Rotation Back Into Ethereum Begins, Could ETH Hit $10,000 in 2024?

Ethereum took a beating over the past month or so as alternative layer-1 blockchains surged in activity and token prices, but it could be time for a rotation back into ETH.

Ethereum’s recent lackluster price movement had many calling it an ‘ETH death’ as rivals Solana and Avalanche skyrocketed.

However, the fourth quarter layer-1 rotation was similar to that in 2021, observed crypto analyst ‘Metaquant’ on Jan. 5.

Moreover, Solana and Avalanche are slowing down after weeks of upward price action, so where is the capital flowing next?

Ethereum Rotation Begins

The analyst noted that ETH is flowing out of centralized exchanges, and activity on the network is slowly increasing compared to the past weeks.

“The rotation from alt L1s to ETH has started – ETH on-chain season is heating up.”

Q4 saw an L1 rotation similar to 2021, but now it’s time for the king to play its hand. $SOL and $AVAX are now slowing down after weeks of up-only PA.

Here is a quick analysis of where the money is flowing next👇

— Metaquant (@QuantMeta) January 4, 2024

The analyst added that in the past ten days, AVAX and SOL have cooled down after their huge runs, while ETH went sideways without showing signs of weakness. “The next run will likely be on ETH and its ecosystem,” he said.

Additionally, the activity on Ethereum and layer-2 networks has been growing steadily for months. Total value locked across the L2 ecosystem hit an all-time high of $21 billion on Jan. 4, according to L2beat.

In addition to the TVL peak, daily active addresses, layer-2 fees, and layer-2 stablecoin market capitalization have also been steadily increasing.

Since ETH prices have been lagging as attention was elsewhere, “once price goes up, everyone will move again on ETH and L2s,” he said.

“Note how there is no bull run without an ETH on-chain season. So, it’s a matter of time before this starts to happen.”

Additionally, embattled crypto lender Celsius has just announced that it is unstaking ETH to return to creditors.

While this may cause some short-term volatility if they sell, it has been viewed as a positive for Ethereum markets without the vampirical cloud of Celsius and its huge ETH bags hanging over them.

ETH Price Outlook

ETH prices have remained flat on the day at $2,242 at the time of writing. However, the asset is down 8% from its weekly high of $2,434 on Dec. 2 as markets cool.

Zooming out, Ethereum has been consolidating at current levels for the past month.

Additionally, analysts have been mulling potential price peaks for ETH this year. Some see it hitting $10,000 quite easily. This is only double its all-time high in the last cycle, in which it made a $4,800 gain from trough to peak.

