News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Bitcoin's price fell below $112,000 support, confirming bear flag breakdown and strengthening bearish momentum on four-hour charts. - Technical indicators show RSI below midline and $114,000 as critical resistance, with failure to hold risking deeper correction toward $100,000. - On-chain data reveals negative 30-day exchange netflow, indicating long-term holders accumulate Bitcoin while sellers dominate short-term trading. - Liquidation clusters below $104,000 suggest potential price absorption, but wee

- Chainlink (LINK) fell below $25 in August 2025 despite Bitwise's ETF filing, defying institutional adoption expectations. - Analysts cite market volatility and bearish indicators as key drivers, with price forecasts ranging from $15.37 to $28.11 by 2026. - Emerging rivals like Layer Brett ($LBRETT) challenge Chainlink's dominance, offering scalable solutions and staking incentives. - Chainlink maintains relevance through 50+ blockchain integrations but faces regulatory risks and competition in the evolvi

- Quantum computing threatens Bitcoin's ECDSA/SHA-256 security via Shor's/Grover's algorithms, risking private key exposure for sovereign reserves. - El Salvador mitigates this by distributing $678M BTC across 14 wallets with <500 BTC each, reducing quantum attack surfaces while maintaining transparency. - NIST's post-quantum standards (CRYSTALS-Kyber, SPHINCS+) and institutional custody solutions now integrate quantum-resistant cryptography ahead of 2035 transition deadlines. - Sovereign crypto-agility st

Bitcoin price is holding above critical support as SOPR and URPD metrics flash potential market bottom signs. A test of $113,500 resistance now looks pivotal.

- Bonk (BONK) trades near $0.00002212, testing a critical "golden pocket" reversal zone supported by Fibonacci levels and volume profile. - Technical indicators show mixed signals: price below key moving averages but RSI stabilizing and 20-day EMA curving upward. - Institutional activity splits outcomes: Safety Shot's $25M investment boosts liquidity, while declining open interest ($73M→$29M) signals bearish conviction. - A $0.000022 breakout could trigger a 65% rally to $0.000037, but breakdown below $0.0

