News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

Experts Warn Bitcoin Faces Critical Quantum Computing Challenges

Cointurk·2025/12/23 06:12

Publicly hyping Ethereum while internal reports are bearish—can Tom Lee's team still be trusted?

BlockBeats·2025/12/23 06:07

Declining mining activity flashes 'bullish signal' for bitcoin price, VanEck says

The Block·2025/12/23 06:06

Crypto events this week Dec. 22–28: UNI burn vote, HYPE proposal, ASTER emissions

CryptoRo·2025/12/23 06:03

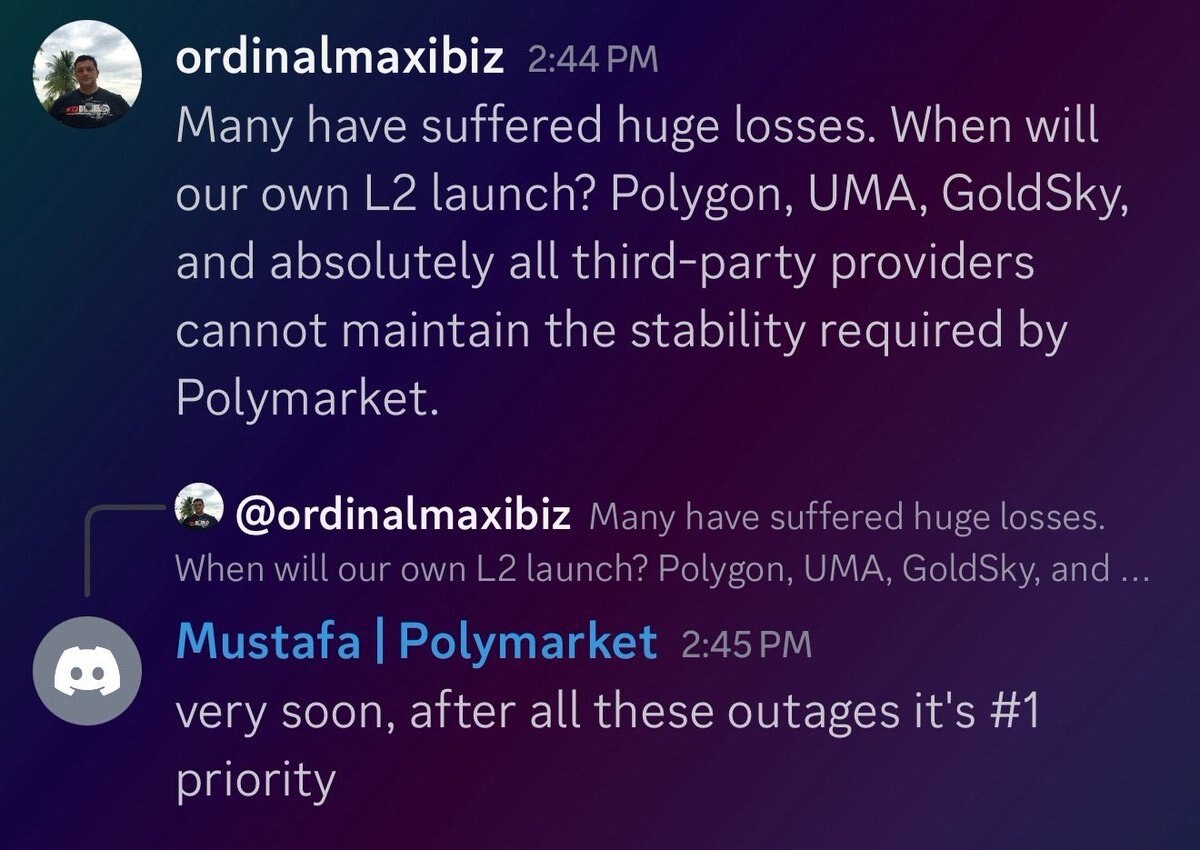

The Economic Calculation Behind Polymarket Leaving Polygon

Odaily星球日报·2025/12/23 06:02

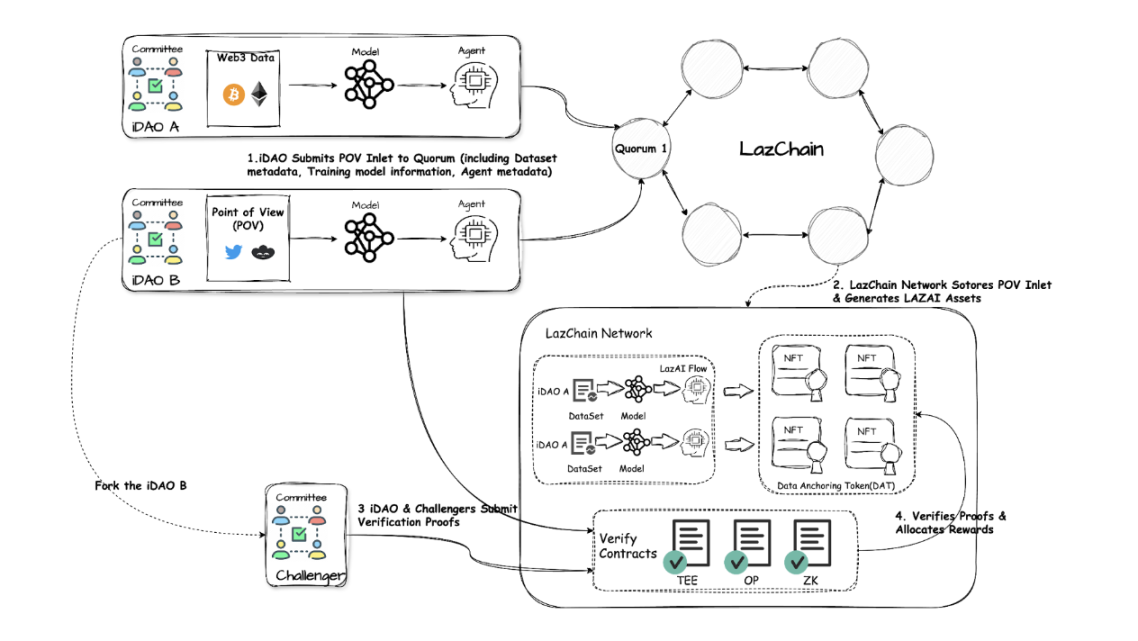

LazAI mainnet goes live, we talked with Metis about this move

ForesightNews·2025/12/23 06:00

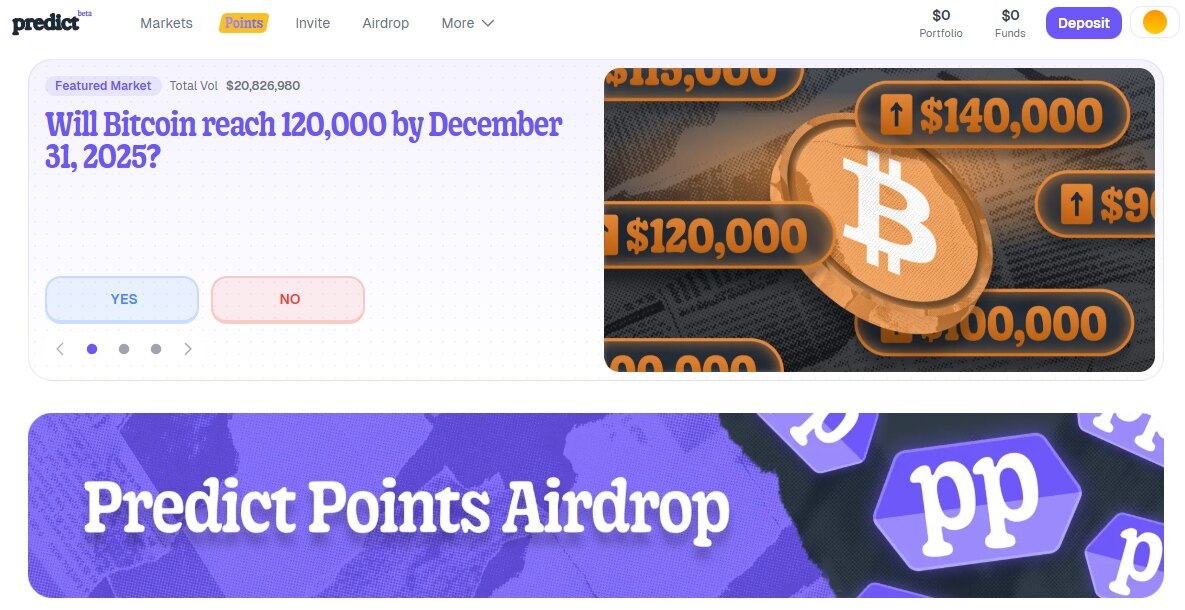

Hot Sectors and New Interaction Opportunities: Three Prediction Markets Favored by YZi Labs

Odaily星球日报·2025/12/23 05:43

Experienced Analyst Rejects Claim of “2026 is a Bear Market for Bitcoin,” Shares What He Expects

BitcoinSistemi·2025/12/23 05:27

Flash

06:21

Yesterday, US spot Bitcoin ETFs saw a net outflow of $142.2 million, marking the third consecutive day of net outflows.BlockBeats News, December 23, according to Farside monitoring, there was a net outflow of $142.2 million from US spot Bitcoin ETFs yesterday, marking the third consecutive day of net outflows. Details are as follows: BITB saw a net outflow of $35.5 million; HODL saw a net outflow of $33.6 million; GBTC saw a net outflow of $29 million; Grayscale BTC saw a net outflow of $25.4 million; ARKB saw a net outflow of $21.4 million; FBTC saw a net outflow of $3.8 million; BlackRock IBIT saw a net inflow of $6 million.

06:17

The US Department of Justice may become a defendant as the controversy surrounding the Epstein files escalates. according to CCTV News, on December 22 local time, U.S. Senate Minority Leader Schumer announced that after the Senate reconvenes in January, he will push for a resolution requiring the Senate to take legal action against the Department of Justice to force it to fully disclose all files related to Epstein and his associate Maxwell. Once the news broke, the focus quickly shifted from "whether to disclose" to "how to disclose." Recently, the Department of Justice's method of releasing the Epstein files has sparked a new round of controversy: the extent of document redactions, gaps in key materials, search experience, and whether the privacy of victims is adequately protected—all of these have turned this transparency promise into an institutional "trust test."

06:10

Banmuxia: Currently, bitcoin is no longer a very good long opportunity, and the market will undergo a complex consolidation.According to TechFlow, on December 23, trader Banmuxia posted on social media stating, "Bitcoin has reached a point where it's no longer a very good opportunity to go long. The medium-term liquidity logic has also been weakened by the recent continuous ETF sell-offs. This is not the best opportunity to go long, but that doesn't mean it won't rise later—it's just that the risk is increasing. During the adjustment phase, unless there is a very high probability opportunity, there is no need to participate. I will continue to observe the market's complex consolidation."

News