5, 2026)2Hyperliquid treasury seeks revenue boost using HYPE holdings as options collateral3Bitcoin drops following Treasury Secretary Bessent's statement that the US government cannot require banks to rescue crypto

Bitcoin Down: Why This Week Is Crucial to Close 2025

Cointribune·2025/12/02 03:33

Wallets, Warnings, and Weak Links

The most important thing is to maintain basic security habits.

Block unicorn·2025/12/02 02:48

Strategy new ‘last resort’ to sell Bitcoin could trigger on 15% dip – sets $1.4B cash reserve contingency

CryptoSlate·2025/12/02 02:19

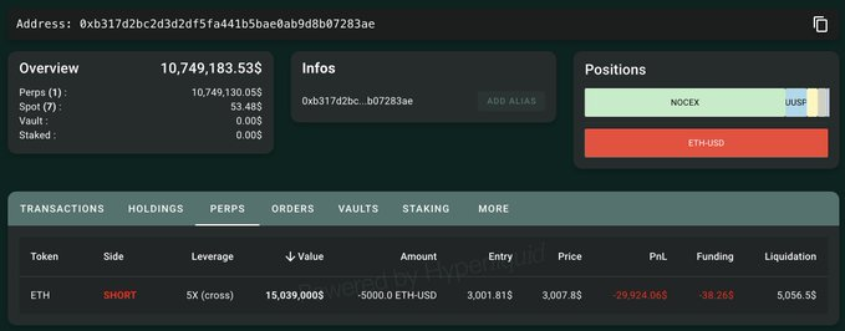

OG whale dumps ETH, is Bitmine insolvent?

AICoin·2025/12/02 01:52

AiCoin Daily Report (December 2)

AICoin·2025/12/02 01:51

Has the "major correction" just begun?

Bitpush·2025/12/02 01:51

Fed vs BOJ: December Global Market 'Scripted Drama', Will Bitcoin Crash First?

In November, the US Dollar Index fluctuated due to expectations surrounding Federal Reserve policies and the fundamentals of non-US currencies; in December, attention should be paid to the impact of the Federal Reserve's leadership transition, the Bank of Japan's interest rate hike, and seasonal factors on bitcoin and the US dollar. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved.

MarsBit·2025/12/02 01:51

BTC price analysis: Bitcoin could crash another 50%

Cointelegraph·2025/12/02 00:00

BTC price dips under $84K as Bitcoin faces ‘pivotal’ week for 2025 candle

Cointelegraph·2025/12/02 00:00

Flash

18:10

BNB breaks below the trendline maintained since 2023—can bulls hold the $675 level?BNB has broken below a key ascending trendline support, dropping 10% to $697, with trading volume surging 40% to $3.75 billion. Analysts warn that if the closing price falls below $675, it could trigger a further 10% decline, with a target price of $610. On-chain data shows that major holders have not increased their positions, while derivatives traders are holding $21.21 million in leveraged short positions, indicating strong bearish sentiment in the market.

17:44

US Treasury Secretary criticizes crypto advocates opposing the market structure billU.S. Treasury Secretary Scott Besant criticized some members of the cryptocurrency industry for obstructing the legislative process of the Digital Asset Market Clarity Act while testifying before the Senate Banking Committee. He stated that these market participants seem to have no desire for any regulation at all. He also suggested that those who do not support strong regulation could choose to move to El Salvador.

17:44

Michael Lewis and Tom Lee comment on the trillion-dollar software stock plunge: "I don't think it's a bad idea to go long on fear stocks right now."According to a report by Bijie Network: In a recent speech, Michael Lewis and Tom Lee from Fundstrat highlighted how extreme market volatility and AI-driven industry transformation are reshaping the investment landscape. Lewis cited a Fidelity study indicating that the best-performing retail accounts belonged to deceased clients, emphasizing that "inactivity" often outperforms "overtrading." Lee pointed out that hedge funds typically hold stocks for only a few seconds, while retail investors with "permanent capital" perform better. He noted that AI has led to a significant shrinkage in software stocks, with a related ETF recently losing about 100 billions USD. Lewis warned against conflating the potential of AI with guaranteed profitability, noting that AI could reduce corporate earnings. The two also discussed the existential risks faced by assets such as bitcoin and gold. Lewis revealed that he holds a "doomsday trade" defensive position in gold, reflecting his cautious investment approach.

News