Spot bitcoin ETFs report $302 million inflows led by Fidelity’s FBTC

U.S. spot bitcoin exchange-traded funds recorded a total daily net inflow of $302.97 million.The largest daily inflow was seen from Fidelity’s FBTC, which drew in $131 million.

Fidelity’s FBTC led the inflows with $131 million worth of daily inflows, followed by Bitwise fund’s $86 million, according to SoSoValue data . Ark Invest and 21Shares’ ARKB drew in $39 million, while bitcoin ETFs managed by Valkyrie, VanEck, Franklin Templeton, WisdomTree, and both Invesco and Galaxy Digital reported single-digit net inflows.

Meanwhile, Grayscale’s GBTC, the largest spot bitcoin fund in terms of net asset value, recorded its third-ever net inflows yesterday, bringing in $27 million. BlackRock, the second largest, recorded zero flows.

“The large inflows suggest that investment advisors and hedge fund managers consider BTC ETFs a unique hedge, providing diversification benefits that traditional asset classes cannot offer,” Rachael Lucas, crypto analyst at BTC Markets, told The Block.

“Despite recent fluctuations, the cumulative net inflow of $12 billion since their debut in January highlights continued attractiveness of these financial instruments,” Lucas added.

As of Wednesday, the 11 spot bitcoin ETFs in the U.S. have seen $12.15 billion worth of cumulative net inflows. However, trading volume on the ETFs has been in a steady decline since peaking in March, according to The Block's Data Dashboard .

The price of bitcoin rose 6.65% in the past 24 hours to $66,081 at the time of publication, according to The Block’s price data .

On Wednesday, New York-based hedge fund Millennium Management revealed that it held $1.94 billion worth of shares in five spot bitcoin ETFs, as of March 31. Its largest allocation was in BlackRock’s IBIT, roughly around $844 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Meta faces antitrust probe in Italy over AI integration in WhatsApp

Share link:In this post: Italy’s antitrust watchdog (AGCM) is investigating Meta for integrating its AI assistant into WhatsApp without user consent. The regulator suspects the tech firm abused its dominant position by forcing users toward its AI, potentially harming competitors. AGCM warns that this integration may limit consumer choice and distort market competition under EU law.

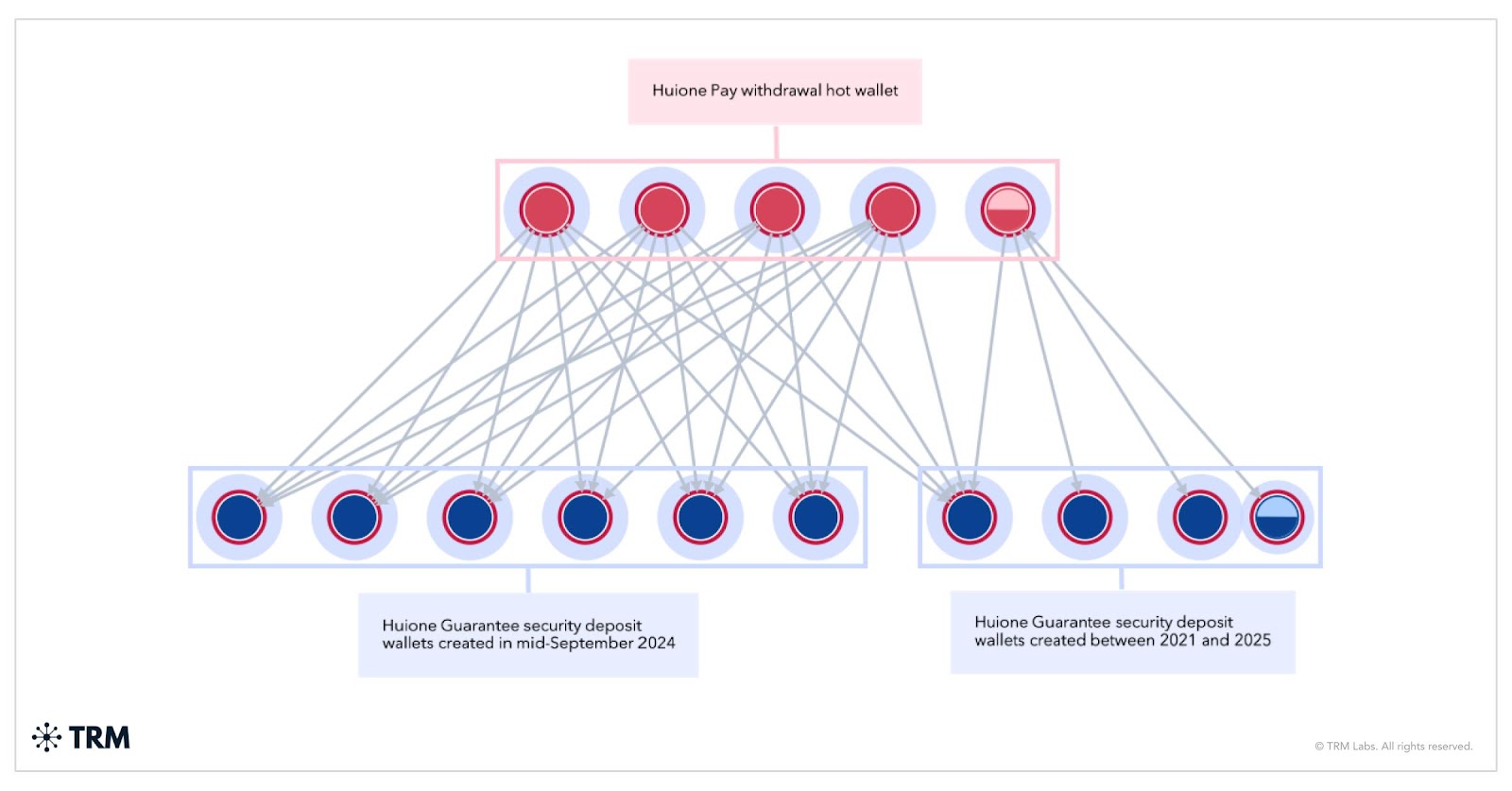

Telegram-banned $35B scam marketplaces find life away from US regulators

Share link:In this post: Telegram banned Huione Guarantee and Xinbi Guarantee after a $35B scam crackdown, but operations quickly shifted to Tudou Guarantee. TRM Labs and Elliptic revealed Huione vendors migrated to alternate platforms, with Tudou seeing a 70x surge in daily transactions. Despite US sanctions and enforcement, Huione Pay, USDH stablecoin, and affiliated services continue operating under new Telegram identities.

Polygon Labs calms fears about reports that its network went down for hours

Share link:In this post: Polygon Labs confirmed its network remained active despite Polygonscan showing no new blocks for over an hour. The issue was caused by a display glitch during a backend update on Polygonscan, not an actual network outage. The incident sparked renewed concerns about overreliance on third-party tools like explorers and RPC providers.

Federal Reserve keeps interest rates unchanged again, as expected

Share link:In this post: The Federal Reserve kept interest rates steady at 4.25% to 4.5%, delaying any cuts until at least September. Trump criticized the Fed’s decision, blaming tariffs for rising costs and demanding lower rates. Borrowers face high rates on credit cards, mortgages, car loans, and student loans, with no relief in sight.