News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

US to reinsure maritime losses in Gulf up to about $20 billion, agency says

101 finance·2026/03/06 19:42

Elon Musk Has One Word As Saudi Arabia Eyes Turning $500B Sci-Fi City Into AI Hub

Finviz·2026/03/06 19:39

LKQ Has Outperform Rating on LKQ Corporation (LKQ)

Finviz·2026/03/06 19:39

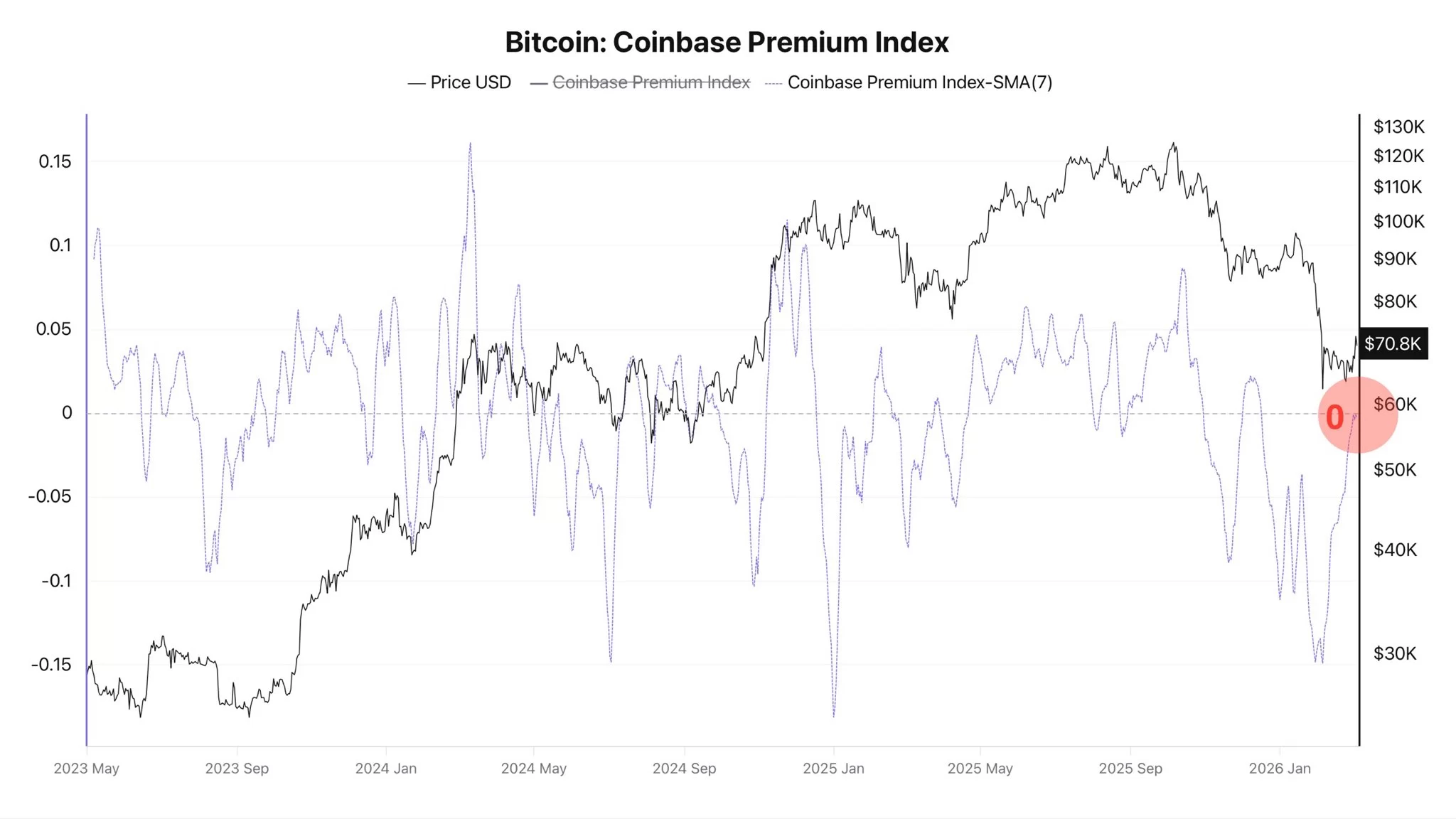

Bitcoin slips below $70K as US jobs shock reignites Fed Cut bets

Crypto.News·2026/03/06 19:36

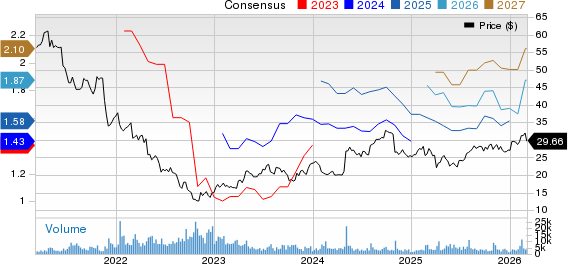

Here’s the Reason Investors Are Turning to Ensign Group Shares Right Now

101 finance·2026/03/06 19:33

Institutional Sellers Step Back as Bitcoin Faces Renewed Volatility

Cointurk·2026/03/06 19:33

UVIX Jumps 13% As VIX Nears 'Fear Zone' Of 30, Volatility ETFs Surge

Finviz·2026/03/06 19:27

Philips Unveils Rembra CT Scanner to Speed Up Medical Imaging

Finviz·2026/03/06 19:27

Flash

09:12

Cerebras Systems hires Morgan Stanley to assist in restarting IPO plansAI chip manufacturer Cerebras Systems has selected Morgan Stanley as the lead underwriter for its initial public offering (IPO) and plans to make another attempt at going public. According to some sources familiar with the matter, the fundraising scale may be around $2 billion, with the earliest possible launch in April. Another source stated that Cerebras has resubmitted its IPO filing and plans to meet with analysts and potential investors this month. Discussions are still ongoing, and specific details of the IPO may change.

08:33

Iran announces the closure of the stock marketGelonghui March 7th|According to CCTV International News, Iran's Minister of Economy announced today that the Iranian stock market will be closed until further notice.

08:32

VCs warn that the AI boom is drawing funds away from cryptocurrency startupsAccording to Odaily, several venture capitalists have warned that the AI boom is diverting funds away from crypto startups. Charles Chong, Vice President of Strategy at BlockSpaceForce, stated that investors now have "real alternative options with faster revenue visibility," and that crypto teams need to work harder, with founders required to be more precise in areas such as defensiveness and profit models. DefiLlama data shows that crypto startups raised $128 million in the first week of March, with total funding in 2026 so far approaching $2.5 billions. This week's investors include Peter Thiel's Founders Fund, Ripple, Y Combinator, Wintermute, and Sequoia Capital, with investments mainly directed towards payments, trading, and DeFi infrastructure sectors. The top three funding events this week: Latin American fintech company ARQ completed a $70 million Series B round led by Sequoia Capital and Founders Fund. The company has an annualized trading volume of over $10 billions and about 2 million users; Crossover Markets completed a $31 million Series B round led by Tradeweb Markets, with Ripple and Wintermute participating, and a valuation of about $200 million. The company operates the institutional digital asset trading network CROSSx; Hybrid derivatives exchange QFEX completed a $9.5 million seed round led by Yuri Sagalov of General Catalyst, with participation from Y Combinator and Paul Graham.