Bitget Futures Market Updates-Spot Bitcoin ETFs In the US Hold Nearly 259,000 BTC Worth $13.48 Billion

Bitget2024/02/20 07:20

By:Bitget

In the past five weeks, spot

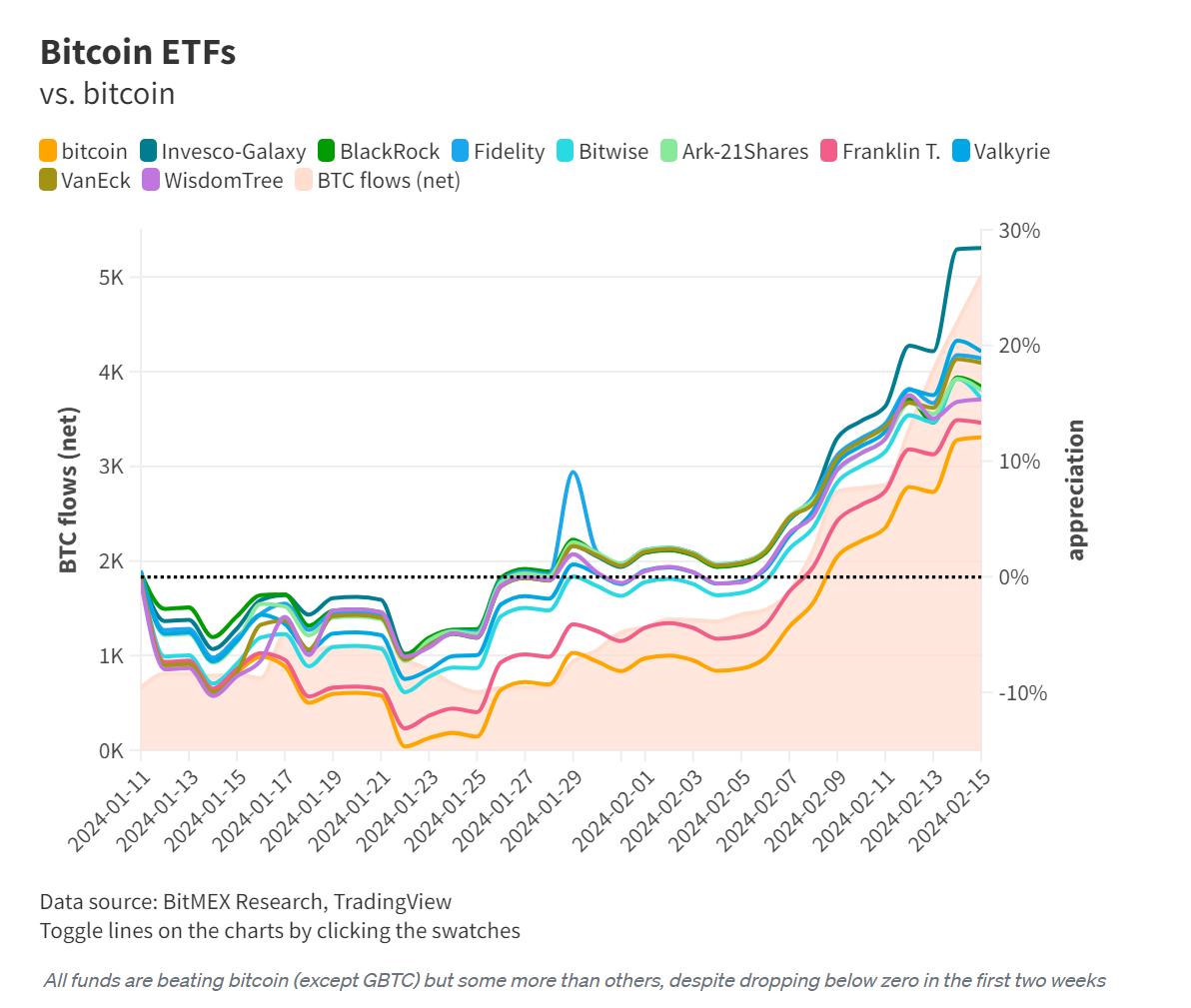

Bitcoin ETFs, excluding Grayscale Bitcoin Trust, attracted a whopping $11.4 billion in investments. These funds, managed by top names like BlackRock, Fidelity, and Ark, together, hold about 258,770 bitcoins, valued at $13.48 billion.

BlackRock's IBIT fund stands out with the most assets under management (AUM), owning 115,991 BTC worth $6.04 billion. Interestingly, some funds, like Invesco-Galaxy's BTCO, have significantly outperformed bitcoin itself, with gains of around 20%.

Overall, these funds have seen impressive returns, with investors up by more than 18% since their launch on January 11, surpassing Bitcoin's own growth of less than 12%. This data underscores the growing popularity of Bitcoin-related investment products and the confidence investors have in them, especially with the backing of established financial institutions like BlackRock and Fidelity.

Futures Market Updates

Bitcoin futures saw an increase in trading volume, which was a bounceback from yesterday's drop. Meanwhile, ETH

futures trading volume maintained its steady growth. ETH still surpassed BTC in both liquidation amounts and

funding rates. Both

markets maintained a balanced long/short ratio. Short liquidations more than doubled long liquidations for ETH, while BTC had a higher number for long liquidations compared to short liquidations.

Bitcoin Futures Updates

Total BTC Open Interest: $23.89B (+0.33%)

BTC Volume (24H): $38.20B (+14.78%)

BTC Liquidations (24H): $17.06M (Long)/$13.62M (Short)

Long/Short Ratio: 49.55%/50.45%

Funding Rate: 0.0079%

Ether Futures Updates

Total ETH Open Interest: $10.42B (+1.55%)

ETH Volume (24H): $27.70B (+39.21%)

ETH Liquidations (24H): $11.28M (Long)/$26.99M (Short)

Long/Short Ratio: 49.97%/50.03%

Funding Rate: 0.0174%

Top 3 OI Surges

PIXEL: $28.22M (+229,480.67%)

GLM: $3.51M (+286.98%)

JASMY: $21.78M (+120.80%)

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Ethereum Outshines Rival Amidst Remarkable Price Surge

Coinlive•2025/07/27 04:05

Joseph Chalom Joins SharpLink as Co-CEO Amid Ethereum Focus

Coinlineup•2025/07/27 04:00

Fed’s Key Decisions Awaited Amid Macro Super Week

Coinlineup•2025/07/27 04:00

Ethereum Sets Target at $4,800 After Holding $3,447 and $3,194 Zones

Cryptonewsland•2025/07/27 02:05

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$118,290.41

+0.64%

Ethereum

ETH

$3,778.91

+0.87%

XRP

XRP

$3.21

+2.01%

Tether USDt

USDT

$1

+0.00%

BNB

BNB

$795.19

+1.64%

Solana

SOL

$187.09

+0.47%

USDC

USDC

$0.9999

-0.00%

Dogecoin

DOGE

$0.2396

+0.96%

TRON

TRX

$0.3213

+1.17%

Cardano

ADA

$0.8298

+0.60%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now