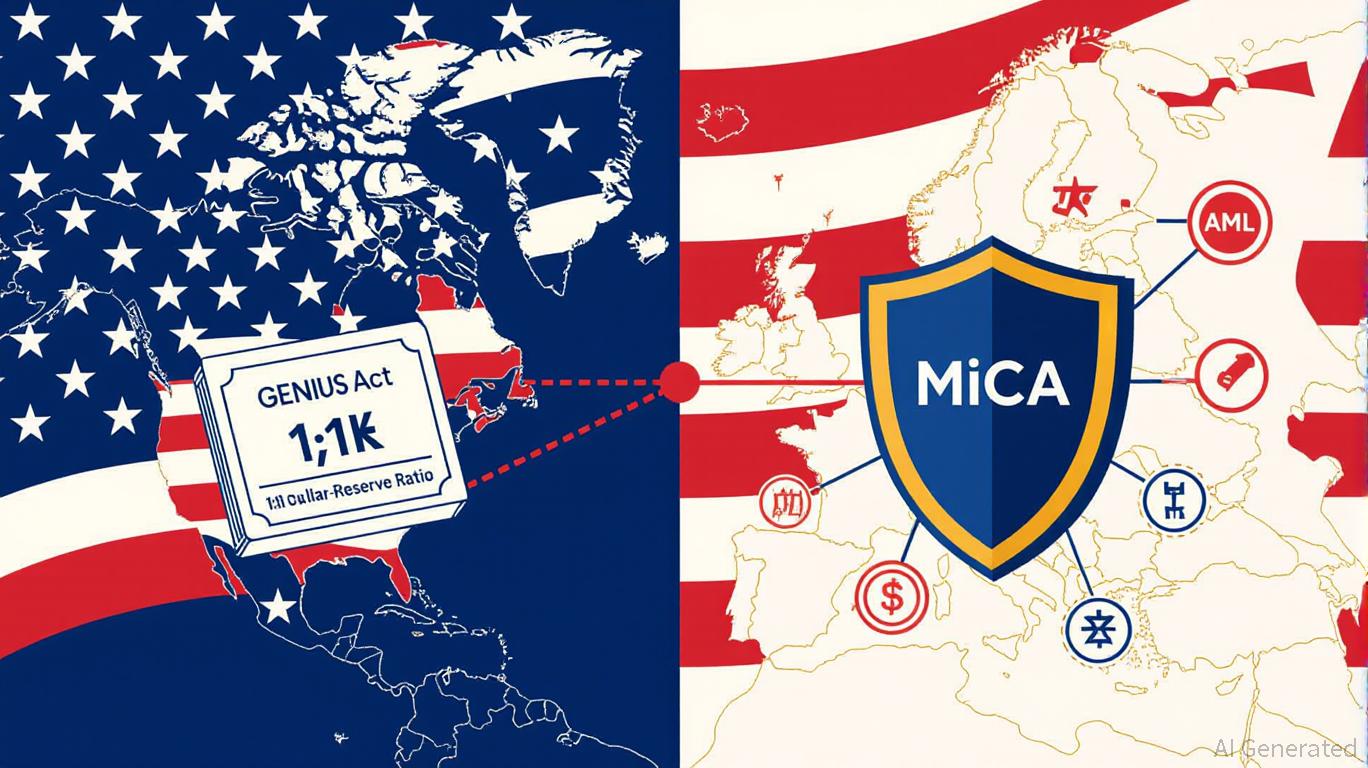

- The 2025 transatlantic crypto divide sees the U.S. and EU adopting contrasting regulatory frameworks, creating compliance challenges and market opportunities for global firms. - The U.S. GENIUS Act and CLARITY Act establish a dual federal-state model for stablecoins and commodity-classified tokens, while the EU enforces MiCA's harmonized licensing and AML requirements. - U.S. enforcement actions against crypto crimes and EU operational resilience mandates under DORA highlight divergent risk management pr

- Solana (SOL) surged 25.65% in 24 hours, driven by 100M+ daily transactions and 40% weekly growth in DeFi/NFT usage. - Ecosystem expansion includes new Solana Foundation open-source funding, rising validator count, and reduced transaction latency. - On-chain metrics show bullish momentum: $180+ price consolidation, tighter MVRV ratio, and 30% decline in short-term selling. - Analysts highlight Solana's scalability advantages and lack of bearish divergences as factors supporting continued price strength.

- PetroChina's 2025 H1 net profit fell 5.4% due to 14.5% lower crude prices and 12.8% refining revenue decline amid shifting energy demand. - The company counters challenges through 30 GW renewable expansion, hydrogen infrastructure, and partnerships with IBM/Huawei for AI-driven sustainability. - Maintaining 52.2% dividend payout ratio contrasts with peers like Sinopec, prioritizing operational flexibility over aggressive shareholder returns. - Strategic bets include ¥3B fusion tech investment and 50% ren

- Luxury brand Gucci launches crypto payments (BTC/ETH) in select markets, aligning with its digital transformation strategy to attract tech-savvy younger consumers. - The pilot partners with fintech firms to convert digital assets to fiat currency, ensuring secure transactions while maintaining traditional payment options. - Analysts view this as a potential industry precedent, though challenges like crypto volatility and regulatory uncertainty remain significant concerns for adoption. - Gucci will evalua

- PetroChina adopts stablecoins for cross-border energy trade via Hong Kong's 100% reserve-backed framework, aiming to cut USD reliance and reduce transaction costs by 40%. - Ripple's RLUSD, compliant with NYDFS/FSA, enables real-time $0.0002 transactions, slashing settlement times and costs for institutions like SBI and Standard Chartered. - Hong Kong's $25M capital requirement and China's yuan internationalization strategy drive stablecoin adoption, with RLUSD processing $10B+ volume since 2024. - Regula

- 19:17Federal Reserve Governor Cook: A rate cut in December is possible, depending on subsequent informationChainCatcher news, according to Golden Ten Data, Federal Reserve Governor Cook stated that a rate cut is possible in December, but it will depend on subsequent new information.

- 19:15AI agent browser Donut Labs completes $15 million seed round financing, with participation from Hack VC and othersBlockBeats News, November 3, Donut Labs has completed a $15 million seed round of financing, with investors including BITKRAFT, Makers Fund, Sky9 Capital, Altos Ventures, Hack VC, as well as some contributors from the Solana, Sui, and Monad ecosystems. Over the past six months, Donut Labs has raised a total of $22 million through pre-seed and seed rounds. Donut Labs is developing Donut Browser, an AI-powered "autonomous agent" browser capable of automatically executing crypto transactions, risk analysis, and on-chain strategies. These agents can analyze markets, calculate risks, and execute on-chain transactions, even when users are offline. Currently, the product has attracted more than 160,000 users on the waiting list, demonstrating strong market demand for AI-native trading tools amid rising DeFi trading volumes.

- 19:14Aster has now launched the JELLYJELLY contract, and some tokens have opened 200x leverage trading.BlockBeats News, November 3, according to official sources, Aster has now launched the JELLYJELLY contract, with a maximum leverage of up to 5x. In addition, 200x leverage trading is now available on the Aster platform, applicable to ASTER, BTC, ETH, and BNB. On the Hyperliquid platform, the maximum leverage available for BTC is 40x, for ETH is 25x, for SOL is 20x, and for BNB is 10x.