VanEck Analyst: After the approval of the spot Bitcoin ETF, there will be an inflow of 2.4 billion dollars in the short term

People generally believe that the application for a spot Bitcoin ETF is the main driving force for Bitcoin to return to levels above $40,000. The argument is simple: as institutional legitimacy increases, the capital pool flowing into Bitcoin will deepen. From hedge funds and Commodity Trading Advisors (CTA) to mutual funds and retirement funds, institutional investors can easily achieve portfolio diversification. They would do this because Bitcoin is an asset resistant to depreciation. It's not only against perpetually depreciating fiat currencies but also unrestricted gold. In contrast, Bitcoin is limited to 21 million and its digital nature is protected by the world's most powerful computing network. VanEck analysts estimate that after approval of a spot bitcoin ETF, there will be a short-term inflow of $2.4 billion in funds. VanEck expects the capital pool to increase by $40.4 billion within the first two years. Galaxy researcher Alex Thorn predicts that capital accumulation in the first year will exceed $14 billion, which could push BTC prices up to $47,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

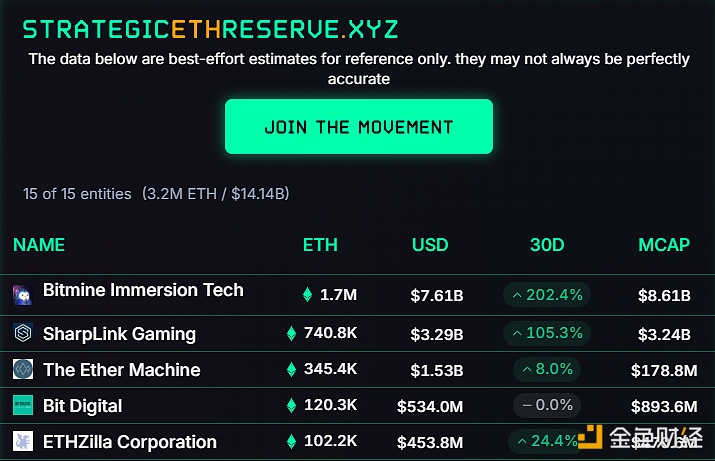

ETHZilla Hints at Further Accumulation of ETH to Surpass Certain Exchanges

The top five ETH asset management firms currently hold over 4 million ETH in total

LIBRA token participant Hayden Davis snipes YZY for a profit of $12 million

SUISEI peaked at $3.77 million in the early hours, now reported at $2.48 million