The nine Bitcoin spot ETFs in the United States reduced their holdings by 866 Bitcoins yesterday, equivalent to approximately 54.85 million US dollars

PANews reported on May 14th that yesterday (May 13th), nine ETFs net sold off 866 Bitcoins, worth about $54.85 million. Among them, Grayscale sold off 706 Bitcoins, valued at approximately $44.74 million and currently holds 291,084 Bitcoins with an estimated value of around $18.45 billion. Meanwhile, Blackrock added 205 Bitcoins to its holdings, worth about $13 million and now holds a total of 274,755 Bitcoins with an estimated value of approximately $17.41 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Is Bitcoin Up Today?

Bitcoin surges past $90,000 amid Trump’s election victory and ETF inflows

Ether clocks ‘insane’ 20% candle post Pectra — a turning point?

Ether has surged following the Pectra hard fork, with analysts suggesting a growing number of long positions could signal a turnaround for the asset.

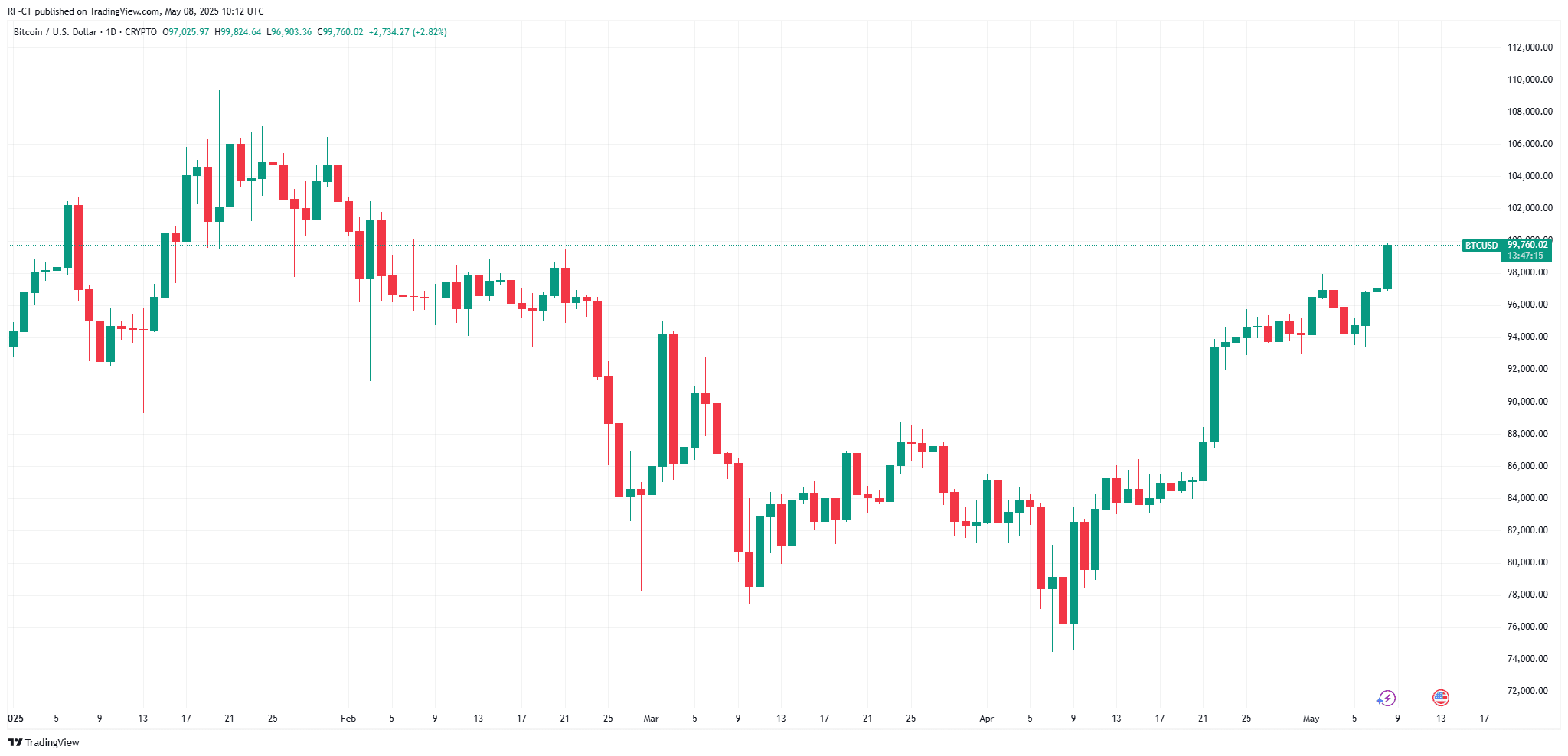

Bitcoin Breaks $100K as BTC Nears New ATH with Bulls Roar in May 2025