Ethena's 'synthetic dollar' USDe crosses $3 billion supply just four months after launch

The USDe stablecoin, issued by Ethena Labs, has hit the $3 billion supply mark just four months after its public launch, making it the fastest USD asset to reach this point in history, according to the protocol’s founder.

Ethena Labs USDe stablecoin, also known as a 'synthetic dollar' which maintains its peg through arbitrage mechanics and a yield-returning cash-and-carry trade, has reached a supply of $3 billion tokens just four months following its public launch in February.

The stablecoin's supply has grown by $1 billion since April 5, when it last crossed the $2 billion threshold . Now, it's on track to challenge DAI as the largest algorithmic or decentralized stablecoin, though it'll have to add another $2 billion in supply to get there, according to data from The Block.

In terms of overall stablecoin supply, USDe is in fourth place with a 3.3% share of the overall stablecoin market, far less than market leader Tether's dominant 57% position.

While USDe's rapid rise has reminded some of Terraform Labs's UST stablecoin, the mechanics of each token differ, with USDe's yield coming from a cash-and-carry trade and staking revenue which is then shared with holders. The stablecoin was recently integrated with Bybit , which provides spot trading pairs with Ethereum and Bitcoin.

USDe also recently began airdropping its governance token , ENA, in April; the token has since hit a market capitalization of $1.3 billion, according to The Block's price page , having fallen from its all-time high price of $1.52 to about $0.91 as of Saturday night.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoftBank shares drop 5%, snapping 9-day rally after $2 billion Intel deal

Share link:In this post: SoftBank shares fell over 5% after it announced a $2 billion deal to buy Intel stock at $23 per share. Asian markets dropped across the board as investors waited for the U.S. Fed’s Jackson Hole meeting. Jerome Powell is expected to signal a possible rate cut, with futures showing an 83% chance for September.

Texas judge sides with Logan Paul’s effort to dismiss CryptoZoo lawsuit

Share link:In this post: Judge Ronald Griffing said Logan Paul’s bid to remove a lawsuit over the collapse of CryptoZoo should be allowed. Griffin also urged the class-action plaintiff to update all but one of its 27 claims against Paul, the one linking him to commodity pool fraud. The judge dismissed Paul’s bid to accuse CryptoZoo co-founders of the project’s failure.

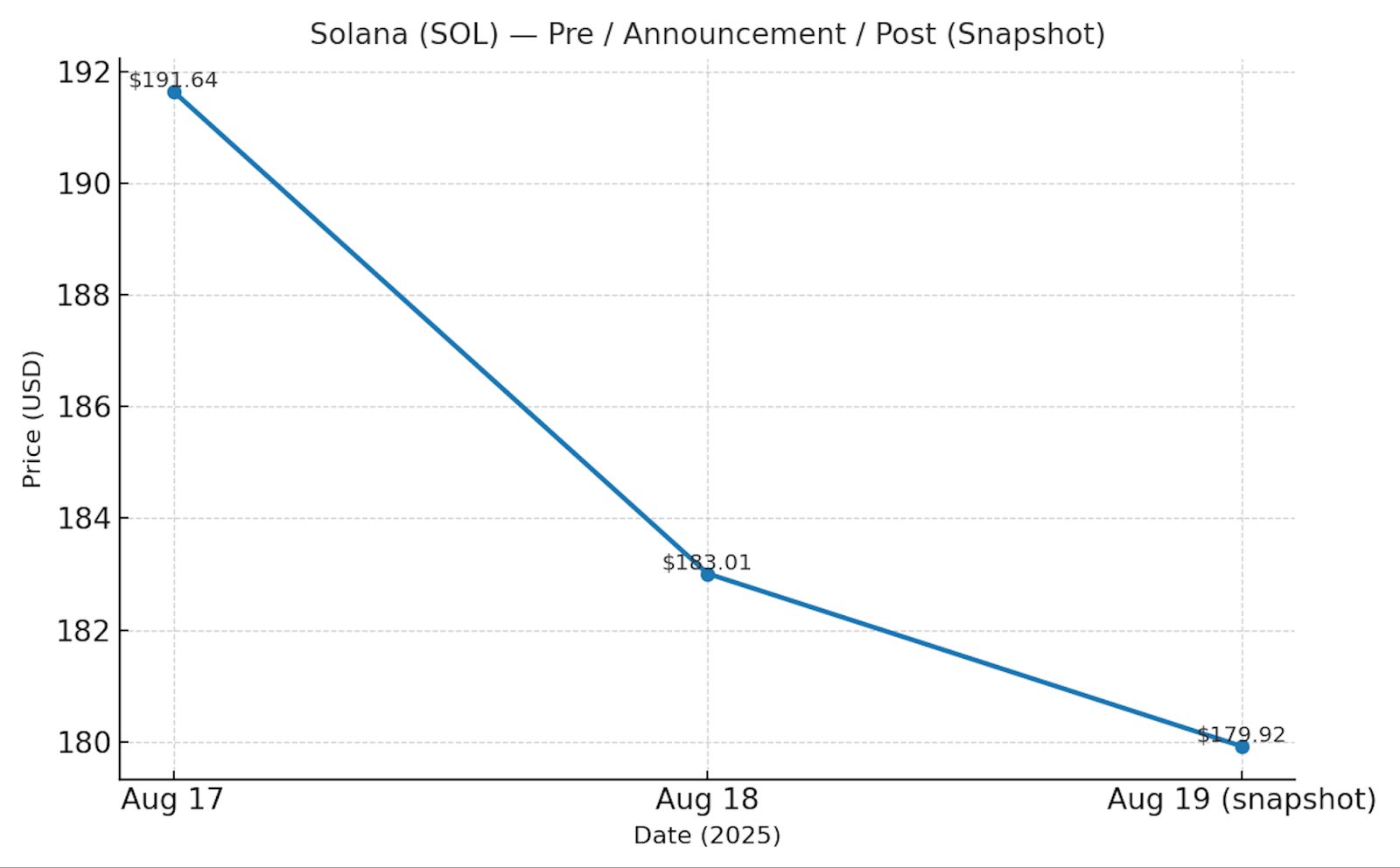

XRP & Solana ETF delays spark volatility – Stay or exit before October?

Share link:

Ethereum ETFs supply holdings to exceed BTC ETF’s holdings by September

Share link:In this post: Ethereum ETFs now hold over 6.5M ETH, with projections showing a September flip as they close in on Bitcoin ETFs’ share of the circulating supply. US spot ETH ETFs saw $59M in outflows on August 15 after record weekly inflows of 649,000 ETH pushed totals above $3.7B. Institutional investors dominate Ethereum with 19.2M ETH, while retail holdings fall sharply, highlighting shifting market influence amid price swings near $4,450.