High end? 20k. Minimum? 10k. $ETH https://t.co/x6rqMzfypd

— CrediBULL Crypto (@CredibleCrypto) January 5, 2024

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

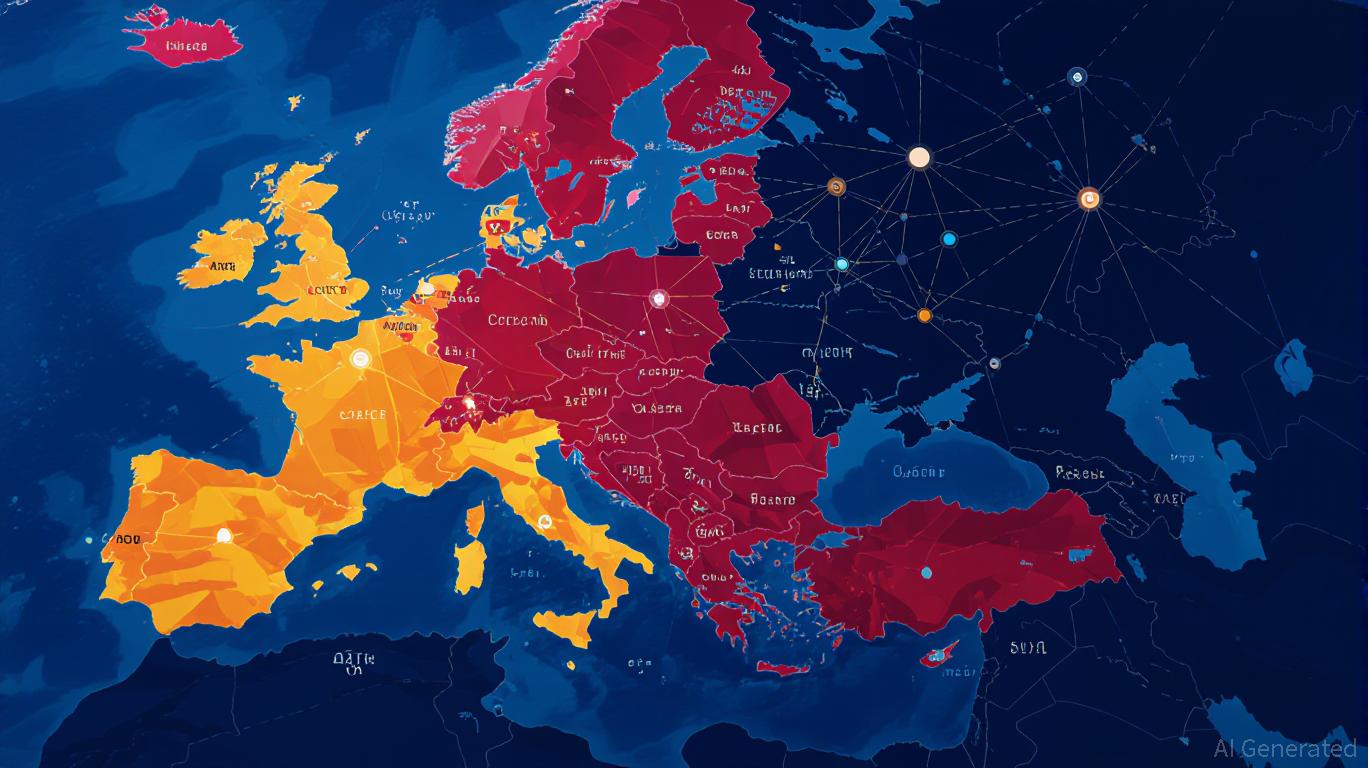

Navigating the Shifting Crypto Media Landscape in Eastern Europe: Strategic Opportunities Amid Traffic Declines

- Eastern European crypto media saw 18.3% Q2 2025 traffic decline, with 17 outlets capturing 80.71% of regional traffic amid regulatory and algorithmic shifts. - Tier-3 platforms (10,000–99,999 visits) retained 17.33% traffic through localized relevance and AI-optimized content in markets like Poland and Czech Republic. - AI-driven discovery tools and regional partnerships (e.g., Kriptoworld.hu) are reshaping distribution, with 20.6% of outlets reporting traffic from platforms like Perplexity. - Investors

Is This the Final Dip Before Altseason?

- Crypto market signals suggest altcoins may outperform Bitcoin amid waning dominance and bullish technical indicators. - Ethereum's 54% August surge and rising ETH/BTC ratio historically precede altcoin growth cycles. - Dovish Fed policy and $3B Ethereum ETF inflows create favorable conditions for altcoin capital rotation. - Institutional confidence in Bitcoin indirectly supports altcoin momentum through liquidity and risk-on appetite. - Strategic entry points for high-conviction investors include Ethereu

The EU's Ethereum-Based Digital Euro: A Strategic Catalyst for Blockchain Infrastructure and DeFi Growth

- EU selects Ethereum as foundational layer for digital euro, challenging U.S. stablecoin dominance and validating its scalability and compliance. - Ethereum's smart contracts, energy-efficient post-Merge model, and GDPR-aligned ZK-Rollups address scalability, privacy, and regulatory needs. - Infrastructure providers (Infura, zkSync) and DeFi platforms (Uniswap) stand to benefit from increased demand for CBDC operations and liquidity. - Geopolitical shift reduces reliance on U.S. payment systems, with Ethe

Metaplanet's $887M Bitcoin Play: A Catalyst for Institutional Adoption and Long-Term BTC Value

- Metaplanet allocated $887M of its ¥130.3B fundraising to Bitcoin in 2025, reflecting corporate treasury strategies shifting toward digital assets amid macroeconomic instability. - Japan's weak yen and 260% debt-to-GDP ratio drive institutional adoption of Bitcoin as a hedge against currency depreciation, with 948,904 BTC now held across public company treasuries. - Metaplanet's 1% Bitcoin supply target (210,000 BTC) and inclusion in global indices signal growing legitimacy, as regulatory reforms in Japan