Safe token trades at $2.8 billion FDV after becoming transferable

The governance token of Safe Protocol has now become transferable. The token currently has a fully diluted valuation of over $2.8 billion.

Since the unlock, the Safe token has decreased by over 19% and was changing hands for $2.8 at 6 a.m. ET. According to Coingecko data , the Safe token's market cap is valued at $1.45 billion — with a fully diluted valuation of over $2.8 billion. The token has a maximum supply of one billion, with a current circulating supply of 427 million.

Tokens had been locked for almost two years

The DAO’s tokens had been locked for almost two years since their launch via an airdrop in October 2022.

Speaking to The Block, a Safe spokesperson described the reasons for the governance token's lengthy frozen period before its unlocking. "The decision to make SAFE tokens transferable, along with the process of reaching this point, was guided by SafeDAO governance," the spokesperson said. "After the community decided against transferability at the end of 2022, SafeDAO aligned on five milestones to be passed to re-issue a vote on transferability."

These five milestones were described as being discussed in-depth over the last year until a DAO voting period ended on April 15, when over 99% of participants accepted the proposal to unpause the Safe token contract and enable transferability. "Token transferability is a significant event, and responsibilities should be with the DAO," the spokesperson added. "If and when there should be a token transferability it should be decided by the DAO itself, the token holder and delegates, and not by a small group of core contributors."

The spokesperson acknowledged that there had been an eagerness within sections of the community to make the Safe token transferable. "We're deeply committed to progressive decentralization, prioritizing secure infrastructure, fair governance frameworks, and transparent resource allocation," they added.

SafeDAO was previously known as Gnosis Safe, a custody solution offered by Gnosis DAO.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

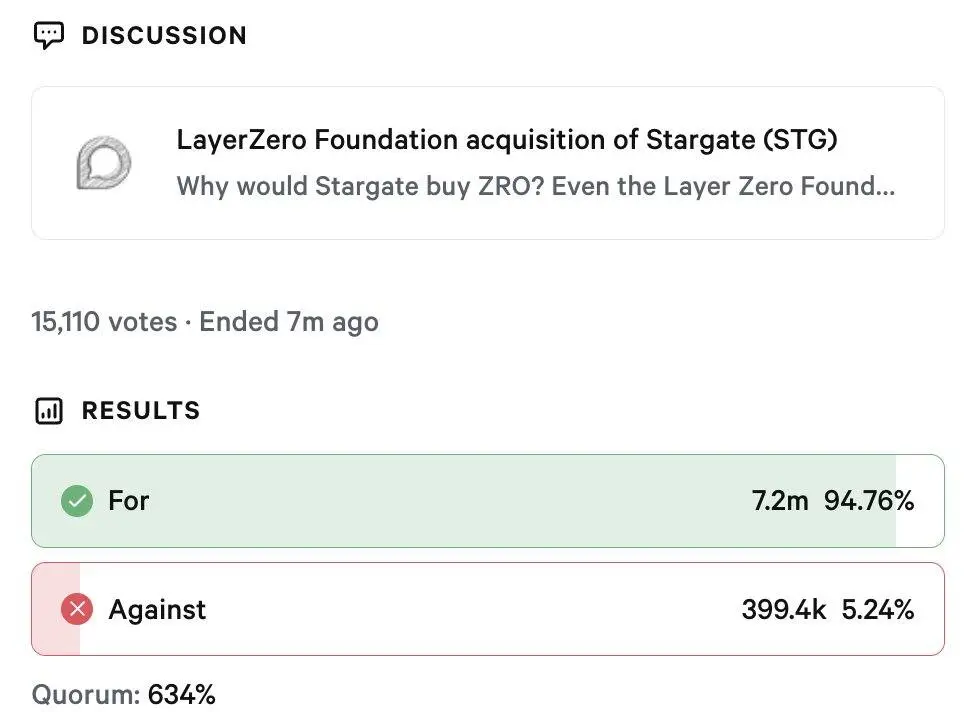

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated