News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 10)|13.8 billion LINEA tokens unlock today; Trump will begin the final round of interviews for the next Federal Reserve Chair this week2Bitcoin’s back above $94K: Is the BTC bull run back on?3BlackRock Enters Ethereum Staking With a First-of-Its-Kind ETF

US Market Liquidity Rebounds, Paving Way for Potential Year-End Crypto Rally

DeFi Planet·2025/11/27 16:09

Bedrock Elevates Bitcoin DeFi Security with Chainlink Integration

DeFi Planet·2025/11/27 16:09

Ripple’s USD Stablecoin RLUSD Gains Regulatory Approval for Use Inside Abu Dhabi’s ADGM

DeFi Planet·2025/11/27 16:09

Nasdaq Expands IBIT Bitcoin ETF Options Limits, Boosting Market Liquidity and Institutional Access

DeFi Planet·2025/11/27 16:09

SpaceX Transfers 1,163 BTC Signals Custody Upgrade

DeFi Planet·2025/11/27 16:09

Do Kwon Urges US Court to Limit Prison Sentence to Five Years Over Terra Collapse

DeFi Planet·2025/11/27 16:09

Solana Price Faces Pressure After $36M Upbit Exploit—Can Bulls Clear the $150 Resistance?

Coinpedia·2025/11/27 16:03

FC Barcelona Distances Itself From Crypto Sponsor Amid Backlash

Barcelona sparked controversy by partnering with Zero-Knowledge Proof, a Samoa-registered blockchain startup that launched its own cryptocurrency days after the deal.

Coinspeaker·2025/11/27 16:00

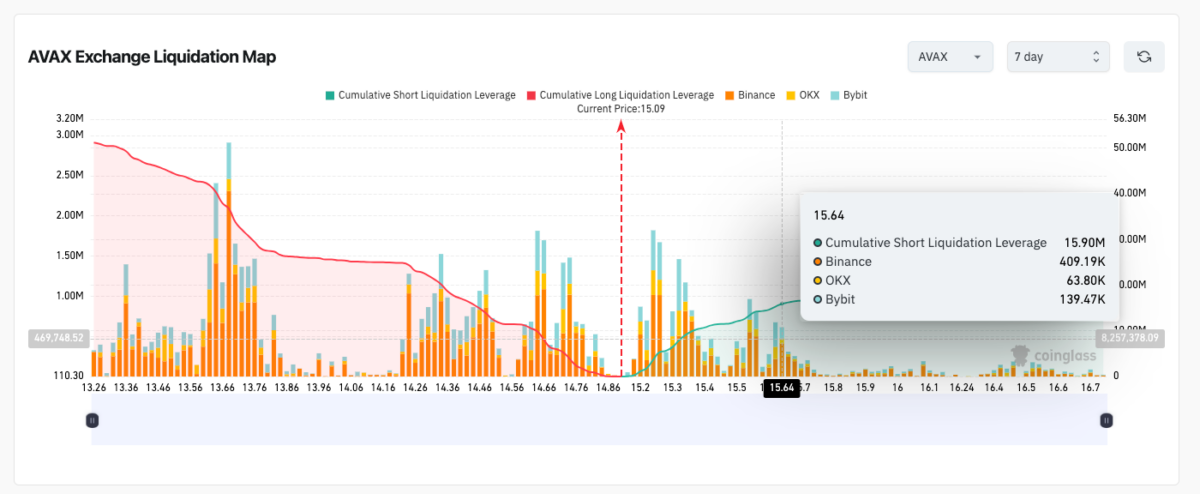

Avalanche (AVAX) Surges Past $15 as Securitize Launches EU-Regulated Trading Platform

Avalanche surges above $15 following Securitize’s announcement of a pan-European trading platform powered by AVAX, approved under EU’s DLT Pilot Regime for 2026 launch.

Coinspeaker·2025/11/27 16:00

Ethereum Price Surges 17% as ETF Inflows Hit $291M in Four Days

Ethereum price rebounds 17% from $2,620 to break above $3,000, fueled by $291 million in US ETF inflows and renewed institutional accumulation.

Coinspeaker·2025/11/27 16:00

Flash

- 21:31The Federal Reserve reminds the market not to take interest rate cuts for granted.According to ChainCatcher, citing Jinse Finance, Chris Grisanti, Chief Market Strategist at New York's MAI Capital Management, stated that although the Federal Reserve's interest rate cut was as expected, there is uncertainty regarding the extent and timing of future rate cuts. He emphasized that the market should not take rate cuts for granted, and that further cuts are only likely if the economy slows down significantly. Grisanti hopes that there will be no rate cuts in 2026, as this would indicate a weakening economy.

- 21:26All three major U.S. stock indexes closed higher.Jinse Finance reported that all three major U.S. stock indexes closed higher, with the Dow Jones up 1.05%, the Nasdaq up 0.33%, and the S&P 500 up 0.68%. Most large technology stocks rose, with Tesla, Amazon, Broadcom, and Google all gaining over 1%, while Meta fell more than 1% and Microsoft dropped more than 2%. The cryptocurrency sector led the declines, with GameStop down more than 4% and Strategy down more than 2%.

- 21:08All three major U.S. stock indexes closed higher, with bank stocks performing strongly.ChainCatcher news, according to Golden Ten Data, U.S. stocks closed higher on Wednesday, with the Dow Jones Industrial Average preliminarily up 1.05%, the S&P 500 up 0.68%, and the Nasdaq up 0.3%. Bank stocks strengthened, with Goldman Sachs up 1.4%, JPMorgan up 3%, and Citigroup up 1.5%. The Nasdaq Golden Dragon China Index rose 0.65%, Alibaba gained nearly 2%, and Huya rose nearly 7%.

News